September 2, 2025

S&P 500 futures are off 0.5% after finishing lower last week, though major indexes still extended multi-month winning streaks in August (S&P, Nasdaq, and Russell 2000 each up four straight months; Nasdaq up five). Asia traded mixed overnight with Japan higher and Greater China lower, while Europe is down about 0.6%. Treasuries remain under pressure with yields up 4–6 bp, pushing the 30-year just below 5%. Dollar index is stronger (+0.7%), gold gained 0.9% to a fresh record above $3,500/oz, Bitcoin rose 1.5%, and WTI crude jumped 2.8%.

Risk sentiment is weighed by a U.S. appeals court ruling that Trump’s IEEPA tariffs are illegal, though levies remain in effect pending appeal to the Supreme Court, compounding business uncertainty. Rising bond yields tied to fiscal strains and U.S. government shutdown risks, seasonally weak September positioning, and scrutiny around an AI capex bubble are additional overhangs. Geopolitical headlines point to closer coordination between China, Russia, and India.

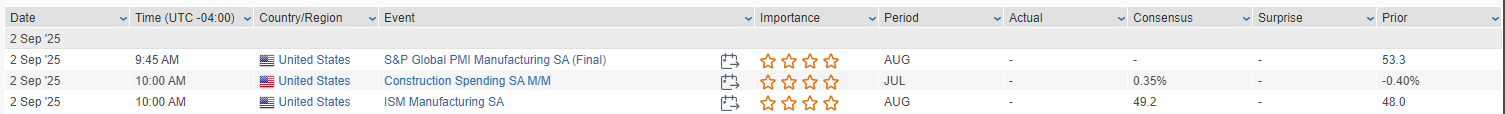

This week’s data calendar is busy, with ISM manufacturing, construction spending, and final S&P Global PMI due today. JOLTS, factory orders, Beige Book, and auto sales follow Wednesday; ADP jobs, productivity, claims, trade balance, and ISM services hit Thursday; and Friday’s August payrolls (Street +75K, unemployment 4.3%, wages +0.3% m/m) close out the week. Fed speakers (Kashkari, Williams, Musalem, Goolsbee) are scheduled before payrolls.

Company News

- Kraft Heinz (KHC): Formally announced plans to split into two separate companies.

- Meta (META): Reportedly considering integrating external LLMs into its ecosystem.

- Tesla (TSLA): Bloomberg noted weak traction in India launch, with just over 600 vehicles ordered since mid-July.

- Novo Nordisk (NVO): Said Wegovy cut heart risk by 57% compared to Eli Lilly’s competing obesity drug.

- Starbucks (SBUX): CEO said company recorded a record sales week on its fall menu launch, including return of pumpkin spice latte.

- Target (TGT): Facing boycott from the second-largest U.S. teachers’ union after cutting some diversity programs.

- Performance Food Group (PFGC): Sachem Head Capital nominated board candidates, urging a merger with US Foods (USFD)

U.S. equities ended modestly lower on Friday in a subdued session (Dow -0.20% | S&P 500 -0.64% | Nasdaq -1.15% | Russell 2000 -0.50%), closing out a week of slight pullback after the S&P 500 reached a fresh all-time high on Thursday. Macro data kept the market contained. July PCE inflation came in exactly as expected, with core PCE rising 0.3% month over month and 2.9% year over year, its highest since February, while headline PCE rose 0.2% month over month and 2.6% year over year. Personal income and spending both posted steady increases, broadly in line with forecasts. Consumer confidence softened, with the final August University of Michigan sentiment index falling to 58.2, weighed by weaker expectations, though inflation expectations eased at both the one-year and five-year horizons.

Meanwhile, the August Chicago PMI slumped to 41.5, well below consensus, pointing to renewed weakness in orders, production, and employment. The July trade deficit also widened sharply to $103.6B, the largest since March, highlighting external imbalances.

On policy, Fed Governor Waller struck a dovish tone, reiterating support for a 25 bp cut in September and further easing over the next three to six months, while urging urgency given rising labor-market risks. He downplayed tariff-driven inflation pressures, calling them transitory. The tariff debate nevertheless resurfaced as Caterpillar and Gap flagged larger cost headwinds, and financial press reports suggested the White House is preparing a new wave of Section 232 tariffs spanning semis, heavy trucks, pharmaceuticals, and metals.

In markets, Treasuries saw curve steepening with the long end up about five basis points, the 2Y/30Y spread returned near multi-year highs, the dollar was flat, gold gained 1.2%, Bitcoin fell 3.2%, and WTI crude slipped 0.9%.

Sector Highlights

Sector performance was mixed, with defensives leading. Healthcare, consumer staples, real estate, and energy all posted gains, supported by rotation into safer segments and resilience to tariff pressures. Financials also managed small gains, helped by the steeper yield curve, while materials and communication services ended little changed. On the downside, technology was the clear laggard, hit by weakness in semis and AI-levered names, while consumer discretionary and industrials also underperformed. Utilities closed slightly lower, trailing their defensive peers.

Information Technology (XLK, -1.63%)

- NVIDIA (NVDA -3.4%) declined after reports that Alibaba developed a new AI inference chip and DeepSeek AI turned to Huawei hardware for training.

- Marvell Technology (MRVL -18.6%) fell sharply on weak Q3 guidance, particularly in Data Center, with concerns about hyperscaler adoption of next-gen chips.

- Dell (DELL -8.9%) disappointed despite better top-line results, with margins pressured by AI server mix and softness in storage, traditional server, and PC units.

- Ambarella (AMBA +16.8%) rallied on a beat-and-raise quarter, led by automotive and IoT strength, especially edge AI adoption.

- Autodesk (ADSK +9.1%) gained after revenue and billings outpaced expectations, RPO accelerated, and long-term margin guidance was raised; closure of an SEC probe added relief.

- SentinelOne (S +7.1%) advanced on stronger-than-expected EPS and raised full-year guidance, citing robust growth in AI-driven endpoint security and international expansion.

Consumer Discretionary (XLY, -1.14%)

- Gap (GPS -7.1%) reported stronger comps at Gap and Banana Republic but cut EPS guidance on an incremental $150–175M tariff burden, with Athleta continuing to struggle.

- Ulta Beauty (ULTA -7.1%) beat on comps, revenue, and EPS but raised its FY outlook cautiously; margin compression concerns weighed.

- Petco (WOOF +23.5%) surged on margin improvement, raised EBITDA guidance, and turnaround traction.

- Affirm (AFRM +10.6%) posted strong GMV and upbeat FY26 guidance, easing worries about Walmart exposure.

- Celsius Holdings (CELH +5.3%) rose after PepsiCo increased its stake and divested Rockstar Energy, making CELH its U.S. energy category lead.

Industrials (XLI, -0.95%)

- Caterpillar (CAT -3.7%) said tariffs will now cut 2025 earnings by $1.5–1.8B, up from prior $1.3–1.5B, and guided FY25 margins toward the low end of its range.

Healthcare (XLV, +0.73%)

- Managed care and biotech drove sector gains, aided by defensive rotation. No major company-specific catalysts.

Consumer Staples (XLP, +0.64%)

- Food and beverage companies such as JM Smucker and Hormel highlighted plans to pass through higher tariff-related costs to consumers, underscoring defensive pricing power.

Financials (XLF, +0.21%)

- Large banks and insurers gained on curve steepening, which improves net interest margins.

Real Estate (XLRE, +0.55%)

- REITs rose modestly as defensive flows and lower front-end yields supported the sector.

Energy (XLE, +0.54%)

- Energy shares outperformed broader commodities, supported by steady demand expectations and dividend yield support.

Communication Services (XLC, -0.32%)

- Media and telecom outperformed internally, though the sector finished slightly lower overall.

Materials (XLB, +0.02%)

- Materials were little changed, balancing tariff protection tailwinds against cost pressures.

Utilities (XLU, -0.36%)

- Utilities lagged other defensives, giving up ground in a rotation toward staples, healthcare, and REITs

Eco Data Releases | Tuesday September 2nd, 2025

S&P 500 Constituent Earnings Announcements | Tuesday September 2nd, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.