August 25, 2025

S&P futures –0.1% Tuesday after U.S. equities slipped Monday, giving back part of Friday’s broad rally. Rails, beverages, pharma, and housing retailers lagged. Asia mostly lower (HK, SK, Japan weak), Europe –0.8% with France under pressure. Treasuries mixed with curve steepening as long-end yields rose 2–4 bp. Dollar –0.1%, gold +0.1%, Bitcoin +0.4%, WTI crude –1.6%.

Main focus was Trump’s move to oust Fed Governor Cook over alleged mortgage fraud, though Cook insisted he lacks authority and she won’t resign. Market reaction muted; fits fiscal dominance/political interference theme. Investors await NVDA earnings Wednesday and core PCE Friday. Williams noted neutral rate may be similar to pre-pandemic levels. Trump also threatened retaliation over digital taxes and warned of 200% tariffs on China without rare-earths cooperation.

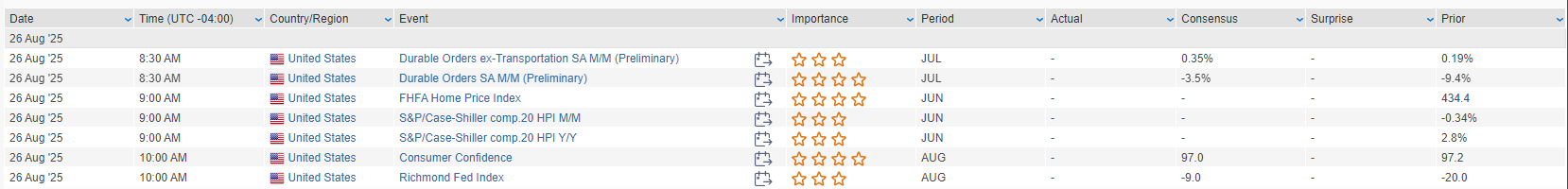

On today’s calendar: durable goods, FHFA HPI, Richmond Fed manufacturing, consumer confidence, plus $69B 2-year auction. Later this week: GDP revisions, claims, pending home sales, $70B 5-year and $44B 7-year auctions, and Friday’s core PCE.

Corporate updates:

- T buying spectrum from SATS for $23B cash.

- BA selling 103 planes to Korean Air for $36.2B.

- IBKR to join S&P 500.

- CG acquiring Intelliflo from IVZ for up to $200M.

- AVY buying Meridian Adhesives flooring unit for $390M.

- HEI noted aerospace aftermarket strength and higher FSG margins.

- SMTC Q2 ahead; Q3 mixed with data center strength, softer CopperEdge.

- WU higher on insider buy.

- IBIO surged after Point72 disclosed 9.9% stake.

- Earnings after the close: MDB, OKTA, PVH.

U.S. equities weakened Monday in a quiet session (Dow –0.77%, S&P 500 –0.43%, Nasdaq –0.22%, Russell 2000 –0.96%), with all major indexes giving back part of Friday’s rally. The S&P 500 logged its sixth decline in the last seven sessions, closing near the day’s lows. Treasuries sold off with short-end yields up ~4 bp, flattening the curve. Dollar index gained 0.8%, gold finished flat, Bitcoin futures fell 4.7% to a six-week low, and WTI crude rose 1.6%.

Markets remain focused on the dovish tilt in Powell’s Jackson Hole speech, though debate continues over rate-cut timing amid tariff-driven inflation risks, labor-market softening, and political pressure. Rate-cut odds stand at just over 50 bp for 2025. AI sentiment remains key ahead of NVDA earnings, while tariff headlines reemerged with Trump launching a furniture trade investigation. On the data front, July new home sales came in slightly above consensus at 652K SAAR, though Dallas Fed manufacturing fell into contraction. This week brings durable goods orders, Richmond Fed manufacturing, and consumer confidence Tuesday, followed by Q2 GDP revisions, claims, and pending home sales Thursday, and core PCE inflation Friday.

Sector Highlights

Communication services (+0.44%) and energy (+0.26%) were the only sectors in positive territory, while tech (–0.09%) and consumer discretionary (–0.13%) held up relatively well. Defensives lagged, with consumer staples (–1.62%), healthcare (–1.44%), and utilities (–1.16%) the worst performers. Industrials (–1.02%) and financials (–0.58%) also trailed.

Industrials:

- CSX –5.1% after Warren Buffett’s Berkshire Hathaway denied interest in acquiring the company.

- CRGY –4.0% announced it will acquire VTLE +14.5% in a $3.1B all-stock deal; analysts flagged debt and capital return concerns.

Consumer Staples:

- KDP –11.5% on plans to acquire JDE Peet’s for $18B, with S&P Global warning of a rating downgrade due to leverage.

- KO reportedly exploring options for its UK Costa Coffee chain.

Consumer Discretionary:

- WSM –5.3% and RH –5.3% sold off after Trump’s announcement of a major tariff probe into imported furniture; ETD gained on U.S. sourcing advantage.

- AEO –2.7% downgraded at BofA, citing tariff risks and weaker Aerie sales momentum.

- SPOT signaled further price hikes as new features roll out.

Information Technology:

- VRNT –1.3% agreed to be acquired by Thoma Bravo for $2B, only a marginal premium.

- FN +6.1% upgraded to overweight at JPM on solid Telecom momentum.

- S –2.2% downgraded at BTIG on rising competition and slower growth outlook.

- Databricks to acquire Tecton to expand AI agent offerings.

Healthcare:

- ABBV agreed to acquire a depression treatment from Gilgamesh for up to $1.2B.

- DYN +3.3% upgraded at Raymond James on optimism for DYNE-251 trial data.

Communication Services:

- Elon Musk’s X and xAI filed suit against AAPL and OpenAI over alleged anticompetitive practices.

Energy:

- CRGY –4.0%, VTLE +14.5% (M&A deal as above).

Eco Data Releases | Tuesday August 26th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday August 26th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.