March 10, 2025

S&P 500 futures are down 1.1% in premarket trading, near session lows, as the market struggles to stabilize after last week’s sharp declines. The S&P ended Friday more than 6% below its February 19 record close, marking its worst week since early September, largely driven by Trump 2.0 policy uncertainty and growth concerns. European markets are broadly lower, following a mixed session in Asia. Treasuries are firmer, partially reversing last week’s yield spike, while the dollar index is down 0.2% after posting its worst week since November 2022. Gold is down 2%, Bitcoin futures are down 5.3%, and WTI crude is up 0.3%.

Investor sentiment remains cautious amid lingering tariff uncertainty, as Trump signaled over the weekend that the economy is entering “a period of transition.” Meanwhile, Congress is working to avoid a government shutdown, with the GOP proposing a six-month stopgap spending bill, though its passage remains uncertain. Despite the downside pressure, some bullish narratives persist, including expectations for Fed rate cuts, dip-buying activity, a softer dollar, and speculation that tariff threats may be more of a negotiating tactic than a concrete policy shift.

There are no major economic releases today, though the NY Fed’s Survey of Consumer Expectations will be released at 11 AM ET. Key data this week includes JOLTS job openings (Tuesday), CPI inflation (Wednesday), PPI and jobless claims (Thursday), and preliminary March consumer sentiment (Friday). The Treasury market will also digest $119B in new issuance, with auctions for 3-year notes (Tuesday), 10-year notes (Wednesday), and 30-year bonds (Thursday).

Corporate News

- Rocket Mortgage (RKT) to acquire Redfin (RDFN) in a $1.75B deal.

- S&P 500 index changes (effective March 24): DoorDash (DASH), TKO Group (TKO), Williams-Sonoma (WSM), and Exelixis (EXE) will join, replacing BorgWarner (BWA), Teleflex (TFX), Celanese (CE), and FMC Corporation (FMC).

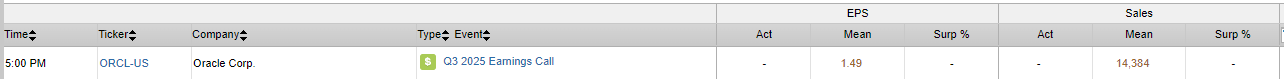

- Notable earnings this week: Oracle (ORCL) reports post-close today, Adobe (ADBE) on Wednesday, and Dollar General (DG) on Thursday morning.

U.S. equities finished higher on Friday, with the S&P 500 (+0.55%), Dow (+0.52%), Nasdaq (+0.70%), and Russell 2000 (+0.43%) posting modest gains after a volatile session. However, both the S&P 500 and Nasdaq recorded their third consecutive weekly decline, with the S&P posting its worst weekly performance since September. Semiconductors, energy, media, food, grocers, REITs, utilities, biotech, rails, machinery, packaging, drug stores (WBA), and managed care stocks outperformed, while staples retailers (COST), airlines, credit cards, money center banks, investment banks, off-price retail, cruise lines, casinos, and apparel stocks lagged.

Treasuries weakened across the curve, reversing earlier strength and continuing the week’s upward trend in yields. The dollar index fell 0.2%, marking its worst week since November 2022. Gold dropped 0.4%, while Bitcoin futures declined 1.7%, experiencing a sell-the-news reaction to Trump’s crypto executive order. WTI crude rose 1.0%, though it pulled back from intraday highs following new Russia-Ukraine headlines.

Friday’s market action was driven by a mostly in-line February payrolls report and dovish commentary from Fed Chair Powell, who downplayed concerns over recent sentiment surveys and inflation expectations. While Broadcom’s (AVGO) strong earnings helped sentiment in AI stocks, uncertainty surrounding Trump’s trade policies, sticky inflation, negative earnings revisions, CTA selling pressure, and capital rotation into Europe remain major headwinds. The VIX hit its highest level of the year on Thursday, reflecting heightened volatility.

The February jobs report showed 151K job gains, slightly below the 160K consensus, while the unemployment rate ticked up to 4.1%. Average hourly earnings growth met expectations at 0.3%, down from a revised 0.4% in January. Analysts saw the report as neutral to slightly positive, though some noted concerns over the falling labor force participation rate. The Fed is still expected to cut rates by ~75 bps in 2025, and Powell reiterated that the Fed is well-positioned to wait for further clarity before making policy moves.

In geopolitics, Bloomberg reported that Russia may be open to discussing a temporary ceasefire with Ukraine, provided it aligns with a final peace settlement framework. This comes ahead of planned U.S.-Ukraine talks in Jeddah, Saudi Arabia, next week.

Sector Performance & Notable Company News

Technology (+1.44%)

- Broadcom (AVGO, +8.6%): Q1 earnings and revenue beat, driven by strong AI revenue and expansion in AI networking and XPU sales. The company raised Q2 guidance and announced two new AI engagement partnerships.

- Hewlett Packard Enterprise (HPE, -12.0%): Missed Q1 EPS estimates, while revenue slightly beat. Gross margins and free cash flow disappointed, and FY25 guidance fell short. Management flagged execution issues, price competition, and looming tariff headwinds.

- Samsara (IOT, -15.6%): Despite beating Q4 earnings and revenue estimates, billings and deferred revenue missed expectations, while FY26 guidance was viewed as uninspiring.

Communication Services (+0.49%)

- Wayfair (W, +5.8%): Upgraded to Buy at Jefferies, citing market share gains, strong B2B momentum, and expanding physical retail presence. The company also cut 340 jobs in its technology division to boost efficiency.

- BigBear.ai (BBAI, -20.5%): Q4 revenue, EPS, and EBITDA all missed estimates, with FY25 revenue guidance falling short. Analysts see long-term AI-driven defense opportunities, but the near-term outlook remains uncertain under the new administration.

Consumer Discretionary (-0.31%)

- Gap (GPS, +18.8%): Q4 earnings, revenue, and operating margins exceeded expectations, with strong comps at Gap, Old Navy, and Banana Republic. The company highlighted inventory discipline and market share gains, while FY26 operating income growth guidance topped estimates.

- Costco (COST, -6.1%): EPS and operating margins were slightly below estimates, though comps were strong, particularly in non-food categories. Membership fee revenue missed expectations, but analysts were positive on Costco’s e-commerce growth and comp resilience vs. peers.

- Genesco (GCO, -16.3%): Missed Q4 earnings and revenue estimates, with weak comps at Schuh and Johnston & Murphy. The company issued FY26 guidance well below consensus.

Consumer Staples (-0.61%)

- Walgreens Boots Alliance (WBA, +7.5%): To be taken private by Sycamore Partners for $23.7B, including a future contingent payout of up to $3 per share, representing a 29% premium. The deal is expected to close in Q4 2025.

Industrials (+1.20%)

- Bloomin’ Brands (BLMN, +2.7%): CEO Mike Spanos disclosed a purchase of 118K shares, signaling confidence in the company’s future.

Energy (+1.64%)

- WTI crude gained 1.0%, extending a late-week rebound, though trading remains volatile amid ongoing Russia-Ukraine tensions and OPEC+ production adjustments.

Financials (-0.58%)

- Investment banks and money center banks underperformed, reflecting ongoing concerns over capital markets activity amid rising global bond yields.

Real Estate (+0.60%)

- REITs rebounded, benefiting from dovish Powell commentary and weaker-than-expected labor market data, which kept rate cut expectations intact

Eco Data Releases | Monday March 10th, 2025

No releases schedules

S&P 500 Constituent Earnings Announcements | Monday March 10th, 2025

Data sourced from FactSet Research Systems Inc.