August 18, 2025

S&P futures down 0.1% Monday following last week’s record highs but softer Friday close led by semis, banks, and machinery. Asia mostly higher with Shanghai Composite at its strongest since 2015 and Nikkei at a new record, while Europe trades lower. Treasuries firmer with yields down 2–3 bp, dollar index up 0.1%, gold +0.4%, Bitcoin –1.5%, and WTI crude +0.5% after last week’s 1.7% drop.

Weekend focus was on geopolitics as the Trump-Putin summit ended without a Ukraine breakthrough, though Russia agreed to allow US and Europe to offer NATO-style guarantees. Trump reiterated steel and chip tariffs are coming this week. US-EU trade deal finalization was delayed and US-India talks canceled. Broader market narrative still centered on extended valuations, strong earnings/revisions, peak buybacks, systematic flows, and AI optimism, against lingering Fed path uncertainty.

Macro calendar is light with August NAHB sentiment due today. Markets are in wait-and-see mode for Jackson Hole, with Powell’s Friday speech the key event; Fed minutes and comments from Bowman and Waller also due midweek. Street expects ~53 bp of cuts priced in for 2025 but risk of hawkish tone remains.

Company News

- NVO: Received FDA clearance for Wegovy in treatment of liver disease.

- AAPL: Reported market share loss to Samsung in smartphones.

- META: Restructuring AI efforts again, dividing superintelligence labs into four groups.

- TSLA: Cut UK leasing prices by up to 40%.

- DAY: Reportedly in buyout talks with Thoma Bravo, deal could be announced in coming weeks.

- SHCO: Confirmed it will be taken private at $9/share.

- OpenAI: Employees reportedly exploring $6B share sale, valuing company at ~$500B.

US equities ended mostly lower on Friday in quiet trading. The S&P 500 fell 0.29%, Nasdaq declined 0.40%, Dow edged up 0.08%, and Russell 2000 lost 0.55%, though small caps still logged their best week since June. The session was uneventful despite a firm retail sales print and higher consumer inflation expectations, which prompted some repricing toward a slightly flatter Fed rate cut path. Headline July retail sales rose 0.5% m/m, in line with consensus, with the control group also up 0.5% versus 0.4% expected, while June was revised notably higher. However, University of Michigan consumer sentiment fell to 58.6 (vs 62.2 consensus), its lowest since May, with one-year inflation expectations jumping 0.4 pp to 4.9% and long-run expectations climbing 0.5 pp to 3.9%. Industrial production unexpectedly contracted in July (-0.1% vs +0.1% expected), while import prices rose 0.4%, suggesting tariff pass-through is being absorbed by consumers. Empire Manufacturing surprised to the upside on new order strength but showed higher prices paid. Treasuries weakened with curve steepening as long-end yields rose 4–5 bp, pushing the 30Y back above 4.90%. The dollar index fell 0.4%, gold dropped 0.8%, Bitcoin slid 5%, and WTI crude settled down 1.8%. Markets largely looked through the Trump-Putin summit, though Trump reiterated plans to set tariffs on steel and chip imports next week. Despite Friday’s dip, the S&P 500 posted another week of gains, with attention now turning to Chair Powell’s Jackson Hole speech.

Sector Performance & Stock Level Highlights

Healthcare led the S&P 500 with a 1.65% gain, supported by strength in managed care, pharma, and biotech. Real Estate (+0.68%), Communication Services (+0.49%), and Consumer Staples (+0.07%) also outperformed. Materials (-0.02%) and Energy (-0.25%) were modest laggards, while Consumer Discretionary (-0.27%), Utilities (-0.37%), Industrials (-0.55%), Technology (-0.75%), and Financials (-1.12%) underperformed. Pressure came from semiconductors, credit cards, investment banks, and energy stocks, while leadership was more defensive, with managed care and healthcare broadly offsetting some cyclical weakness.

Information Technology

- AMAT (-14.1%): Q3 beat but Q4 guidance missed on moderating China demand, delayed export license approvals, and softer leading-edge demand. Management remained constructive on DRAM demand longer term.

- SNDK (-4.6%): FQ4 results ahead, but light EPS and GM guidance tied to underutilization and startup costs; flagged a 14-week fiscal Q1 as partial drag.

- CSCO (-4.5%): Downgraded at HSBC to Hold from Buy; analysts flagged slowing networking demand and restocking cycle nearing an end.

- INTC (+2.9%): Extended Thursday’s rally on reports the Trump administration is considering a strategic stake in the company.

Healthcare

- UNH (+12.0%): Jumped after Berkshire Hathaway and Appaloosa disclosed new stakes in the company via 13F filings.

- HIMS (-2.4%): Declined after reports the FTC has been probing its advertising and cancellation practices for more than a year.

Communication Services

- RBLX (-6.3%): Weighed down after the State of Louisiana filed a lawsuit alleging inadequate child safety protections.

- TWLO (+4.8%): Announced addition to the S&P MidCap 400 effective Aug 19, replacing AMED.

Consumer Discretionary

- OPEN (+4.3%): Rose after CEO Carrie Wheeler announced departure; Shrisha Radhakrishna appointed interim leader as company searches for permanent replacement.

- LULU (+1.7%): Gained after Michael Burry’s Scion Asset Management disclosed new equity and call option positions.

- WING (+3.6%): Upgraded to Strong Buy from Outperform at Raymond James, citing strong early results from its Smart Kitchen system.

Consumer Staples

- FLO (-5.4%): Missed on Q2 revenue with weakness in bread demand and pricing; lowered FY guidance midpoints and cited intensifying competition.

Financials

- Investment banks, money-center banks, and card issuers broadly underperformed, contributing to sector lagging the S&P.

Industrials

- Broader weakness across machinery, electricals, and multis pressured the sector.

Materials

- NUE, LEN, DHI: Buffett’s Berkshire disclosed new stakes in steelmaker Nucor and homebuilders Lennar and D.R. Horton, though price reactions muted.

Other Notables

- EVLV (+5.2%): Q2 beat with stronger customer acquisition; raised FY guidance and noted DOJ had dropped investigation into marketing practices

Eco Data Releases | Monday August 18th, 2025

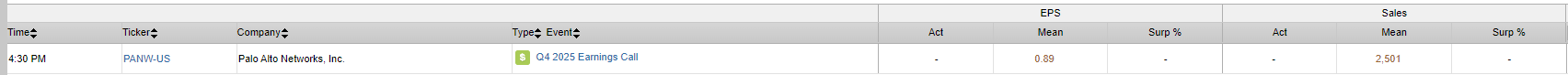

S&P 500 Constituent Earnings Announcements | Monday August 18th, 2025

Data sourced from FactSet Research Systems Inc.