September 25, 2025

S&P futures slightly lower in Thursday morning trading after U.S. equities fell for a second straight session. Big tech led the decline (AAPL, NVDA, GOOGL, MU, PLTR), while China tech, energy, staples, builders, chemicals, and managed care outperformed. Asian markets mixed, Europe −0.4%. Treasuries flat to firmer, dollar steady, WTI crude −0.6%.

Fed speakers cautious on further easing; White House warned agencies of mass layoffs in a possible shutdown. U.S. launched new tariff probes into medical equipment, robotics, and machinery. Quarter-end flows and trimmed Fed easing expectations weighing on tone. AI spending remains a structural tailwind but faces scrutiny over ROI and “circularity.”

Corporate updates:

- ORCL-US: Downgraded to Sell at Rothschild & Redburn, weighing on shares.

- INTC-US: Extended gains after Bloomberg reported investment talks with AAPL as part of comeback bid.

- AAPL-US: Reported to be considering investment in Intel’s turnaround plan.

- C-US: Selling 25% stake in Banamex business.

- BIRK-US: Guided fiscal Q4 sales slightly above consensus, reiterated FY EBITDA outlook.

- KBH-US: Q3 revenue and GM beat; positive early Q4 trends highlighted.

- FUL-US: Q3 results in line; FY guidance trimmed slightly lower.

- SCS-US: Q2 beat, driven by strong demand from large U.S. corporate customers.

U.S. equities declined Wednesday (Dow −0.37%, S&P 500 −0.28%, Nasdaq −0.33%, Russell 2000 −0.92%), extending their pullback from Monday’s record highs. The S&P 500, Nasdaq, and Russell 2000 are now modestly lower for the week. Trading was influenced by a mix of rate, Fed, and quarter-end dynamics. Treasuries sold off, with yields up 2–5 bp across the curve, partly on corporate issuance (Oracle) and hawkish commentary from Fed’s Goolsbee. The dollar rose 0.7%, gold fell 1.3% after a three-day rally, while WTI crude jumped 2.5% and is now up over 4% for the week. Market participants continue to weigh near-term headwinds—quarter-end pension rebalancing (Goldman projects ~$22B in equity selling), corporate buyback blackouts, and scrutiny on AI ROI—against ongoing bullish themes of Fed easing, resilient corporate/consumer balance sheets, and broadening participation. On the geopolitical front, Trump’s shift in tone on Ukraine drove some support for energy and aerospace/defense.

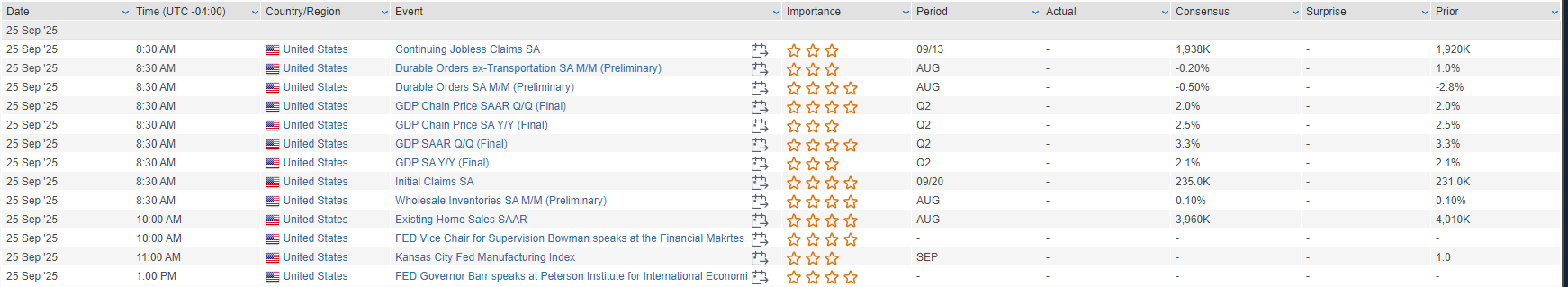

August new home sales surprised to the upside, hitting 800K (vs. 650K consensus), the strongest pace since January 2022, with gains concentrated in the South. Median sales price rose 4.7% m/m and 1.9% y/y. Mortgage applications ticked higher, extending recent momentum, while 30-year mortgage rates fell to 6.34%, the lowest since September 2024. Treasury’s $70B 5-year note auction tailed slightly, with foreign demand broadly in line. On the Fed front, Chicago’s Goolsbee warned against overly frontloaded rate cuts, while Fed’s Daly was scheduled after the close. Attention now shifts to Thursday’s data-heavy calendar (GDP, durable goods, jobless claims, and existing home sales), with PCE inflation on Friday the key highlight.

Sector Highlights

Energy (+1.23%) led gains, supported by higher crude prices and geopolitical tailwinds, while Utilities (+0.73%) and Consumer Discretionary (+0.70%) also outperformed. On the downside, Materials (−1.59%) was hit by weakness in copper and gold miners, Real Estate (−1.01%) and Communication Services (−0.82%) lagged, while Tech (−0.52%) and Industrials (−0.51%) underperformed amid post-earnings pressures and AI scrutiny.

- Information Technology

- MU: Reported FQ4 results with ~30% q/q HBM revenue growth, nearing an $8B run rate, but shares slipped on high expectations.

- INTC: Reportedly seeking investment from AAPL to support turnaround strategy.

- MRVL: Announced $5B buyback and $1B accelerated repurchase.

- IAS: Agreed to be taken private in a $1.9B deal, representing a 22% premium.

- ADBE: Downgraded at Morgan Stanley on concerns over AI monetization and growth visibility.

- Communication Services

- META: CEO Zuckerberg said Instagram reached 3B monthly active users.

- META also unveiled a new AI model (Qwen3-Max) through Alibaba cloud integration.

- DIS: Jimmy Kimmel Live set to return Tuesday; however, Nexstar and Sinclair said they will boycott the show.

- Consumer Discretionary

- MLKN: Beat earnings but bookings disappointed; guidance in line with Street.

- THO: EPS/revenue beat across all segments; guidance assumes modest retail declines.

- GM: Upgraded at UBS on positive catalysts tied to EPA rulings and FY26 guidance.

- Consumer Staples

- KVUE: Shares rebounded despite Tylenol litigation risks; White House comments seen as a clearing event.

- Health Care

- ACAD: Fell sharply after a Phase 3 drug trial failed to show benefit.

- ACHC: Rallied on reports of activist Engine Capital taking a ~3% stake.

- MCK: Raised FY26 EPS guidance at its Investor Day.

- JNJ: Upgraded at Guggenheim, citing strength in Innovative Medicine outlook.

- Industrials

- CTAS: Missed earnings; guidance raise smaller than expected.

- KBR: Announced spinoff plans for Mission Technology Solutions and reaffirmed guidance.

- PWR: Upgraded at Jefferies on growth in TAM and strong execution.

- Energy & Materials

- LAC: Surged on reports White House may take up to a 10% stake.

- FCX: Cut Q3 sales forecast for copper (−4%) and gold (−6%) vs. prior estimates.

- BE: Downgraded at Jefferies on valuation concerns.

Eco Data Releases | Thursday September 25th, 2025

S&P 500 Constituent Earnings Announcements | Thursday September 25th, 2025

Data sourced from FactSet Research Systems Inc.