September 29, 2025

S&P futures are up 0.6% Monday morning, near premarket highs, following Friday’s rebound that snapped a three-day losing streak. Asian markets were mostly firmer and Europe is broadly higher. Treasuries are stronger with modest curve flattening, dollar index off 0.2%, gold up 1%, Bitcoin +2.9%, and WTI crude down 1.7% on reports of a possible November OPEC+ production hike.

Focus remains on U.S. shutdown risk ahead of Tuesday’s deadline. Trump meets congressional leaders at the White House today after last week’s cancelled session. Markets remain relatively unconcerned about lasting economic damage, though risks include data release disruptions and potential federal job cuts. Broader narratives unchanged: bulls point to Fed rate-cut expectations, favorable Q4 seasonality, and resilient economic data; bears flag political uncertainty and looming labor-market reports.

On the calendar: August pending-home sales and the Dallas Fed manufacturing report today, JOLTs Tuesday, ADP Wednesday, and September nonfarm payrolls Friday (expected +51K, unemployment steady at 3.7%).

Corporate news was light: Trump called for MSFT to dismiss its global affairs chief, WMT’s CEO discussed workforce AI readiness, BA resumes union contract talks with federal mediation, and U.S. urged missile suppliers like LMT to boost production. OXY is reportedly exploring a $10B sale of its OxyChem unit, and MRUS will be acquired by GMAB in an ~$8B deal

U.S. equities closed higher Friday (Dow +0.65%, S&P 500 +0.59%, Nasdaq +0.44%, Russell 2000 +0.97%), ending just off best levels and breaking a three-day losing streak for the S&P 500 and Nasdaq. Despite the bounce, both indices finished modestly lower for the week. Treasury yields were little changed to slightly higher, with the curve flattening; the dollar eased 0.4% but remained up for the week. Gold gained 1.1%, Bitcoin slipped 0.2% (down 5% weekly), and WTI crude added 1.1%, capping a 5.3% weekly rally—the strongest since June.

Macro data helped counter stagflation concerns: August core PCE rose 0.2% m/m and 2.9% y/y, in line with expectations, while personal income (+0.6%) and spending (+0.3%) showed solid momentum. Final University of Michigan sentiment dipped slightly to 55.1, but near-term inflation expectations were revised lower. Fed commentary was mixed: Richmond Fed’s Barkin emphasized limited risk of deterioration, while Vice Chair Bowman warned of labor-market fragility that could necessitate faster easing.

Trade policy remained a dominant theme. President Trump unveiled sweeping tariffs including 25% on heavy trucks, 50% on housing products, 30% on upholstered furniture, and 100% on branded drugs unless U.S. production is underway. Reports also suggested the White House may pursue a 1:1 ratio of domestically manufactured to imported semiconductors, sparking concerns about potential disruption for global chipmakers. Meanwhile, government shutdown risks lingered with little progress ahead of the Sept. 30 deadline, though markets continued to largely discount the risk.

Sector Highlights

Friday’s rally was broad-based, with most cyclical groups leading. Utilities (+1.59%), Consumer Discretionary (+1.45%), and Materials (+1.05%) were the top performers, while Staples (-0.11%), Communication Services (+0.13%), and Tech (+0.21%) lagged. Energy, Industrials, and Financials also posted solid gains, reflecting tariff-driven moves in truck manufacturing, building materials, and capital markets activity

Information Technology

- INTC (+4.4%) gained after reports it approached TSM about manufacturing partnerships, building on earlier headlines of outreach to AAPL.

- ORCL (-5.6%) remained pressured following a sell-side downgrade and headlines about its TikTok stake evaluation.

- EA (+14.9%) surged on reports of a potential $50B take-private deal, with Silver Lake and Saudi PIF named among possible buyers.

Industrials

- BA (+3.6%) rose on reports the FAA may relax regulations, allowing the company to regain control of some safety checks.

- PCAR (+5.2%) benefited from Trump’s new 25% tariff on heavy trucks, given its large domestic manufacturing base.

- FUN (+4%) rallied after activist Land & Buildings pressed for real estate monetization, including a possible REIT spinoff.

Consumer

- W, RH, WSM all declined following tariffs on upholstered furniture.

- IHG (+4.6%) was upgraded to overweight by JPMorgan, which cited stronger earnings visibility and FCF conversion.

- COST (-2.9%) reported Q4 results with share gains and membership tailwinds, though analysts flagged valuation concerns.

Healthcare

- ALKS (+2.8%) upgraded to outperform at RBC on valuation and expectations for favorable safety profile of pipeline drug.

Communication Services

- CNXC (-13.3%) sold off on weak margins and excess capacity concerns tied to tariffs.

Materials

- MBC (+6.1%) and AMWD both rallied, as Trump’s proposed 50% cabinet import tariffs highlight their 95%+ U.S. revenue exposure.

Utilities & Energy

- Energy broadly outperformed again, supported by oil’s 5.3% weekly gain, its best since June, amid geopolitical tensions.

Eco Data Releases | Monday September 29th, 2025

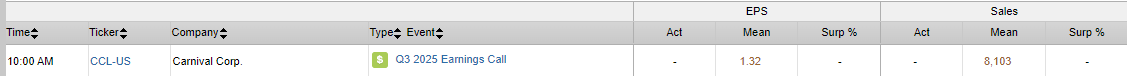

S&P 500 Constituent Earnings Announcements | Monday September 29th, 2025

Data sourced from FactSet Research Systems Inc.