September 23, 2025

S&P futures are little changed Tuesday after U.S. equities extended record highs on Monday, led by gains in big tech (NVDA, AAPL, TSLA). Treasuries firmed with yields down ~2 bp, while the dollar slipped 0.1%, gold rose 1.2%, Bitcoin added 0.2%, and WTI crude gained 0.6%.

Macro focus today is on U.S. flash PMIs and Powell’s midday remarks, with Micron earnings after the close as a key test for the AI trade. Bullish themes remain Fed easing, resilient balance sheets, supportive positioning, and rising earnings estimates, though risks include quarter-end dynamics, AI ROI scrutiny, and lagged tariff effects.

Company News:

- NVDA: Added ~$160B in market value after announcing a $100B OpenAI investment; some scrutiny on “circular” funding dynamic.

- AAPL: Outperformed on favorable demand commentary and sell-side upgrades for new products; last Mag 7 name to turn positive YTD.

- TSLA: Extended Monday’s momentum as part of big tech leadership.

- BA: Benefited from speculation around a large upcoming order from China.

- KVUE: Rebounded after Trump administration’s acetaminophen–autism warning seen as a clearing event, though litigation risks remain.

- AZO: Scheduled to report earnings this morning.

- MU: High-profile earnings after the close, viewed as a key AI trade catalyst

U.S. equities extended Friday’s gains (Dow +0.14%, S&P 500 +0.44%, Nasdaq +0.70%, Russell 2000 +0.59%), with all three major indices closing at record highs, while the Russell 2000 ended just below last week’s record. Breadth was negative, with equal-weight S&P 500 lagging cap-weighted performance. Treasuries weakened modestly with yields up 2–4 bp, curve flattening slightly. The dollar index fell 0.3%, gold hit another record (+1.9%), Bitcoin slid 2.1%, and WTI crude dipped 0.2%.

The market remains supported by Fed easing, resilient U.S. data, and the AI growth narrative, while M&A activity added further momentum. Positioning and sentiment continue to point toward room for further upside, though concerns remain around quarter-end dynamics, tariffs, housing softness, and China AI competition. Government shutdown risk is being largely ignored. Fed commentary was mixed: Governor Miran leaned dovish, saying policy is overly restrictive, while others including Hammack and Musalem warned against easing too quickly.

Sector Highlights

Technology (+1.74%) led gains, fueled by NVDA’s massive OpenAI investment, Apple’s stronger iPhone outlook, and upgrades across semis and hardware. Utilities (+0.92%) also outperformed, helped by defensive bid in a volatile backdrop. Underperformers included Communication Services (–0.92%), dragged by Match; Consumer Staples (–0.89%); and Consumer Discretionary (–0.43%), where housing weakness (LEN downgrade) and apparel retail softness weighed. Energy (–0.18%) lagged as crude prices eased

- Technology:

- NVDA +3.9% announced up to $100B investment in OpenAI to expand AI data center capacity.

- AAPL +3.2% asked suppliers to boost iPhone 17 base model production by 30–40% amid strong early demand.

- ORCL in $20B cloud talks with META; also announced new co-CEOs.

- META unveiled AI-driven dating features, weighing on MTCH –5.4%.

- AMAT +5.5% upgraded at Morgan Stanley on stronger fab equipment outlook.

- TER +12.8% gained on reports of traction at TSM’s AI supply chain.

- FDS +2.2% upgraded at UBS, praised for AI integration.

- Communication Services:

- FOX +2.7% linked to U.S. TikTok deal alongside ORCL and DELL; White House confirmed U.S. majority board control.

- DIS said it will reinstate Jimmy Kimmel Live

- META’s dating launch pressured MTCH.

- CMCSA planning job cuts in internet/mobile/TV unit.

- TMUS named Gopalan as new CEO, effective Nov-1.

- Consumer Discretionary:

- TSLA approved for autonomous vehicle testing in Arizona.

- SHOO +3.6% upgraded on positive industry fashion trends.

- CROX –4% downgraded on demand concerns.

- Healthcare:

- PFE to acquire MTSR +60.7% in a $7.3B obesity drug deal.

- SRPT +7% upgraded at BMO on ramping Elevidys uptake.

- INSP –1.7% downgraded on reimbursement delays.

- KVUE –7.5% fell after White House announced autism–acetaminophen review.

- Industrials:

- FDX +2.4% beat on revenue/EPS, Express segment strength offset Freight softness.

- ODP to be taken private in a $1B transaction.

- PRO to be acquired by Thoma Bravo for $1.4B.

- Financials:

- PINC +9.7% to be acquired by Patient Square Capital for $2.6B.

- COMP –15.8% to acquire HOUS +45.5% in $10B all-stock merger; HOUS shareholders receive 84% premium.

- JEF expanded partnership with Sumitomo Mitsui.

- GNW boosted buyback by $350M.

- Real Estate:

- HOUS surged on merger deal with COMP.

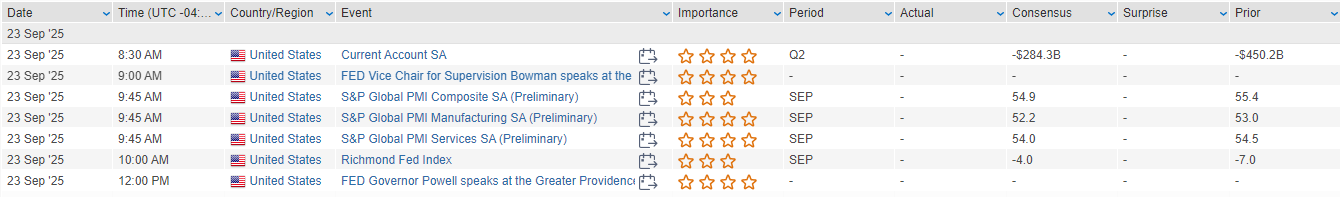

Eco Data Releases | Tuesday September 23rd, 2025

S&P 500 Constituent Earnings Announcements | Tuesday September 23rd, 2025

Data sourced from FactSet Research Systems Inc.