March 5, 2025

S&P 500 futures are up 0.5% in early trading, attempting a rebound after Tuesday’s sharp selloff, which saw the S&P 500, Dow, and Russell 2000 all decline more than 1%. The market has now erased all gains since the election, losing nearly $3.5 trillion in market cap. Financials led the downturn as cyclicals remained under pressure. Treasuries continue to weaken, with global bond yields moving higher. The dollar index is down 0.6%, while gold is up 0.3%. Bitcoin futures are seeing a strong rebound, rising 2.5%, while WTI crude is down another 1.6%, extending losses after recent OPEC+ supply concerns.

Two major developments are in focus today. Commerce Secretary Howard Lutnick suggested that tariff rate relief for Canada and Mexico could come as soon as today, offering a potential reprieve amid rising trade tensions. Meanwhile, European markets are rallying after Germany’s CDU/CSU and SPD parties agreed on a substantial fiscal expansion plan aimed at infrastructure and defense, which some are calling Germany’s “whatever it takes” moment. Despite this bounce attempt, the overall market tone remains cautious. President Trump’s Congress address reaffirmed his full-throttle tariff approach, offering no signs of policy softening. Concerns about stagflation under Trump 2.0, heavy systematic selling from CTAs, negative earnings revisions, and a perceived lower “Trump put”—where the administration appears more focused on Main Street than Wall Street—continue to weigh on sentiment.

Today’s economic calendar features key data releases, including ADP private payrolls, expected to show a gain of 150K jobs in February following January’s 183K increase. ISM services is projected to be little changed at 52.7, while factory orders will also be reported. The Beige Book, offering insight into regional economic conditions, is due this afternoon. Looking ahead, Thursday will bring the trade balance, Q4 productivity, jobless claims, and wholesale inventories, while the February employment report is set for release on Friday, with Fed officials Powell, Williams, and Kugler scheduled to speak.

In corporate news, Alphabet (GOOGL) is reportedly urging the DOJ to abandon its push to break up the company, citing national security concerns as a key argument. AppLovin (APP) is in discussions to sell its gaming business for approximately $900 million. CrowdStrike (CRWD) is under pressure after reporting declining annual recurring revenue (ARR) and providing disappointing Q1 and full-year margin guidance. Meanwhile, Flutter (FLUT) issued FY25 guidance largely in line with consensus, which was viewed as a positive given broader market uncertainty.

In retail, Ross Stores (ROST) reported a Q4 beat on comps and EPS, but the full-year outlook fell short, with the company citing weather-related headwinds and elevated macroeconomic and geopolitical volatility. Dollar Tree (DLTR) announced a new CFO, while Box (BOX) provided a weaker-than-expected April-quarter outlook. Shares of AeroVironment (AVAV) are down sharply after the company missed earnings estimates and cut its guidance, blaming high winds and fires in Southern California for disruptions

U.S. equities closed lower in choppy trading on Tuesday, with the S&P 500 (-1.22%) marking its largest pullback of the year. The Dow (-1.55%), Nasdaq (-0.35%), and Russell 2000 (-1.08%) also posted losses as cyclicals faced outsized pressure.

Concerns over a global trade war remain front and center, with new U.S. tariffs on Canada, Mexico, and China taking effect today. In response, China announced retaliatory tariffs on U.S. agricultural goods, while Canada and Mexico also imposed countermeasures. Investors worry about the risk of further escalation, especially after President Trump reiterated plans for additional tariffs on agricultural imports starting April 2.

Treasuries weakened, with the yield curve steepening as earlier strength reversed. The dollar index fell 1%, while gold (+0.7%) and Bitcoin futures (+2.4%) both gained. WTI crude (-0.2%) settled lower after a sharp decline the previous day, driven by OPEC+ supply guidance.

Despite overall weakness, AI-linked names, China tech, software, and semiconductors outperformed, driven by dip-buying in previously sold-off momentum stocks.

Key Economic & Policy Developments

- Trump to address Congress at 9 PM ET: Expected to discuss tariffs, economic policy, and U.S.-Ukraine minerals deal.

- Fed commentary: NY Fed President Williams noted tariffs could increase inflationary pressures but saw no immediate need for policy adjustments.

- Upcoming data releases:

- Wednesday: ADP private payrolls, ISM services, factory orders, Beige Book.

- Thursday: Trade balance, Q4 productivity, initial jobless claims.

- Friday: February employment report.

Geopolitics & Trade Updates

- China’s retaliation: 15% tariffs imposed on U.S. chicken, wheat, corn, and cotton, plus 10% tariffs on soybeans, pork, beef, seafood, fruits, and dairy.

- Canada’s countermeasures: $20.6B in U.S. goods to face 25% tariffs, with a second round coming in three weeks.

- Mexico’s response: President Sheinbaum confirmed retaliatory tariffs set for Sunday.

- Trump administration warns of further tariff hikes in response to any retaliation

Sector Performance & Notable Company News

Technology (+0.01%)

- Okta (OKTA, +24.3%): Surged post-earnings as Q4 results beat expectations. FY26 revenue and margins guided higher, driven by 15% cRPO growth and strong execution. Multiple sell-side upgrades followed.

- SoundHound AI (SOUN, -5.9%): Delayed 10-K filing, citing accounting complexity from acquisitions. Also flagged material weaknesses in internal controls.

Communication Services (-0.40%)

- Alphabet (GOOGL, +0.2%): Outperformed broader tech, benefiting from rotation into AI-driven names.

- DoubleVerify (DV, -4.6%): Downgraded to Hold at Loop Capital, citing a tough outlook and ongoing challenges with large customers.

Healthcare (+0.93%)

- UnitedHealth (UNH, +1.6%): Department of Justice lawsuit over Medicare fraud expected to be dropped, driving shares higher.

- BeOne Medicines (ONC, +4.8%): FDA approved TEVIMBRA, a new first-line cancer treatment.

- Walgreens Boots Alliance (WBA, +5.6%): Sycamore Partners nearing a $10B acquisition deal to take the company private.

Consumer Discretionary (-1.67%)

- Target (TGT, -3.0%): Q4 results beat expectations, but guidance flagged consumer uncertainty and the impact of tariffs.

- Best Buy (BBY, -13.3%): Reported positive Q4 comps, but FY26 outlook weaker than expected. Consumer spending caution and tariff risks weighed on sentiment.

- Tesla (TSLA, -4.5%): February China EV sales plunged 49% YoY and 51% MoM, raising demand concerns. Company ramping up incentives to boost sales.

Consumer Staples (-1.78%)

- Hershey (HSY, -1.2%): Expressed concerns that ICE cocoa futures market is disconnected from reality, highlighting potential pricing pressures.

- Scotts Miracle-Gro (SMG, +7.3%): Upgraded to Buy at Stifel, citing earnings recovery, long-term growth potential, and minimal tariff risk.

Industrials (-1.96%)

- JetBlue (JBLU, -5.7%): Downgraded to Hold at Deutsche Bank amid concerns over economic softness impacting travel demand. Also flagged engine issues.

Financials (-3.54%)

- Goldman Sachs (GS, -1.8%): Announced 3-5% workforce reductions as part of annual performance reviews.

- Private credit lenders preparing for the next phase of the credit cycle, with rising distress risks flagged by strategists.

Energy (-0.86%)

- Oil services stocks declined as WTI crude (-0.2%) struggled following the OPEC+ meeting, where production cuts failed to provide a bullish catalyst.

Materials (-1.38%)

- Bloom Energy (BE, -3.1%): Reportedly priced a new share offering at $23.25 through Morgan Stanley.

- Aluminum stocks outperformed as China announced new export restrictions, tightening supply concerns.

Real Estate (+1.21%)

- BlackRock-backed group acquiring two Panama Canal ports, previously owned by a Hong Kong firm, amid U.S. pressure.

Utilities (-1.71%)

- Ontario to impose a 25% tariff on power exports to three U.S. states, escalating the trade conflict with the U.S.

Eco Data Releases | Wednesday March 5th, 2025

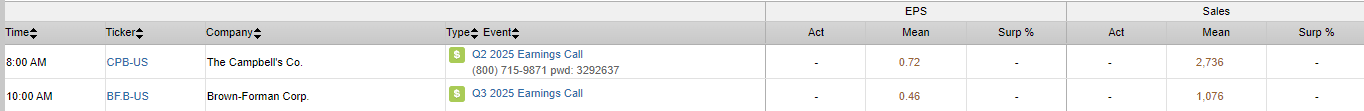

S&P 500 Constituent Earnings Announcements | Wednesday March 5th, 2025

Data sourced from FactSet Research Systems Inc.