September 9, 2025

U.S. equities are up slightly after Monday’s modest gains, led by semis, software, Mag 7, China tech, asset managers, and retail, while defensives (utilities, pharma/biotech, food/beverage) and cyclicals (energy, steel, transport, insurers) lagged. Treasuries are weaker with curve steepening (yields +1–3 bp). Dollar -0.2% as yen rallies on hawkish BoJ. Gold +0.4%, Bitcoin +0.7%, WTI +0.9%.

Markets remain in wait mode ahead of today’s BLS payroll benchmark revision, with labor market softening seen as the key driver of Fed easing expectations. Futures now price ~75 bp of cuts this year, with September fully priced for 25 bp. Inflation data (PPI Wed, CPI Thu) may carry less weight given Fed’s labor focus. Positioning, buyback flows, equity supply, and tariff spillovers are also in focus.

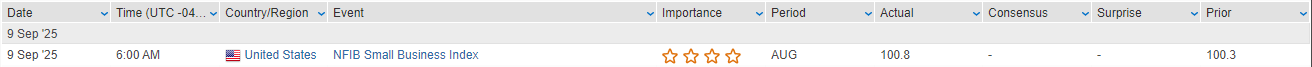

Data & policy this week: NFIB optimism rose to 100.8 in August. Today brings payroll revisions and a $58B 3Y auction. Treasury sells $39B 10Y (Wed) and $22B 30Y (Thu). Michigan sentiment due Friday. Fed in blackout ahead of FOMC next week.

Company News

- Apple (AAPL): Hosting product event today.

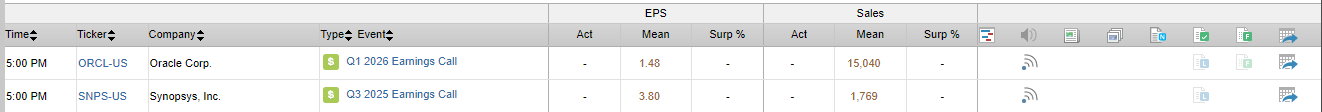

- Oracle (ORCL): Reports after the close.

- Dell (DELL): CFO Yvonne McGill stepping down; guidance reaffirmed.

- AT&T (T): Reiterated FY25 and long-term outlook.

- Fox (FOX), News Corp (NWS): Weaker after Murdoch family trust settlement; sale of 16.9M Class B shares planned.

- NBIS: Jumped on multi-billion AI infrastructure agreement with Microsoft; CRWV also a beneficiary.

- Casey’s (CASY): FQ1 ahead, reiterated FY26 outlook.

- Brighthouse (BHF): Boosted by takeover interest report.

- Mission Produce (AVO): Beat Q3 on strong avocado volumes.

U.S. equities edged higher in a quiet Monday session (Dow +0.25% | S&P 500 +0.21% | Nasdaq +0.45% | Russell 2000 +0.16%), trading rangebound with limited catalysts. The Nasdaq still managed a fresh record close. Treasuries firmed for a fourth straight session with long-end yields down ~8 bp, driving some curve flattening. Dollar index slipped 0.3%, gold gained 0.7%, Bitcoin rose 0.5%, and WTI crude climbed 0.6% as OPEC+’s output hike was widely expected while geopolitical concerns resurfaced.

Markets remain in wait-and-see mode ahead of August CPI on Thursday. Bullish narratives emphasize Fed easing, earnings revisions, consumer resilience, AI capex, corporate buybacks, and strong retail flows. Bearish themes continue to highlight sticky inflation, tariff uncertainty, seasonality, stretched positioning, supply headwinds, and global political risk. Fed is in blackout ahead of next week’s FOMC, with futures fully pricing a 25 bp September cut. Trade tensions linger with U.S.–EU steel and aluminum disputes and little progress with China. AI scrutiny also intensified following reports of heavy OpenAI cash burn.

The NY Fed survey showed 1-year inflation expectations ticking up to 3.2%, while 3- and 5-year horizons were unchanged. Notably, the mean perceived probability of finding a job after losing one fell to the lowest on record. This week’s data slate includes NFIB small business optimism and labor benchmark revisions (Tue), PPI (Wed), CPI and jobless claims (Thu), and Michigan sentiment (Fri). Treasury issuance is also in focus with $58B 3Y (Tue), $39B 10Y (Wed), and $22B 30Y (Thu).

Sector Performance

Gains were modest and uneven. Technology (+0.67%) and consumer discretionary (+0.53%) led on semiconductor momentum and retail strength. Materials (+0.23%) also finished higher. On the downside, utilities (-1.07%), real estate (-0.68%), and communication services (-0.32%) underperformed, reflecting yield sensitivity and weaker telecom/media sentiment. Consumer staples (-0.17%), energy (-0.15%), healthcare (-0.11%), financials (+0.02%), and industrials (+0.21%) were little changed.

Company Highlights by Sector

Information Technology (XLK, +0.67%)

- Planet Labs (PL +47.9%): Beat Q2 EPS and revenue; raised FY26 guidance; highlighted new government contracts.

- QuantumScape (QS +21.1%): Debuted QSE-5 solid-state batteries at Munich IAA; first anode-free battery in a real-world vehicle.

- AppLovin (APP +11.6%): Jumped after being added to S&P 500 at the Sept. 22 rebalance.

- Veeva Systems (VEEV +3.6%): Upgraded to Overweight at JPMorgan on TAM expansion and margin potential.

- Dexcom (DXCM -3.1%): Downgraded at Oppenheimer on concerns over G7 accuracy and competitive pressures.

Communication Services (XLC, -0.32%)

- Paramount (PSKY): Exploring ways to revitalize MTV, Comedy Central, and Nickelodeon.

- T-Mobile (TMUS -3.9%): Declined after SpaceX agreed to acquire spectrum licenses from EchoStar.

Consumer Discretionary (XLY, +0.53%)

- Children’s Place (PLCE +15.8%): Rose on Q2 revenue beat, restructuring plan, and tariff mitigation commentary.

- Canada Goose (GOOS +12.8%): Upgraded to Buy at TD Cowen, citing improved fundamentals.

- Gap (GPS): CEO said company aims to expand Gap chain domestically and overseas.

Consumer Staples (XLP, -0.17%)

- CVS Health (CVS -4.8%): Weighed down after CEO/CFO gave no update on star ratings or guidance at a conference.

Healthcare (XLV, -0.11%)

- Summit Therapeutics (SMMT -25.2%): Dropped on analyst concerns over lung cancer drug data.

- Alkermes (ALKS -5.0%): Phase 2 narcolepsy trial data in line, but safety concerns noted.

- UnitedHealth (UNH +1.5%): Reaffirmed FY EPS guidance of ≥$16.

Financials (XLF, +0.02%)

- PNC Financial (PNC): Announced $4.1B acquisition of Colorado’s FirstBank.

- Bank of America (BAC): Management reiterated FY NII guidance; said credit risks remain manageable.

- FHFA: Preparing $30B listing for Fannie Mae and Freddie Mac.

- LoanDepot (LDI): Mentioned positively by Citron Research.

Industrials (XLI, +0.21%)

- Emcor (EME): Set to join the S&P 500 at September rebalance.

Real Estate (XLRE, -0.68%)

- Boston Properties (BXP -1.4%): Cut quarterly dividend by 29% to $0.70.

Other Notables

- EchoStar (SATS +19.9%): Surged on $17B spectrum sale to SpaceX.

- Premier (PINC +4.9%): Reported in talks for potential buyout by Patient Square Capital.

Eco Data Releases | Tuesday September 9th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday September 9th, 2025

Data sourced from FactSet Research Systems Inc.