October 17, 2025

S&P 500 futures were down 1.1% Friday morning, extending Thursday’s selloff but holding above overnight lows. Risk appetite remained weak amid renewed worries over regional-bank credit stress, fading AI trade momentum, and limited economic visibility due to the government shutdown. European markets followed Asia lower, while Treasuries were steady to stronger at the short end—2-year yields hit fresh three-year lows. The dollar index slipped 0.1%, heading for its worst week since early August. Gold rose 1.1% on safe-haven demand, Bitcoin futures fell 3.3%, and WTI crude dropped 1.1%, set for its lowest close since February 2021.

Investors continued to assess lingering regional-bank concerns following headlines around Zions (ZION) and Western Alliance (WAL), adding to unease after the First Brands and Tricolor bankruptcies. Comments from JPMorgan CEO Jamie Dimon—warning such incidents could be “cockroaches”—fueled fears of broader credit ripple effects. Meanwhile, U.S.–China trade tensions remained elevated with no progress toward a Trump–Xi meeting at APEC. The AI trade stayed under pressure amid mounting bubble concerns.

Economic data were absent Friday, and Fedspeak quieted ahead of the pre-FOMC blackout. St. Louis Fed’s Musalem speaks at 12:15 p.m. ET, the final scheduled appearance before next Wednesday’s expected 25 bp rate cut. Market focus now turns to next week’s September CPI, existing-home sales, flash PMIs, and final October University of Michigan sentiment.

Corporate Highlights

- CSX ( + ) – Beat earnings and revenue expectations on stronger intermodal volume and improved efficiency; analysts cited positive operational momentum.

- Interactive Brokers (IBKR + ) – Reported solid results with record new-account growth and higher commission income, though the brokerage group traded broadly weaker.

- Bank OZK (OZK – ) – Missed EPS estimates; net-interest income and margin largely in line.

- American Express (AXP), Truist (TFC), Schlumberger (SLB), State Street (STT), and Fifth Third (FITB) – Key reports due next week as Q3 earnings volume accelerates.

- Eli Lilly (LLY) & Novo Nordisk (NVO) – Weaker after Trump said GLP-1 drug prices would “come down pretty fast.”

- Micron (MU) – Reuters reported it will halt server-chip shipments to Chinese data centers but continue supplying other sectors

U.S. equities declined Thursday (Dow -0.65% · S&P 500 -0.63% · Nasdaq -0.47% · Russell 2000 -2.09%), giving back a portion of this week’s gains as financials and energy led the market lower amid renewed credit concerns, mixed economic data, and lingering uncertainty around the government shutdown. The S&P 500 fell 0.6%, its second decline in three sessions, though major indices remain on track for solid weekly gains following Monday and Tuesday’s strength.

The day’s tone turned defensive as regional banks came under heavy pressure after Zions Bancorp (ZION) disclosed two large commercial loan charge-offs, reigniting worries about credit quality in regional and private credit markets. Contagion concerns spread to Western Alliance (WAL) and First Horizon (FHN), while insurance stocks slumped on weak underwriting metrics. At the same time, AI-related optimism—a key support for equities earlier in the week—proved mixed. TSMC (TSM) raised FY25 guidance again, underscoring conviction in the “AI megatrend,” but ORCL (Oracle) and CRM (Salesforce)’s upbeat analyst-day commentary was offset by renewed concerns of overvaluation and “circular” AI deal structures, including reports of xAI negotiating a $20B lease-to-own deal for NVIDIA chips.

Economic data reinforced a stagflation-like narrative of cooling activity but sticky prices. The October Philadelphia Fed Manufacturing Index posted a surprise negative print, its lowest since April, with declines in new orders and average workweek metrics, though price components rose again after easing last month. Conversely, homebuilder sentiment improved: the NAHB Housing Market Index jumped five points to 37, the best reading since April, and future expectations crossed back above 50 for the first time in nine months. Builders cited better buyer traffic but noted that price cuts reached their highest level since October 2024.

The federal government shutdown, now entering its third week, continues to distort market expectations. With key data releases—PPI, retail sales, and jobless claims—still delayed, the absence of official inflation and employment readings has left investors relying on surveys and corporate earnings to gauge the economy’s trajectory. Treasury Secretary Bessent reiterated that the administration would not alter its negotiating stance with China due to market volatility but hinted at a potential extension of the trade truce if Beijing eases rare earth export restrictions.

On monetary policy, the day’s Fedspeak leaned dovish. Governor Miran repeated his call for a 50 bp rate cut in October, arguing a pause in balance sheet runoff may soon be warranted, and warned that U.S.–China tensions could weigh on 2026 growth. Governor Waller maintained that while AI innovation may increase layoffs, it ultimately enhances productivity and supports the Fed’s long-term growth mandate. The bond market responded favorably: Treasury yields fell 7–8 bp at the front end, flattening the curve modestly and sending the 2Y yield to its lowest level since September 2022.

Commodities and currencies reflected the cautious tone. The Dollar Index fell 0.5%, while gold surged 2.5% to $4,300/oz, extending its record-breaking rally on safe-haven flows and tariff-related inflation concerns. Bitcoin declined 2.8%, while WTI crude fell 1.5%, closing below $59/bbl amid signs of oversupply and cautious commentary from refiners.

Sector Highlights

Sector performance was broadly negative, with cyclical weakness in financials (-2.75%), energy (-1.12%), and consumer discretionary (-0.88%) weighing most heavily. The financial sector led losses after regional-bank disclosures raised questions about credit risk and private-lending exposure. Energy followed crude lower, while utilities (-1.03%) and consumer staples (-0.78%) also underperformed as investors rotated toward cash and gold. Modest gains in technology (+0.13%), healthcare (-0.11%), and real estate (-0.30%) helped cushion broader declines. Despite Thursday’s weakness, most indices remain positive for the week, supported by Tuesday’s rally and improving earnings sentiment.

Financials

- Zions Bancorporation (ZION -13.1%) – Announced a $60M provision and $50M charge-off related to two C&I loans; cited borrower misrepresentations and contractual defaults.

- Western Alliance (WAL -10.9%) – Confirmed exposure to one of Zions’ loan counterparties; reaffirmed FY25 guidance but sentiment weak.

- Travelers (TRV -2.9%) – Core EPS and revenue beat, but net premiums written below consensus; softer commercial pricing weighed on outlook.

- Marsh & McLennan (MMC -8.5%) – Organic growth inline; risk and insurance services underperformed, offset by consulting; sees current reinsurance conditions persisting into 2026.

- Charles Schwab (SCHW) – Trading and fee income strong, though expenses higher; commentary supportive of long-term deposit stability.

Information Technology

- TSMC (TSM) – Raised FY25 revenue growth outlook to ~35% (from ~30%) with Q4 revenue and margin guidance above expectations; gross margin improved to 59.5%, beating 57.5% consensus; reaffirmed long-term AI demand CAGR in the mid-40% range through 2029.

- Oracle (ORCL +3.1%) – Announced AI infrastructure GM ~35%, AI infra revenue +117% y/y, and distributed cloud growth +77%; pushed back on recent profit concerns.

- Hewlett Packard Enterprise (HPE -10.1%) – Fell on underwhelming FY26 guidance despite dividend increase and buyback.

- Datadog (DDOG -5.5%) / GitLab (GTLB +10.6%) – StreetInsider reported Datadog exploring $60/share takeover bid for GitLab.

- Celestica (CLS +3.7%) – Initiated Buy at Goldman Sachs, citing strong positioning in AI server assembly and data center components.

- CoreWeave (CRWV +1.8%) – Gained on report xAI raising $20B SPV to lease NVIDIA GPUs for its Colossus 22 data center.

Industrials

- J.B. Hunt (JBHT +22.1%) – Q3 EPS and revenue beat; operating profit +16% y/y on cost improvements and late-quarter volume lift; intermodal decline offset by strength in Eastern U.S. volumes.

- Commercial Metals (CMC -7.3%) – FQ4 in-line; guided NA finished steel shipments lower sequentially; announced $1.84B acquisition of Foley Products Company.

Consumer Discretionary

- United Airlines (UAL) – Beat and guided above, though unit revenue softness and higher costs drew scrutiny; comps remain tough post-DAL.

- Papa John’s (PZZA +9.4%) – Jumped after Apollo submitted a $64/share take-private bid (~31% premium).

- Tesla (TSLA) – Extended recent declines amid broad tech weakness and concerns about EV demand moderation.

Consumer Staples

- CRM (Salesforce +4.0%) – Analyst day reaffirmed long-term $60B+ FY30 revenue target, 10%+ organic CAGR, and 40% operating margin goal (“Rule of 50”); emphasized Agentforce adoption and share buybacks.

Healthcare

- Praxis Precision Medicines (PRAX +183.7%) – Announced positive Phase 3 results for ulixacaltamide in essential tremor; will file NDA early 2026.

- Abbott Labs (ABT -2.4%) – In-line Q3; med-devices strong, but nutrition segment lagged; narrowed FY25 EPS guide.

Materials & Energy

- Lithium Americas (LAC -21.7%) – Cut to Underweight at JPM; cited valuation concerns after 200% rally post-government stake.

- American Battery Tech (ABAT -36.7%) – DOE terminated grant for lithium hydroxide facility; company appealing decision.

- Energy sector broadly lower, tracking weaker crude and refinery margin commentary.

Communication Services

- Meta (META) – Benefited from AI talent migration, including reported poaching of another key Apple engineer.

- Media and telecom names were mixed; AI infrastructure stories (xAI, CoreWeave) remained the focus.

Real Estate

- Prologis (PLD +6.3%) – FFO and leasing volumes beat, raised FY25 guidance; cited improving occupancy, limited new supply, and data center pipeline expansion.

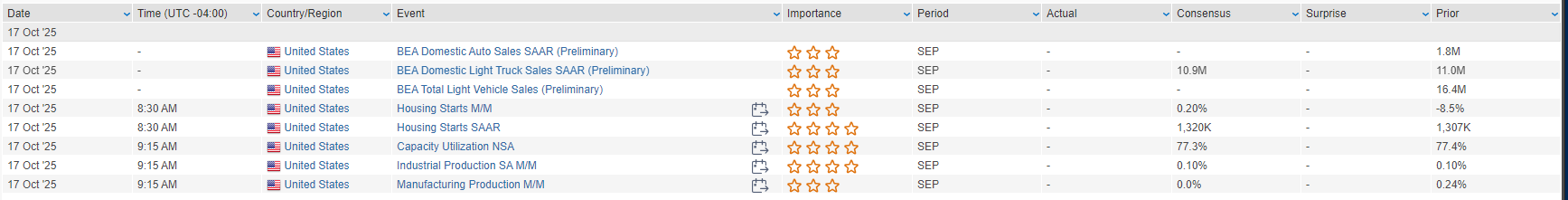

Eco Data Releases | Friday October 17th, 2025

S&P 500 Constituent Earnings Announcements | Friday October 17th, 2025

Data sourced from FactSet Research Systems Inc.