September 4, 2025

U.S. equities are edging higher (S&P futures +0.2) after Wednesday’s tech-led gains. Department stores, builders, REITs, airlines, GSEs, and exchanges outperformed yesterday, while energy lagged on crude weakness. Overnight, Asia was mixed (Japan +1.5%, Hong Kong/China down >1%), and Europe is little changed. Treasuries are firmer with yields down 2–3 bp. Dollar index +0.1%, gold -1%, Bitcoin -1.4%, and WTI -1.2% after a 2.5% drop Wednesday.

No major directional drivers ahead of a busy data slate: ADP payrolls, productivity, unit labor costs, claims, trade balance, and ISM services this morning. Focus remains on Friday’s jobs report (Street: +75K NFP, unemployment 4.3%, wages +0.3% m/m). Fed watchers eye Stephen Miran’s Senate Banking hearing today, plus speeches from NY Fed’s Williams (11:30) and Chicago Fed’s Goolsbee (after close).

Earnings and corporate news are stock-specific. Application software sentiment remains cautious (CRM a key drag), though consumer resilience was highlighted at Goldman’s Retail Conference. Street still debates seasonal headwinds versus bullish drivers like earnings revisions and Fed easing expectations.

Company News

- Apple (AAPL): Reportedly planning AI-powered web search launch in 2026.

- Tesla (TSLA): Opened robotaxi app to the general public.

- Salesforce (CRM): Fell post-earnings despite Q2 beat; guidance muted and AI contribution still early-stage.

- HPE: Gained on Juniper integration and AI server demand.

- FIG: Dropped after Q2 results lacked new details; volatility persists post-IPO.

- GitLab (GTLB): Q2 ahead, but pressured by absence of FY guidance and CFO exit.

- Asana (ASAN): Rallied on strong enterprise adoption and AI Studio momentum.

- American Eagle (AEO): Jumped on Q2 beat and reinstated FY outlook.

- Canada Goose (GOOS): Exec denied reports of going private.

U.S. equities ended mixed on Wednesday (Dow -0.05% | S&P 500 +0.51% | Nasdaq +1.02% | Russell 2000 -0.10%), with the S&P 500 and Nasdaq closing higher on late-session strength while the Dow and Russell 2000 slipped. The main catalyst was strength in mega-cap tech after Alphabet and Apple benefited from a favorable antitrust ruling, viewed as less severe than feared. Fed easing expectations also provided support as the probability of a September rate cut climbed above 95% following a weaker JOLTS job openings report. Treasuries rallied, more than reversing Tuesday’s move, with the long bond yield down 7 bp to ~4.90% and the curve flattening. The dollar index slipped 0.2%, gold gained 1.2% to extend its record run, and Bitcoin futures rose 1.2%. Oil was weaker, with WTI down 2.5% after reports OPEC+ may consider an additional output hike.

On the data front, July JOLTS job openings fell to 7.18M, the lowest since September 2024 and below consensus, reinforcing signs of a cooling labor market. July factory orders fell 1.3% m/m, a softer decline than June’s 4.8% drop. Fed Governor Waller reiterated his preference to begin cutting rates in September, pointing to labor market risks, while Musalem, Bostic, and Kashkari offered more cautious takes, citing lingering inflation and tariff impacts. The Fed’s Beige Book described little change in economic activity but flagged increased job-seeking and some consumer strain. Political developments added another layer, with Senator Tillis stating he would block a Fed Governor replacement for Lisa Cook until her legal dispute is resolved, underscoring tensions over Fed independence.

Sector Highlights

Technology (+0.82%) and communication services (+3.76%) led the market, boosted by relief in the Google Search trial outcome and strength across big tech. Consumer discretionary also finished modestly higher, led by department stores. On the downside, energy (-2.30%) lagged on oil weakness and restructuring headlines, while materials (-0.53%), industrials (-0.48%), and healthcare (-0.41%) also fell. Real estate and utilities each dipped 0.2%. Financials (-0.16%) underperformed, weighed by bank weakness, while consumer staples were essentially flat (+0.02%).

Information Technology (XLK, +0.82%)

- Zscaler (ZS): Fiscal Q4 ahead of consensus on billings strength; mixed Q1 and FY26 guidance described as noisy due to Red Canary acquisition.

- TSMC (TSM): Waiver allowing shipment of chipmaking equipment to China revoked by the White House.

- Sprinklr (CXM -10.0%): Beat Q2 EPS and revenue, raised full-year outlook, but Q3 guide disappointed; CFO to depart Sept. 19.

Communication Services (XLC, +3.76%)

- Alphabet (GOOGL +9.1%): Rallied after antitrust ruling required limited remedies—no forced Chrome divestiture and continued revenue-sharing deals, including ~$20B annually with Apple. Analysts lifted price targets on removal of overhang.

- Apple (AAPL +3.8%): Benefited from continuation of Google’s search revenue-sharing agreement, a boost to its Services segment.

Consumer Discretionary (XLY, +0.43%)

- Macy’s (M +20.7%): Posted strong Q2 beat with first positive comp in 13 quarters; raised FY guidance.

- Dollar Tree (DLTR -8.4%): Q2 beat and raised, but tariff timing tailwind set to reverse in Q3; guidance raise underwhelmed relative to beat.

- Polestar Automotive (PSNY -17.3%): Reported narrower Q2 loss but margins hit by $739M tariff-driven impairment.

- Knight-Swift (KNX): Expressed support for planned Union Pacific/Norfolk Southern merger.

Consumer Staples (XLP, +0.02%)

- Campbell Soup (CPB +7.2%): FQ4 beat on EPS/EBIT; productivity gains offset tariff impacts; FY26 EPS guided ahead of consensus.

- Kraft Heinz (KHC): Unveiled plan to split into two standalone companies.

Healthcare (XLV, -0.41%)

- HealthEquity (HQY +7.5%): Q2 beat and raised, driven by Custodial strength, record GMs, and leverage to HSA expansion.

- Wave Life Sciences (WVE -16.8%): Dropped after data from RestorAATion-2 trial disappointed some investors.

- Revvity (RVTY -5.1%): Weakness after flagging worsening China diagnostic headwinds.

Energy (XLE, -2.30%)

- ConocoPhillips (COP -4.4%): Announced plans to cut 20–25% of its workforce as part of a restructuring program.

Financials (XLF, -0.16%)

- Comerica (CMA): Reportedly under activist pressure to pursue a sale.

- Freddie Mac (FMCC +2.9%): Rose on reports U.S. government considering sale of ~5% stake in GSEs.

Industrials (XLI, -0.48%)

- REV Group (REVG +12.6%): Beat Q3 estimates; Specialty Vehicles strength drove upside; raised FY guidance

Eco Data Releases | Thursday September 4th, 2025

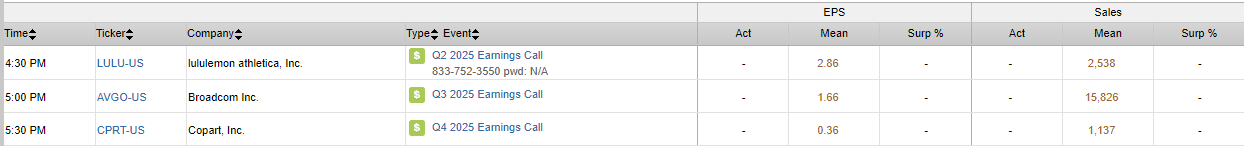

S&P 500 Constituent Earnings Announcements | Thursday September 4th, 2025

Data sourced from FactSet Research Systems Inc.