September 30, 2025

S&P futures down 0.2% Tuesday after U.S. equities gained Monday, led by crypto, biotech, China ADRs, Mag 7, rails, IBs, builders, and airlines, while energy, cruise lines, regional banks, and apparel lagged. Asia mostly higher overnight with Taiwan a standout; Europe narrowly mixed. Treasuries firmer with curve steepening; dollar off 0.1%, gold down 0.5%, Bitcoin down 1.5%, WTI crude down 0.7% after Monday’s 3.5% drop on OPEC+ speculation.

Macro backdrop remains cautious with shutdown risk dominating headlines, though many strategists downplay lasting economic damage from a brief closure. Debate continues on whether a delayed September jobs report could revive bond market volatility. Tariff noise persists, but lumber and housing product levies appear less severe than feared. Quarter-end positioning and buyback blackouts also cited as short-term drags.

Today’s data slate includes July FHFA and S&P Case-Shiller home prices, August JOLTS, and September consumer confidence. Fedspeak lineup: Jefferson (downside risks to jobs, upside risks to inflation), with Collins, Goolsbee, and Logan still ahead. Later this week: ADP, ISM manufacturing, construction spending, claims, factory orders, and ISM services (though shutdown could delay Friday’s payrolls).

Corporate news:

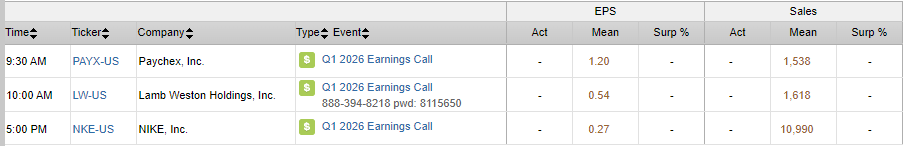

- PAYX reports before the open.

- NKE earnings after the close.

- BA reportedly in early stages of designing a 737 MAX successor.

- CNP raised FY25 EPS guidance, guided FY26 in line, and announced a 10-year plan.

- SATS higher on reports VZ in talks to buy its wireless spectrum.

- JEF beat Q3 metrics, citing rebound in global market sentiment.

- MTN Q4 EBITDA in line, though Epic pass sales slowed and FY26 outlook softened.

- COTY launched a strategic review of its Consumer Beauty business.

- PRGS beat and raised, highlighting AI-driven tailwinds and integration of ShareFile

U.S. equities finished higher Monday (Dow +0.15%, S&P 500 +0.26%, Nasdaq +0.48%, Russell 2000 +0.04%), recovering from earlier weakness with a late-session rebound. The main focus was the looming government shutdown, as funding authority expires Tuesday night. President Trump met with congressional leaders in the Oval Office, though expectations for a breakthrough remain low. Reports suggested Senate Democrats may propose a 7–10 day continuing resolution to buy time. The Bureau of Labor Statistics confirmed it would suspend operations in the event of a shutdown, raising uncertainty about this week’s critical labor-market releases.

Trade remained a central theme. President Trump reiterated calls for steep tariffs on furniture, announced plans for 100% tariffs on foreign films, and continued threats of 100% tariffs on branded drugs unless production occurs in the U.S. At the same time, China’s Commerce Ministry condemned U.S. export controls on advanced semiconductors, calling them “unreasonable suppression.” Tensions also rose over Taiwan, with Xi reportedly pressing the U.S. to oppose Taiwanese independence.

Fed governors reflected mixed tones:

- NY Fed’s Williams: Some upside inflation risks have ebbed; September cut was appropriate, but Fed still far from 2% inflation goal.

- St. Louis’ Musalem (voter): Tariffs’ impact muted so far, but Fed should remain cautious on further cuts.

- Cleveland’s Hammack: Inflation remains too high, labor weakness overstated.

- Atlanta’s Bostic: More inflation still to come, reiterated cautious stance.

Economic data were mixed. August pending-home sales rose 4.0% m/m, the fastest since April, underscoring housing resilience despite higher mortgage rates. Meanwhile, the Dallas Fed manufacturing index fell to -8.7, with new orders and employment weakening further, reflecting tariff and rate headwinds. Treasuries rallied, with yields down ~5 bp at the long end and the curve flattening to its narrowest 2s/30s spread in nearly two months. Gold hit another record (+1.2%), Bitcoin surged 5%, while crude dropped 3.5% on renewed OPEC+ production hike speculation.

Sector Highlights

- Outperformers: Consumer Discretionary (+0.55%), Technology (+0.49%), Financials (+0.48%), Materials (+0.43%), Industrials (+0.31%), Utilities (+0.29%), Healthcare (+0.29%).

- Underperformers: Energy (-1.91%), Communication Services (-0.45%), Consumer Staples (+0.12%), Real Estate (+0.15%).

Information Technology (XLK)

- NVDA gained on continued AI enthusiasm despite trade headwinds.

- SHOP and ETSY announced a partnership with OpenAI for ChatGPT Instant Checkout, with ETSY up 15.8%.

- WDC rallied 9.2% after Morgan Stanley raised its target to $171, citing upside from AI-driven cloud infrastructure demand.

- LRCX rose 2.2% after an upgrade at Deutsche Bank highlighted attractive valuation relative to wafer fab equipment outlook.

Communication Services (XLC)

- NFLX fell after Trump pledged a 100% tariff on foreign films, raising content-cost risk.

- WBD dropped 3.3% on the same news, as U.S. studios face higher competitive pressure.

Consumer Discretionary (XLY)

- EA confirmed it will be taken private by PIF, Silver Lake, and Affinity Partners in a ~$55B deal ($210/share).

- CCL beat and raised guidance, citing strong bookings, though stock lagged on high expectations.

- WSM declined 4.7% after Trump reaffirmed 30% tariffs on upholstered furniture, weighing on import-heavy retailers.

- UBER partnered with Aldi on nationwide on-demand grocery delivery.

Industrials (XLI)

- CSX rose 5.4% after naming former Linde CEO Steve Angel as new CEO, following activist pressure tied to the UNP merger push.

- LMT advanced as media reports said the Pentagon urged missile suppliers to double or quadruple production rates amid heightened China tensions.

Energy (XLE)

- OXY was in focus after reports it is exploring a $10B sale of its OxyChem unit, but broader Energy stocks fell alongside crude.

Healthcare (XLV)

- MRUS surged 36% after agreeing to be acquired by Genmab (GMAB.DC) in an ~$8B all-cash deal.

- MLTX plunged ~90% after disappointing results from its Phase 3 HS VELA trial.

Eco Data Releases | Tuesday September 30th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday September 30th, 2025

Data sourced from FactSet Research Systems Inc.