October 1, 2025

S&P futures -0.5% after U.S. equities closed mostly higher Tuesday, with strong September and Q3 gains. Pharma led on PFE’s drug pricing deal with the White House, while consumer finance and travel/leisure lagged.

Asian trading was mixed (South Korea outperformed, Japan lagged, Greater China shut for holiday). Europe slightly higher (+0.1%). Treasuries narrowly mixed with modest curve steepening. Dollar index -0.1%. Gold +1% (after +10% in September, +17% in Q3). Bitcoin +1.5%. WTI crude -0.9%.

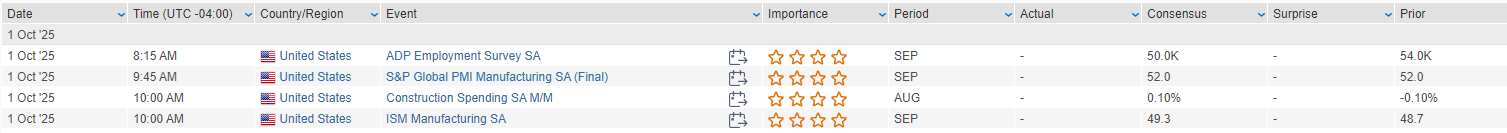

Weak futures tone blamed on shutdown uncertainty, though risks widely flagged and economic impact seen as limited. Bigger concern is delayed data releases, with jobless claims and Friday’s NFP on hold. ADP payrolls (+50K est.), ISM manufacturing (49.0 est.), and August construction spending highlight today’s calendar.

Corporate news:

- NKE posted a stronger FQ1 turnaround (NA revenue growth, strong running category), though guidance was light.

- AES reportedly near a $38B sale to BlackRock-owned GIP.

- BRK.B close to $10B deal for OXY’s petrochemical unit.

- LAC surged after DOE took a 5% stake in both the company and its Thacker Pass JV with GM.

- TSLA raised U.S. lease prices after EV tax credit expiration.

- FCX nearing sale of additional PT Freeport Indonesia shares.

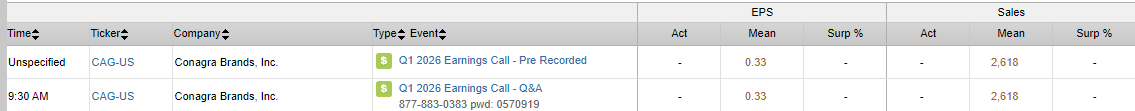

- CAG earnings on tap this morning.

U.S. equities ended Tuesday mostly higher (Dow +0.18%, S&P 500 +0.41%, Nasdaq +0.30%, Russell 2000 +0.05%), with the Dow finishing at a fresh all-time high and the S&P 500 closing just below its own record. The session capped a strong September and third quarter, as equities overcame seasonal headwinds thanks to a combination of Fed easing, resilient consumer demand, and persistent AI-driven capex momentum. The looming government shutdown dominated political headlines. With federal spending authority expiring at midnight, negotiations between the parties remained stalled, and no clear path forward had emerged. While past shutdowns have tended to be relatively short-lived, markets are more concerned about the delay of important economic data, particularly Friday’s scheduled nonfarm payrolls report, than the direct economic fallout.

Economic data painted a mixed picture. The August JOLTS report came in stronger than expected at 7.227M job openings, though the quits rate declined to 1.9%, its lowest since December, highlighting a labor market with less churn. September consumer confidence fell to 94.2 from 97.8 in August, driven by the sharpest monthly drop in the Present Situation Index in a year. Inflation expectations eased slightly to 5.8%, though they remain elevated relative to the start of the year. Meanwhile, the Chicago PMI unexpectedly fell to 40.6, marking continued contraction in regional manufacturing, while July FHFA and S&P Case-Shiller home price indices both slipped.

Federal Reserve commentary reinforced the sense of a cautiously dovish policy stance. Vice Chair Jefferson flagged downside risks to employment but emphasized upside risks to inflation. Boston Fed President Collins suggested additional easing may be appropriate but stressed the need to maintain a modestly restrictive stance. Chicago’s Goolsbee pointed to a steady labor market but underscored uncertainty from new tariffs. Collectively, these remarks support the narrative that while the Fed is easing, policymakers remain wary of inflationary shocks.

Broader market context remained constructive. The S&P 500 extended its streak to five consecutive monthly gains, bucking the typical September weakness. A 25 bp rate cut at the September FOMC meeting and a dovish tilt in the dot plot provided an additional tailwind. Disinflation support came from the sharp decline in oil prices, while consumer resilience was highlighted at the Goldman Sachs Retail Conference and confirmed by stronger-than-expected retail sales data. Q3 GDP tracking estimates improved by nearly a full percentage point during the month to +3.9%. Depressed bond volatility, healthy foreign demand at Treasury auctions, a pickup in IPO and M&A activity, and still-elevated retail participation added to the bullish narrative.

Treasuries finished mixed, with front-end yields up 1–2 bp and curve steepening modestly. The dollar index slipped 0.1%. Gold reversed early weakness to finish 0.5% higher, while Bitcoin futures ended slightly lower, down 0.1% but well off session lows. WTI crude extended its slide, falling 1.7% after a 3.5% drop on Monday, as OPEC+ discussions about potentially raising output weighed on sentiment.

Sector Performance

Sector moves reflected the mixed macro backdrop. Healthcare led the market higher, up 2.45%, driven by gains in pharmaceuticals, hospitals, and life sciences following reports of drug pricing agreements that eased tariff concerns. Technology gained 0.86%, helped by AI-linked momentum and strong semiconductor and software demand. Industrials (+0.80%) and Materials (+0.55%) also outperformed, with strength in aerospace, E&C, and select commodity producers.

On the downside, Energy fell 1.07% alongside weaker crude oil, while Consumer Discretionary (-0.55%) slipped on soft results in retail and travel/tourism. Communication Services (-0.47%) lagged despite strength in media and telecom, as SPOT traded sharply lower. Financials (-0.45%) also underperformed as banks and consumer finance names remained pressured. Defensive groups saw only modest gains, with Utilities (+0.21%), Consumer Staples (+0.27%), and Real Estate (+0.29%) little changed.

Sector & Company Highlights

Healthcare (+2.45%)

- PFE +6.8%: Medicaid pricing agreement with Trump administration; also expected to announce $70B US manufacturing investment.

- LLY advanced with broader pharma strength.

- Hospitals and life sciences rallied on policy clarity and defensive rotation.

Information Technology (+0.86%)

- CRWV +11.7%: $14B+ computing power deal with META.

- PATH +6.5%: Announced AI automation partnerships with SNOW, NVDA, and OpenAI.

- SMTC +15.3%: Upgraded at Oppenheimer on AI-driven interconnect growth.

- PRGS +3.1%: Beat and raised on AI capabilities and ShareFile integration.

- NVDA gained on continued hyperscaler and sovereign demand signals.

Industrials (+0.80%)

- BA: Reports of early-stage development of a new single-aisle aircraft.

- MTN: Q4 EBITDA largely in line but softer Epic pass sales growth weighed on FY26 guidance.

Materials (+0.55%)

- FCX +5.7%: Upgraded to Buy at BofA; Grasberg risks seen as priced in.

- CRH +4.6%: Reaffirmed FY25 guidance; outlined five-year growth plan.

- AA -2.8%: Announced permanent closure of Kwinana alumina refinery; $890M in charges.

Consumer Staples (+0.27%)

- LW +4.3%: Beat on earnings and margins; reaffirmed guidance.

- UNFI +18.5%: Strong EPS/EBITDA beat; FY26 outlook raised despite light revenue.

- COTY: Initiated review of Consumer Beauty unit.

Consumer Discretionary (-0.55%)

- NKE: Reported earnings after the close.

- CART -3.1%: Downgraded on intensifying competition from AMZN, UBER, and DASH.

- MTDR -1.5%: CFO transition announced; no financial issues cited.

Communication Services (-0.47%)

- SPOT -4.2%: CEO Ek stepping down; downgrade at GS.

- SATS +3.7%: Lifted on reports VZ may buy spectrum.

Financials (-0.45%)

- JEF: Beat on Q3 results, citing improved market sentiment; comp ratio flagged.

- PAYX -1.4%: EPS beat but revenue missed; analysts noted PEO slowdown.

Energy (-1.07%)

- OKLO -4.2%: Downgraded at BofA on valuation concerns relative to SMR adoption.

- WTI crude -1.7% pressured broad sector.

Utilities (+0.21%)

- CNP: Raised FY25 EPS guidance slightly; issued FY26 in line; unveiled 10-year plan.

Real Estate (+0.29%)

Eco Data Releases | Tuesday October1st, 2025

S&P 500 Constituent Earnings Announcements | Tuesday October1st, 2025

Data sourced from FactSet Research Systems Inc.