October 27, 2025

S&P futures +0.8% Monday morning, extending last week’s strength when the Dow, Nasdaq, and Russell 2000 each rose over 2%. The S&P 500 heads into the final week of October on pace for a sixth straight monthly gain, while the Nasdaq is set for its seventh. Asia rallied overnight (Japan, South Korea, Taiwan strong; China +1%), and Europe up ~0.3%. Treasuries weaker (yields +2–3 bp), Dollar −0.1%, Gold −2%, Bitcoin +4.1%, and WTI −1%.

Risk sentiment remains buoyed by Fed easing expectations, strong macro data, and resilient earnings momentum. The Fed is expected to cut 25 bp at Wednesday’s meeting and may signal an end to QT. Optimism is also building ahead of this week’s Trump–Xi meeting, though any agreement is likely limited to a renewed trade truce. Market focus remains on the AI-driven capex boom, with five of the “Mag 7” reporting this week (GOOGL, META, MSFT Wednesday; AAPL, AMZN Thursday). Seasonality and renewed corporate buybacks are additional tailwinds.

Corporate highlights:

- Novartis (NVS) to acquire RNA Therapeutics (RNA) for $72/sh in cash (~46% premium, $12B deal).

- Plymouth Industrial REIT (PLYM) to be acquired by Makarora for $22/sh all-cash ($2.1B).

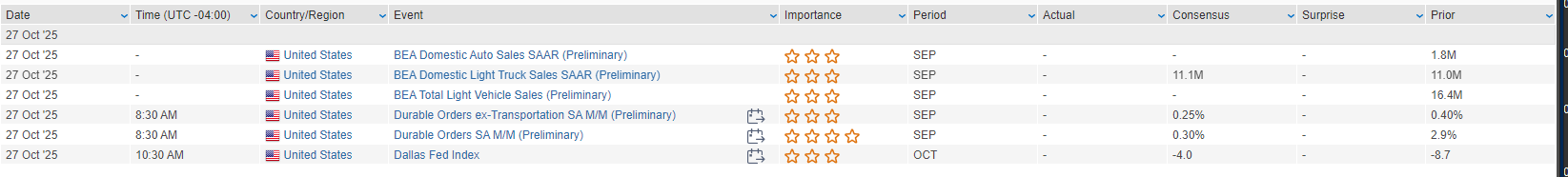

On the economic calendar, data remain limited amid the government shutdown. Today brings the Dallas Fed Manufacturing Index, followed by Consumer Confidence, Richmond Fed, and Case-Shiller on Tuesday. The FOMC meeting dominates Wednesday, with Treasury auctions for 2-, 5-, and 7-year notes spread through midweek. Friday’s Chicago PMI rounds out the week.

Stocks advanced Friday finishing near highs (Dow +1.01%, S&P 500 +0.79%, Nasdaq +1.15%, Russell 2000 +1.24%), capping a week of fresh record closes for the S&P 500, Nasdaq, Dow, and Russell 2000. The tone was supported by a cooler-than-expected September CPI (core +0.2% m/m, headline +0.3% m/m) with shelter easing, and flash PMIs that surprised to the upside (services led, manufacturing steady). Despite the softer inflation print, Treasury yields were little moved (2Y −1 bp) and the market still prices ~42 bp of additional 2025 cuts. The Dollar was flat, gold −0.2% (after Thursday’s bounce), Bitcoin +0.4%, and WTI −0.5% on the day but notched its best week since June.

Earnings remained a tailwind: the Q3 beat rate ~84% and the blended growth rate has risen ~100 bp since reporting began. Sentiment also got a nudge from confirmation of the Trump–Xi meeting (Oct 30) and conciliatory remarks from China’s Commerce Minister, even as USTR Greer confirmed a Section 301 probe into China’s 2020 trade-deal compliance. The market largely ignored Trump’s move to terminate talks with Canada.

Sector Highlights

Leadership skewed toward growth and duration-sensitive groups: Tech (+1.58%), Communication Services (+1.27%), Utilities (+1.18%), and Financials (+1.09%) outperformed. Cyclicals were mixed: Industrials (+0.06%) and Real Estate (+0.37%) lagged the tape, while Energy (−1.01%) and Materials (−0.61%) trailed as crude cooled intraday and metals faded. Consumer Staples (−0.39%) and Consumer Discretionary (−0.12%) underperformed; Health Care (+0.02%) was flat. Overall breadth improved, with momentum pockets still choppy but broader indexes securing weekly records

Information Technology

- Intel (INTC) – Q3 beat in CCG & DCAI; Q4 guide stronger ex-Altera.

- Applied Materials (AMAT) – To reduce workforce by ~4% as part of cost actions.

Communication Services

- Alphabet (GOOGL) – Outperformed after Anthropic expanded use of Google Cloud TPU chips (access to up to 1M TPUs).

- Grindr (GRND) – Disclosed a $18/sh non-binding take-private proposal.

Consumer Discretionary

- Ford (F) – Beat; outlook better than feared; plans to boost truck production.

- Deckers (DECK) – Fell on softer implied 2H guide despite a strong Q2 EPS beat.

- Boyd Gaming (BYD) – Beat, solid core customer trends; destination softness noted.

Industrials

- General Dynamics (GD) – Beat; strength in Aerospace & Marine.

- Comfort Systems (FIX) – Surged on Q3 beats; record backlog ($9.38B); dividend +20%.

- Norfolk Southern (NSC) – Land-sale gain offset by OR deterioration and intermodal share loss.

Financials

- Western Union (WU) – Beat; reiterated FY25 guides; digital revenue acceleration.

- SLM (SLM) – Missed; raised FY EPS guide; credit metrics stable.

Health Care

- HCA Healthcare (HCA) – Beat; raised FY guidance; volumes and cost control positive.

Consumer Staples

- Boston Beer (SAM) – Big EPS beat; raised FY EPS & GM; positive reception to Sun Cruiser and continued Angry Orchard growth.

- Target (TGT) – Plans to cut ~1,800 corporate roles as part of turnaround.

Energy

- Baker Hughes (BKR) – Beat with strength in IET; FY EBITDA raise underwhelmed some.

Materials

- Newmont (NEM) – Beat; reiterated 2025 production/cost guides; exploring strategic options around Barrick Nevada assets; shares weighed by a large YTD run.

Eco Data Releases | Monday October 27th, 2025

S&P 500 Constituent Earnings Announcements | Monday October 27th, 2025

Data sourced from FactSet Research Systems Inc.