September 18, 2025

S&P futures +0.8% Thursday morning, led by big tech. Follows Wednesday’s mixed close with choppy post-FOMC trade; small caps outperformed while growth/momentum lagged, with NVDA a drag. Asia mixed (Korea, Taiwan, Japan strong; China/HK weak), Europe up ~1%. Treasuries firmer (yields -2 bp), dollar flat, gold -0.3%, Bitcoin +1.5%, WTI crude -0.4%.

Fed remains the main driver, with easing historically a tailwind despite near-term pullback calls tied to seasonality, buyback blackouts, and quarter-end. Goldman noted S&P’s largest drawdown since May just -2.7%, with no 2% pullback in over 100 days.

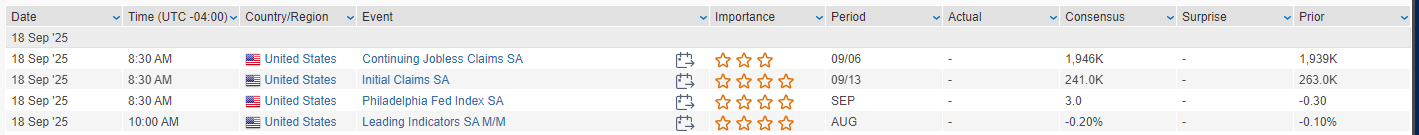

On the calendar: jobless claims (expected 240K vs last week’s fraud-driven spike to 263K) and September Philly Fed (seen +3.0). Friday quiet; next week’s focus includes PMIs, durable goods, existing home sales, and core PCE.

Corporate:

- AAPL: Aiming for 10% iPhone shipment increase next year, aided by foldable model.

- GOOGL: China dropped antitrust probe.

- META: Unveiled AI-enabled smartglasses; exploring media licensing for AI.

- NUE: Guided Q3 EPS ~20% sequential decline, all segments softer.

- NRG: Raised 2025 guidance midpoint by ~8%, light on detail.

- COO: Boosted buyback authorization by $1B to $2B.

- CBRL: Guided FY26 revenue/EBITDA below, citing weak traffic.

- ETNB: To be acquired by Roche for up to $3.5B.

U.S. equities ended mixed Wednesday (Dow +0.57%, S&P 500 (0.10%), Nasdaq (0.33%), Russell 2000 +0.18%) as markets digested the FOMC decision. The Fed delivered a widely expected 25 bp rate cut to 4.00–4.25%, with Governor Miran dissenting in favor of a larger 50 bp move. The dot plot signaled another 50 bp of easing this year, while Powell emphasized labor market softening and downside employment risks but noted no broad support for a half-point cut. Treasuries weakened with short-end yields up 3–4 bp, the dollar gained 0.3%, and gold slipped 0.2%. Bitcoin futures fell 1.0%. WTI crude settled down 0.7%.

Housing data disappointed with August starts down 8.5% m/m to the slowest pace since May, while permits also fell 3.7% m/m. Meanwhile, the Bank of Canada cut rates to 2.5%, signaling further easing if risks increase. Trade headlines remained tense: FT reported Beijing ordered major tech firms to stop buying NVDA AI chips, while SCMP suggested possible progress on U.S.–China deals around TikTok, ag products, and BA jets.

Sector Highlights

Financials (+0.96%) and Consumer Staples (+0.90%) led Wednesday’s gains, joined by modest strength in Materials, Utilities, Energy, Healthcare, and Real Estate. Tech (-0.70%), Industrials (-0.45%), and Consumer Discretionary (-0.31%) lagged as investors rotated out of growth and momentum stocks following the Fed decision.

- Information Technology

- NVDA (-2.7%): Hit by reports China banned its largest tech firms from buying its AI chips, including the RTX Pro 6000D designed for the Chinese market.

- AAPL: iPhone sales in China reportedly fell 6% y/y ahead of the iPhone 17 launch, a deeper slump than typical.

- WDAY (+7.3%): Jumped after Elliott disclosed a >$2B stake, pledging support for management; board authorized $4B in new buybacks.

- ARW (-6.2%): Slumped after CEO Sean Kerins resigned, with the company noting the move was unrelated to financials.

- Communication Services

- BABA (+2.4%): Announced China Unicom as a customer for its AI chips, deploying accelerators in a new datacenter.

- LYFT (+13.1%): Surged on partnership with Waymo to launch autonomous ride-hailing in Nashville by 2026.

- UBER (-5.0%): Fell on competitive concerns following the LYFT–Waymo announcement.

- GRAB (-3.5%): Downgraded at HSBC on valuation after a 30% rally.

- Consumer Discretionary

- ZG (+2.0%): Upgraded to Outperform at Bernstein, citing stronger revenue execution and opportunities in Rentals and Showcase.

- PGRE (-11.4%): Dropped after RITM confirmed acquisition at $6.60/share, ~11% below prior close.

- Healthcare

- ROIV (+7.8%): Reported positive Phase 3 results for Brepocitinib in Dermatomyositis, meeting primary and all secondary endpoints.

- VCEL (-9.7%): Downgraded at BTIG after proprietary survey suggested weaker growth outlook for MACI.

- Industrials

- ORA (+1.6%): Upgraded to Overweight at Piper Sandler, citing improving regulatory backdrop and AI-driven datacenter power demand.

Eco Data Releases | Thursday September 18th, 2025

S&P 500 Constituent Earnings Announcements | Thursday September 18th, 2025

Data sourced from FactSet Research Systems Inc.