August 12, 2025

S&P futures up 0.1% after U.S. equities closed mostly lower Monday, with weakness in software, E&Ps, transports, commodity chemicals, building products, homebuilders, and industrial metals. Retail favorites, most-shorted names, and semis outperformed. Asia mostly higher overnight (Japan +2%, China up for sixth straight day); Europe flat. Treasuries little changed, gold -0.2%, Bitcoin -0.2%, WTI crude +0.1%.

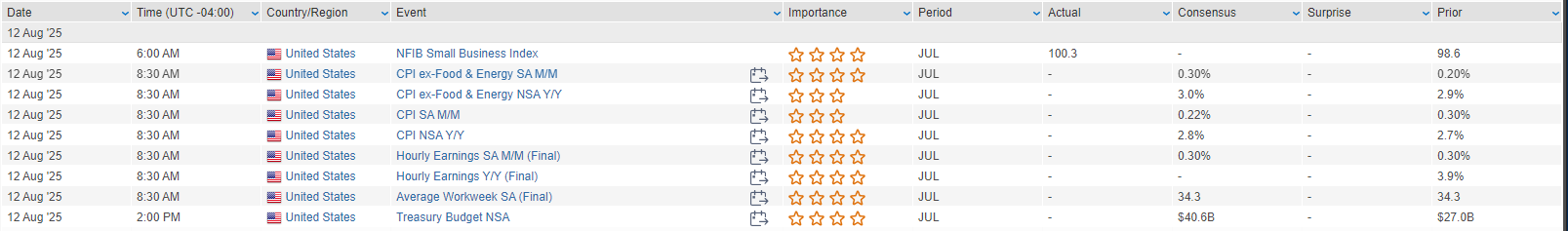

Markets await July CPI (08:30 ET). Core CPI expected +0.3% m/m, +3.0% y/y—the fastest pace in six months—after five cooler-than-expected prints. Debate continues over the near-term tariff impact on goods prices given lags from pull-forward and supply chain dynamics. Trump signed a 90-day extension of the U.S.–China tariff truce. Fed chair succession talk remains focused on Waller as favorite. NFIB small business optimism topped expectations in July.

Later today: Fed’s Barkin and Schmid speak. Wednesday is quiet, Thursday brings PPI and weekly claims, and Friday features retail sales and Michigan sentiment.

Corporate Highlights

- NVDA – Beijing reportedly told Chinese firms to avoid H20 chips; Trump said downgraded Blackwell chips may be allowed for sale in China.

- AAPL – Elon Musk threatened to sue over App Store AI tool rankings.

- INTC – Gained after Trump praised CEO Lip-Bu Tan post-White House meeting.

- ONON – Beat and raised guidance.

- CE – Weighed down by continued weakness in Acetyls.

- BBAI – Fell sharply on Q2 miss and softer FY revenue guide.

- HBI – Spiked on report it is close to being acquired by GIL.

- FFBC – To acquire BFIN in all-stock deal valued at ~$142M.

U.S. equities closed lower Monday, with the Dow down 0.45%, S&P 500 off 0.25%, Nasdaq down 0.30%, and Russell 2000 off 0.09%. Stocks finished above session lows, leaving the S&P 500 less than 1% from its record close. Treasuries were little changed to slightly firmer, with the curve flattening and long-end yields down 1 bp. The dollar index rose 0.4%, gold fell 2.5% after Trump confirmed gold imports will not be tariffed, Bitcoin futures rose 2.3%, and WTI crude inched up 0.1%.

Markets remain in a holding pattern ahead of Tuesday’s July CPI report, expected at +0.2% m/m and +2.8% y/y for headline, +0.3% m/m and +3.0% y/y for core. Goods prices will be closely watched for signs of tariff impact, though analysts remain split on timing given potential front-loading and supply chain dynamics. The odds of a September rate cut remain above 90%, with ~60 bp of easing expected this year; Fed Vice Chair Bowman reiterated her call for 75 bp of cuts, citing labor market softness. Trade developments included Trump extending the U.S.–China tariff truce by 90 days, urging China to increase soybean purchases, and suggesting reciprocal tariffs will fade as trade balances normalize. Geopolitical headlines remain busy ahead of Friday’s planned Trump–Putin meeting, though markets continue to largely discount geopolitical risks.

Sector Level

Defensive Consumer Staples (+0.17%) and Consumer Discretionary (+0.14%) led modest gainers, aided by upgrades and select earnings beats. Healthcare (+0.07%) was supported by strength in pharma, managed care, and healthcare distributors. Financials (-0.05%) were mixed, with GSEs and asset managers outperforming. Communication Services (-0.08%) saw mixed media and entertainment moves, while Materials (-0.24%) were supported by lithium strength. Tech (-0.56%) lagged on weakness in software and select hardware despite MU’s rally. Energy (-0.79%) was the worst performer on broad oil weakness, while Real Estate (-0.65%), Utilities (-0.36%), and Industrials (-0.29%) also underperformed in a quiet session

Information Technology

- MU +4.1% – Raised Q4 EPS, revenue, and GM guidance on better DRAM pricing and execution.

- INTC +3.7% – CEO meeting with Trump amid calls for his resignation; addressed “misinformation” about background.

- MNDY -29.8% – Beat and raised FY guidance but Q3 guide only bracketed consensus; concerns on H2 growth.

- AI -25.6% – Negative preannouncement; cited disruptive reorganization.

Communication Services

- RUM +3.1% – Q2 miss; MAU down q/q, ARPU up; weighing $1.17B acquisition of Northern Data’s GPU cloud/data center business.

- TKO +10.2% – Announced $7.7B UFC media rights deal with Paramount as exclusive U.S. broadcaster.

Consumer Staples

- ELF +9.7% – Upgraded to Overweight at Morgan Stanley, citing higher-than-expected profit potential and upside from Rhode acquisition.

Consumer Discretionary

- AMC +3.4% – Q2 beat on revenue, FCF; strong admissions and food/beverage; higher attendance, ticket prices.

Financials

- TGNA +29.8% – Spiked on report NXST in advanced talks to acquire the company.

- AVTR +5.2% – Rose after Engine Capital disclosed 3% stake, pushing for sale or strategic alternatives.

Healthcare

- RDNT +16.2% – Q2 beat; strong growth in advanced imaging volumes; raised FY Imaging Center guidance.

Materials

- ALB +7% – Lithium names higher after CATL halted production at key Chinese mine due to permit expiry; suspension could last up to three months.

Industrials

- AAON -10.5% – Missed Q2 estimates on segment weakness and ERP implementation; cut FY25 outlook.

Eco Data Releases | Tuesday August 12th, 2025

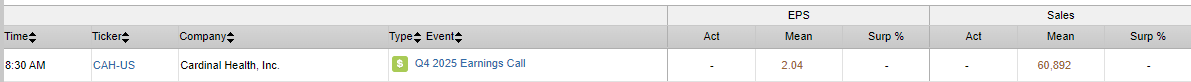

S&P 500 Constituent Earnings Announcements | Tuesday August 12th, 2025

Data sourced from FactSet Research Systems Inc.