August 21, 2025

S&P futures down 0.1% Thursday after US equities extended losses Wednesday, with the S&P 500 falling for a fourth straight session. Mag 7 again led declines, down over 1% for a second day. Asia was mixed (Australia higher, Japan and Hong Kong lower), while Europe slipped ~0.3%. Treasuries weakened with yields up ~2 bp, the dollar was steady, gold -0.2%, Bitcoin -0.9%, and WTI crude +0.1%.

Markets remain in wait-and-see mode ahead of WMT earnings this morning and Powell’s Jackson Hole speech Friday. Debate continues over how dovish Powell may lean and how much is already priced in. Tech weakness persists, fueled by concerns over AI returns after an MIT report said 95% of enterprises adopting AI saw no measurable profit gains. NVDA earnings on Aug 27 are the next key catalyst. On trade, FT reported high-powered AI chips remain central to the US-China tech standoff. Geopolitical hopes faded as Russia pushed back on Ukraine security guarantees.

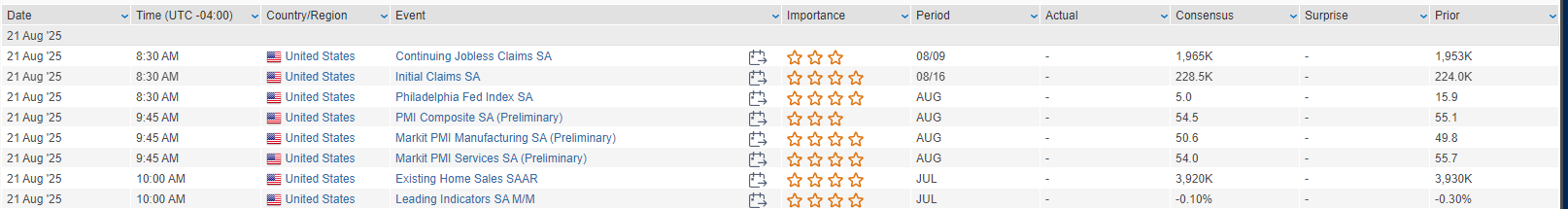

Today’s economic calendar includes jobless claims (seen at 227K), Philly Fed (expected +5.5), flash PMIs, and July existing home sales (-0.4% m/m expected). Friday’s focus is Powell’s Jackson Hole remarks.

Company Updates

- WMT: Earnings due pre-market.

- NVDA: FT reported China’s restrictions on H20 chip sales tied to US Commerce Secretary Lutnick’s comments.

- META: Reportedly pausing AI hiring after heavy recent spending.

- DVA: Boosted share buyback authorization by $2B.

- NDSN: Beat FQ3, cited strength in Advanced Technology Solutions; FY25 EPS tracking ahead; announced $500M buyback.

- COTY: Fell on weaker FQ4 and guidance pointing to continued 1H26 pressure.

- CBRL: Drew social media backlash over its first logo change in 47 years.

US equities ended mostly lower Wednesday, with the Dow up 0.04% while the S&P 500 fell 0.24%, Nasdaq declined 0.67%, and Russell 2000 lost 0.32%. The S&P notched its fourth straight decline as big tech and AI-linked names weighed on growth and high-beta factors. Equal-weight S&P once again outperformed, highlighting ongoing rotation. Treasuries were modestly firmer with yields down ~1 bp, the dollar index slipped 0.1%, gold rose 0.9%, Bitcoin gained 0.9%, and WTI crude advanced 1.9%.

The pullback in mega-cap tech continued to dominate sentiment, with concerns over valuations, AI bubble risks, competitive pressures, and disappointing monetization outside of select sectors. Still, some suggested the downturn could be short-lived given buy-the-dip resilience. Retail earnings were another focal point, with a mix of results but consumer resilience still intact. July FOMC minutes leaned hawkish, noting inflation risks outweighing employment risks, but the impact was muted given the weak July payrolls and subsequent data. Markets remain focused on Powell’s Jackson Hole speech Friday, with debate over whether he will strike a more dovish tone.

Sector Performance

Energy (+0.86%), Consumer Staples (+0.80%), Healthcare (+0.60%), and Financials (+0.51%) led Wednesday’s gains, joined by Real Estate (+0.34%), Materials (+0.19%), and Utilities (+0.12%). Industrials (-0.09%) were flat, while Consumer Discretionary (-1.18%), Technology (-0.77%), and Communication Services (-0.56%) underperformed, dragged lower by continued weakness in big tech, AI, and retail favorites.

Company News by Sector

Information Technology

- INTC: Reportedly in discussions with other large investors for an equity infusion.

- NVDA: Under pressure ahead of earnings on 27-Aug as AI valuation concerns mount; reports Chinese cities targeting 70% self-sufficiency in AI chips.

- ADI (+6.3%): Beat FQ3 expectations and guided Q4 ahead, citing backlog strength and demand momentum in Auto/Industrial.

- KEYS (-3.0%): Posted better Q3 results and guided Q4 in line, but tariff-related headwinds expected to add ~$75M in annual costs.

- MU (-4.0%): Weaker after reports Samsung’s HBM4 passed NVIDIA’s initial quality tests.

Communication Services

- META: Pressured by reports of inflated ad metrics and restructuring of AI division.

- GOOGL: Unveiled new Pixel 10 smartphones with Gemini AI integrated.

- BIDU (-2.6%): Reported Q2 EPS beat but missed on revenue and EBITDA, with weakness in iQIYI; AI cloud business highlighted as a bright spot.

- TGNA (+4.3%): To be acquired by NXST for $6.2B.

Consumer Discretionary

- LOW: Q2 comps +1.1%, EPS beat, raised FY revenue guidance; highlighted $8.8B acquisition of Foundation Building Materials.

- TGT (-6.3%): Q2 better than feared but comps down -1.9% and traffic -1.3%; reiterated FY guidance; CEO transition criticized by some investors.

- TJX (+2.7%): Beat on Q2 comps (+4%), EPS, and revenue; raised FY guidance, noting strong momentum in off-price retail.

- EL (-3.7%): Results and outlook underwhelmed; guided to $100M tariff impact in FY26.

- LZB (-12.1%): Fell after mixed Q1 and weak Q2 guidance tied to softer margins.

- GES (+26.3%): Announced agreement to be taken private by Authentic Brands at $16.75/sh.

- HTZ (+6.0%): Rose after confirming partnership with AMZN to sell used vehicles online.

- MCD: Cutting combo meal prices after agreement with franchisees.

- URBN (-2.6%): Downgraded to Neutral at Citi on tariff risk and apparel group caution.

- CVNA (-1.6%): Lower following HTZ/Amazon news.

Consumer Staples

- MKC (+1.2%): Assumed Overweight at JPMorgan, which noted favorable retailer dynamics despite slower food producer growth.

- PEP: Will raise concentrate prices by 10% beginning Sept 7.

Healthcare

- MDT: Beat and raised but results seen as underwhelming; Elliott confirmed stake with board changes ahead.

- ALC (-10.1%): Missed Q2 and lowered FY25 outlook, citing softness in Surgical and competitive headwinds.

- CVS: Ordered to pay $290M in damages over Medicare overcharging.

Industrials

- TOL: Q2 beat on closings and margins but ASP light; volume guidance at lower end.

- DY (-4.6%): Missed on Q2 revenue; guided Q3 below consensus though margins improved.

- JHX (-34.4%): Dropped after Q1 miss and lowered FY outlook on weak demand and inventory de-stocking.

Financials

- SOFI: Announced blockchain-backed international transfers.

- MTB: Raised dividend.

- DAY (+3.0%): Confirmed advanced buyout talks with Thoma Bravo.

Energy & Materials

- Russia’s oil output expected to remain stable at ~4.8M bpd.

- NWE: To be acquired by BKH.

Eco Data Releases | Thursday August 21th, 2025

S&P 500 Constituent Earnings Announcements | Thursday August 21th, 2025

Data sourced from FactSet Research Systems Inc.