September 11, 2025

S&P futures +0.1%. U.S. equities were mixed Wednesday with the S&P and Nasdaq closing at fresh record highs, though breadth was weak (nearly 60% of the S&P declined). Tech dominated focus: ORCL, NVDA, and AVGO rallied, while AAPL and AMZN slipped. Asia traded mixed overnight—Mainland China, Japan, Korea, and Taiwan gained on tech strength, while Hong Kong and Australia fell. Europe is modestly higher (+0.2%). Treasuries slightly weaker (yields +1 bp). Dollar +0.2%. Gold -0.7%. Bitcoin +0.3%. WTI crude -0.3%.

Markets are in wait mode for August CPI, due this morning alongside weekly jobless claims. Street expects +0.3% m/m on both headline and core, with y/y headline rising to 2.9% and core steady at 3.1%. Fed is in blackout ahead of next week’s meeting, where a 25 bp cut is fully priced. Focus also on today’s $22B 30Y bond auction after a strong 10Y sale Wednesday. Trade and geopolitical headlines are muted—EU unlikely to hike tariffs on China/India despite Trump’s request, while Middle East and Russia tensions remain elevated.

Company News

-

FIGR: IPO pricing today; GEMI, VIA, and LGN set for Friday debuts.

-

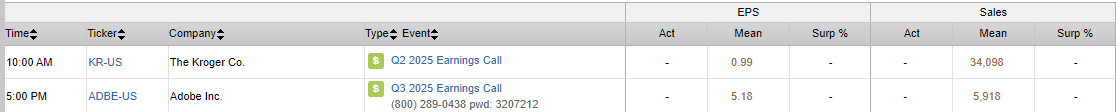

Kroger (KR): Reports earnings before the open.

-

Adobe (ADBE): Reports after the close.

-

Starbucks (SBUX): Narrowed list of final bidders for China business.

-

PNC: CEO said goal is to double bank’s size to $1T.

-

Opendoor (OPEN): Gained after naming Shopify COO Kaz Nejatian as new CEO.

-

Oxford Industries (OXM): Jumped despite sales miss; margins and EPS beat; guidance reiterated with higher tariffs accounted for.

-

Enovix (ENVX): Fell after announcing $300M convertible note offering.

U.S. equities finished mixed on Wednesday, Dow (0.48%) | S&P 500 +0.30% | Nasdaq +0.03% | Russell 2000 (0.16%). The S&P 500 and Nasdaq still managed fresh record closes. Trading was choppy, with an afternoon dip tied partly to political headlines, but a rally in AI and energy names provided support. Treasuries were firmer with modest curve flattening after a very strong $39B 10Y auction. Yields fell 1–4 bp. Dollar index edged up 0.1%. Gold was flat. Bitcoin gained 1.9%. WTI crude rallied 1.7% following early geopolitical headlines, including an Israeli strike in Qatar.

Macro developments were led by the August PPI report, which surprised to the downside. Headline PPI fell 0.1% m/m vs. expectations for a 0.3% increase, while core PPI also fell 0.1% m/m against +0.3% consensus. Both headline and core readings from July were revised lower. The decline was driven by softer services prices, particularly margins in wholesale trade. The cooler print reinforced Fed easing expectations, though market pricing of ~66 bp of cuts through year-end was little changed. On policy, a federal judge temporarily blocked Trump’s effort to fire Fed Governor Lisa Cook, clarifying her status ahead of next week’s FOMC. On trade, Trump reiterated threats of steep tariffs on China and India for purchasing Russian oil, while the Supreme Court agreed to fast-track review of the IEEPA tariff case.

Sector Performance

Sector leadership rotated toward cyclicals and defensives. Energy (+1.8%), Tech (+1.8%), Utilities (+1.7%), and Industrials (+0.7%) led the market, helped by strength in crude, semis, and select cap goods. Consumer Discretionary (1.6%) and Staples (1.1%) lagged sharply, joined by Healthcare (0.9%), Communication Services (0.9%), and Financials (0.3%). Materials (+0.2%) and Real Estate (0.1%) were little changed. Breadth was negative overall, with equal-weight S&P lower despite index-level gains.

Company News by GICS Sector

Information Technology

- Oracle (ORCL) +36%: Fiscal Q1 results overshadowed by 359% y/y surge in RPO to $455B, driven by four large AI contracts; guided RPO above $500B this year.

- Synopsys (SNPS) -36%: Missed Q3, cut guidance; Design IP weakness tied to China restrictions and foundry transitions.

- TSMC (TSM): August revenue up 34% y/y, highlighting robust AI demand.

- Rubrik (RBRK) -18%: Beat and raised FY26 ARR guide, but stock fell after large run-up and conservative tone.

Communication Services

- VMEO (Vimeo): To be acquired by Bending Spoons for $1.38B.

- Trade Desk (TTD) -12%: Downgraded at Morgan Stanley; weak guidance flagged continued CTV headwinds.

- GameStop (GME) +3%: Beat Q2 earnings/revenue; announced warrant dividend.

Consumer Discretionary

- Klarna (KLAR) +15%: IPO priced at $40, opened at $52.

- Chewy (CHWY) -17%: Missed EPS; concerns over margin trajectory despite revenue beat.

- Potbelly (PBPB) +31%: To be acquired by RaceTrac for $566M cash.

- Lands’ End (LE) +5%: Guidance raised; noted tariff mitigation strategies.

Energy

- Phillips 66 (PSX) +1.6%: Buying remaining 50% of WRB Refining from Cenovus, highlighting synergies and margin benefits.

- Albemarle (ALB) -11%: Declined after China’s Yichun lithium mine restart eased supply concerns.

Healthcare

- UnitedHealth (UNH) +9%: Estimated 78% of members in 4-star or higher plans for Star Year 2026.

- Summit Therapeutics (SMMT) -7%: Weighed down by reports U.S. considering new restrictions on Chinese drug imports.

Industrials

- AeroVironment (AVAV): Beat earnings, cited near-term award opportunities.

- Lear (LEA) -2.5%: Downgraded at BofA on valuation and auto production headwinds.

- Alcoa (AA) -1.1%: Offered cautious Q3 update with weaker shipments and higher expenses.

Financials

- Fifth Third (FITB): Taking $200M charge tied to fraudulent subprime loans at Tricolor.

- Brighthouse (BHF) +12%: Boosted on takeover speculation.

- Bill Holdings (BILL) +4%: Elliott disclosed >5% stake.

Eco Data Releases | Thursday September 11th, 2025

S&P 500 Constituent Earnings Announcements | Thursday September 11th, 2025

Data sourced from FactSet Research Systems Inc.