September 5, 2025

S&P 500 Futures are ahead 0.2% Friday after Thursday’s broad gains, which pushed the S&P 500 to a new record high. Big tech led, joined by banks, asset managers, retail/apparel, builders, hotels, and cruise lines. Asia was higher overnight (Shenzhen +4%, Hong Kong +1.5%, Japan +1%), while Europe is little changed. Treasuries flat into the jobs report. Dollar index -0.4%, gold steady, Bitcoin +1.7%, WTI -0.3%.

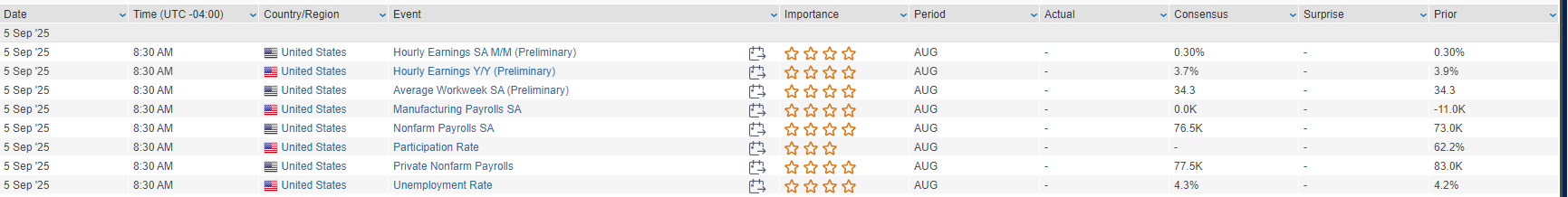

Focus is squarely on the August employment report. Consensus calls for +75K payrolls (vs. +73K in July), unemployment up to 4.3%, and wages +0.3% m/m. Six-month average payroll growth has slipped to 81K, the weakest of this cycle. Markets price ~60 bp of Fed cuts for the rest of 2025. No Fed speakers today, though Hammack pushed back against September easing, while Goolsbee remained undecided. Next week brings labor benchmark revisions (Tue), PPI (Wed), and CPI (Thu). Tariff headlines center on U.S.–Japan auto trade, USMCA renegotiations, and levies’ role in cushioning Treasury demand amid deficit worries.

Company News

- Broadcom (AVGO): Strong Q3 beat and raised Q4; highlighted OpenAI as a new AI chip customer.

- Lululemon (LULU): Fell on weak U.S. performance and lowered guidance.

- Copart (CPRT): Q4 revenue light but EPS ahead.

- Samsara (IOT): Rallied on better ARR growth reacceleration.

- Guidewire (GWRE): Positive cloud deal activity, including large Liberty Mutual contract.

- DocuSign (DOCU): Beat and raised, with IAM segment strength.

- Titan Machinery (TTAN): Beat and raised; Roto-Rooter deal seen as strategic win.

- UiPath (PATH): Beat on ARR, raised guidance; noted stabilization in public sector.

- Bill Holdings (BILL): Gained after Starboard disclosed stake.

U.S. equities advanced Thursday (Dow +0.77% | S&P 500 +0.83% | Nasdaq +0.98% | Russell 2000 +1.26%), finishing near session highs and pushing the S&P 500 to another record close, while the Dow and Nasdaq closed just below all-time highs. Tailwinds included a rate reprieve as Treasury yields eased 3–6 bp, weaker labor data reinforcing expectations for Fed easing, and resilient consumer commentary from retail conferences. September Fed rate cut probability remains above 95%. Dollar index rose 0.2%, gold fell 0.8%, Bitcoin futures dropped 2.3%, and WTI crude slipped 0.8% following Wednesday’s 2.5% decline.

Economic data was mixed. ADP private payrolls rose just +54K in August, well below consensus and prior months, highlighting hiring softness linked to labor shortages, cautious consumers, and possible AI disruptions. ISM Services beat expectations with a jump to 52.0, driven by stronger new orders, though employment stayed in contraction. Weekly jobless claims edged up to 237K, Challenger layoffs were the highest for August since 2020, and the trade deficit widened more than expected. Meanwhile, productivity was revised up sharply to +3.3% SAAR in Q2 while unit labor costs were revised down to +1.0%. On policy, NY Fed’s Williams said gradual rate cuts remain appropriate if the economy evolves as expected, while Stephen Miran pledged Fed independence in his Senate Banking Committee hearing. Media also reported the DoJ opened a criminal investigation into Governor Cook, adding to Fed governance uncertainty.

Sector Highlights

Cyclicals led Thursday’s rally. Consumer discretionary (+2.25%), industrials (+1.09%), and financials (+1.00%) outperformed, boosted by strong retail earnings, housing and auto demand, and asset manager strength. Communication services (+1.12%) also outperformed on Amazon-related AI tailwinds. On the other side, defensives lagged: utilities (-0.16%), consumer staples (+0.09%), and healthcare (+0.36%) saw muted gains. Tech (+0.55%) participated but trailed the broader market, weighed by mixed software earnings. Energy (+0.60%) underperformed despite oil’s stabilization, while real estate (+0.64%) posted modest gains.

Company Highlights by Sector

Information Technology (XLK, +0.55%)

- Salesforce (CRM -4.9%): Beat Q2 but guided cautiously for Q3; muted FY outlook and limited AI contributions weighed.

- Ciena (CIEN +23.3%): Beat Q3 earnings and revenue with record optical orders; raised guidance.

- Credo Technology (CRDO +7.4%): Strong Q1 beat and raised FY outlook; demand for AEC products driving +120% y/y revenue growth.

- GitLab (GTLB -7.4%): Q2 beat but light Q3 revenue guide, CFO exit, and concerns over GTM execution pressured stock.

- C3.ai (AI -7.3%): Missed Q1 EPS, lowered guidance, and withdrew FY forecast amid CEO transition.

- Texas Instruments (TXN -4.3%): At Citi TMT Conference, noted recovery slower than expected; outlook implied softer wafer starts.

- HPE (HPE +1.5%): FQ3 beat with Juniper contribution; networking strength; raised full-year guidance.

Communication Services (XLC, +1.12%)

- Amazon (AMZN +4.3%): Reportedly ramping Anthropic data center buildout; Trainium chips to anchor >1.3GW capacity.

- AppLovin (APP +2.6%): Target price raised by Jefferies on growth in e-commerce ads, international expansion, and new referral programs.

- Duolingo (DUOL -3.5%): Downgraded at DA Davidson on declining active-user metrics and brand sentiment challenges.

Consumer Discretionary (XLY, +2.25%)

- American Eagle (AEO +38.0%): Surged on Q2 beat; stronger margins and SG&A; reinstated FY outlook despite tariff headwinds.

- Shoe Carnival (SCVL +20.3%): Posted better EPS and upbeat commentary on August performance, highlighting rebanner momentum.

- Gap (GPS +5.9%): Announced expansion into beauty and accessories; phased launch at Old Navy.

- Asana (ASAN +2.8%): Q2 beat, raised revenue outlook; AI Studio ARR doubled q/q.

- Canada Goose (GOOS): Denied reports of going private.

Consumer Staples (XLP, +0.09%)

- e.l.f. Beauty (ELF +2.7%): Upgraded at Piper Sandler; cited easing comps, pipeline strength, and pricing power.

- Campbell Soup (CPB +7.2%): Reported strong cost controls offsetting tariffs; guided FY26 EPS above consensus.

Financials (XLF, +1.00%)

- T. Rowe Price (TROW +5.8%): Rose after Goldman Sachs announced up to $1B stake to expand private-market offerings.

- Genuine Parts (GPC +3.7%): Gained after settlement with Elliott, including two new board seats.

Healthcare (XLV, +0.36%)

- Agios Pharma (AGIO -11.0%): FDA extended review of PYRUKYND amid safety concerns.

- Elevance Health (ELV -4.2%): Reaffirmed below-consensus FY guidance.

- Revvity (RVTY -5.1%): Continued weakness on China diagnostics headwinds.

Industrials (XLI, +1.09%)

- Science Applications (SAIC -6.9%): Lowered FY revenue and EBITDA guidance on slower contract growth and award delays.

- Toro Co. (TTC): Management flagged persistent residential headwinds.

Energy (XLE, +0.60%)

- ConocoPhillips (COP -4.4%): Announced workforce reduction of 20–25% globally.

Eco Data Releases | Friday September 5th, 2025

S&P 500 Constituent Earnings Announcements | Friday September 5th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.