August 14, 2025

S&P futures slightly lower after Wednesday’s gains, led by small caps (Russell 2000 +~2%) and strength in pharma, apparel, regional banks, builders, HPCs, retail favorites, and heavily shorted names. Treasuries firmed (yields -2–3 bps), dollar flat, gold -0.1%, Bitcoin -1.1%, WTI crude +0.4%.

Markets await July PPI and weekly jobless claims this morning, with retail sales and Michigan sentiment due Friday. A 25 bp September cut is fully priced, with >60 bp of easing expected in 2025, though some Fed officials push back on 50 bp cut calls. Powell’s Jackson Hole speech next week is expected to lean dovish. Tariff headlines remain quiet; Trump–Putin summit seen as low market risk.

Economic expectations – July headline and core PPI both +0.2% m/m; initial claims steady at 226K; continuing claims under scrutiny after hitting highest since Nov 2021.

Corporate Highlights

- DE – Cut FY guidance; flagged continued customer caution.

- CSCO – Q4 beat; guidance in line; strong Network, softer Security; AI tailwinds; likely conservative outlook.

- TPR – Pressured on lighter FY26 EPS guide, elevated expectations.

- COHR – Fell sharply; cautious tone on DC growth slowdown, CPO headwinds; positives on product ramps, AAPL partnership, margin plans.

- BIRK – Beat on sales/margins; maintained FY guidance.

- NICE – Beat/raised on AI demand; cloud sales in line; mixed Q3 guide.

- IBTA – Dropped on Q2 miss, softer Q3 outlook; concerns over CPID transition delay and sales force restructuring.

U.S. equities advanced Wednesday, with the Dow up 1.04%, S&P 500 +0.32%, Nasdaq +0.14%, and Russell 2000 +1.98%. The equal-weight S&P saw its best session since late May as breadth was broadly positive and small caps outperformed for a second day. Gains were driven by strength in pharma/biotech, apparel, regional banks, chemicals, managed care, homebuilders, media, insurers, HPCs, and China tech, while retail-favorite and heavily shorted names also rallied. Big tech lagged, with AAPL a relative bright spot on AI/robotics headlines. Underperformers included staples retailers, moneycenter banks, exchanges, online brokers, E&Cs, waste, aerospace & defense, software, semis, and tobacco.

Treasuries strengthened, with yields down ~5–6 bps across the curve, though off best levels. The dollar index fell 0.3%, gold gained 0.2%, Bitcoin futures rose 2.6%, and WTI crude slipped 0.8%. Macro drivers remained muted, with upside momentum supported by expectations for near-term Fed easing, solid earnings/revisions trends, low volatility, AI growth optimism, tariff mitigation, buyback activity, and fiscal/deregulatory tailwinds. Risks cited included labor market softness, delayed tariff inflation effects, high valuations, extended systematic long positioning, and Treasury market headwinds.

On the policy front, Chicago Fed’s Goolsbee said all upcoming meetings remain “live” and flagged services inflation as a concern in July CPI. Atlanta’s Bostic reiterated his call for one cut this year, citing labor market strength, while Treasury Secretary Bessent repeated his view favoring a 50 bp September cut. Bloomberg reported the White House is considering 11 candidates—public and private sector—for Fed Chair, with no clear front-runner.

Sector Highlights

Materials (+1.69%) and Healthcare (+1.58%) led the S&P 500 on lithium and biotech strength. Consumer Discretionary (+1.29%) advanced on apparel gains and restaurant outperformance, while Energy (+1.20%) rose despite weakness in select E&P names. Real Estate (+0.63%), Financials (+0.56%), and Industrials (+0.39%) posted moderate gains. Communication Services (-0.49%), Consumer Staples (-0.44%), and Technology (-0.19%) lagged, with staples pressured by AMZN’s grocery expansion and tech weighed by semiconductor softness. Utilities (+0.17%) saw only modest buying interest in the broader risk-on session.

Information Technology

- AMD +5.4% – Benefited from reports NVDA redesigning its Rubin AI chip to better compete with AMD’s Mi450.

- AAPL +1.6% – Bloomberg reported AI device push, including robotics, conversational Siri, and home security tech.

- SPNS +44.2% – Agreed to be acquired by Advent for $2.5B cash at $43.50/sh (~47% premium).

- SSYS -12.0% – Q2 in line but lowered FY revenue/EBITDA guidance amid macro uncertainty and cautious customer spending.

Communication Services

- AMZN +1.4% – Announced expansion of same-day grocery delivery to 2,300 locations by year-end (from ~1,000).

- VG +12.0% – Won arbitration against Shell over LNG cargoes; beat Q2, raised FY cargo guidance.

Consumer Staples

- HBI +3.7% – Gildan confirmed acquisition valued at ~$4.4B; $6/sh cash-and-stock consideration.

- WMT -2.5% – Weighed down on AMZN grocery delivery expansion news.

Consumer Discretionary

- CPRI +12.3% – Upgraded to Overweight at JPMorgan on comp acceleration and 2H product/marketing benefits.

- EAT – Beat on strong Chili’s comps; announced $400M buyback.

- CAVA -16.6% – Q2 comp miss, FY comp guidance cut; valuation and near-term headwinds cited despite July improvement.

Financials

- HI +12.6% – Bloomberg reported strategic review including potential sale.

Healthcare

- LLY +3.3% – Introduced Mounjaro injector pens in India.

- INTA +15.4% – Beat across metrics; strong AI-driven demand and large-deal traction; raised FY guidance; announced $150M buyback.

Industrials

- ECG +4.4% – Q2 beat; highlighted data center growth in commercial backlog; raised FY guidance.

Materials

- ALB +4.7% – Said recent La Negra plant incident will not affect sales.

Energy

- CRWV -20.8% – Q2 beat, raised FY guide, but pressured by margin headwinds, higher borrowing costs, and looming IPO lockup expiration.

Eco Data Releases | Thursday August 14th, 2025

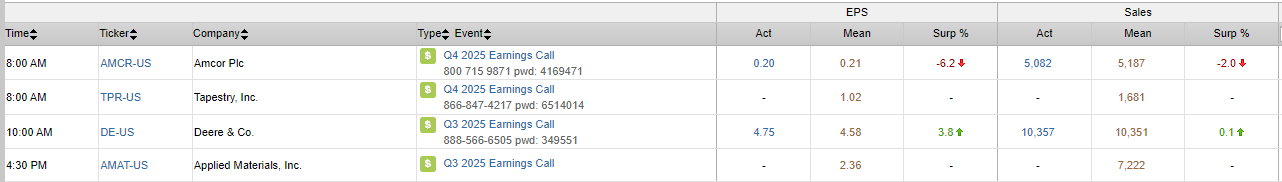

S&P 500 Constituent Earnings Announcements | Thursday August 14th, 2025

Data sourced from FactSet Research Systems Inc.