November 3, 2025

S&P futures +0.3% following a strong October in which the S&P 500 rose for a sixth straight month and the Nasdaq for a seventh. Asian equities were higher overnight (South Korea +3% to a record), while Europe gained ~0.5%. Treasuries firmed slightly with front-end yields −2 bp. Dollar Index +0.1%, gold +0.3%, Bitcoin −2.2%, WTI crude flat after the expected OPEC+ output hike and Q1 pause announcement.

Markets enter November with momentum amid a favorable seasonal backdrop and resilient earnings. S&P 500 Q3 EPS growth now near +11%, with broad participation despite ongoing scrutiny of AI capex and monetization. Rate-cut odds for December remain around 70%, while dovish weekend remarks from Waller and Miran offset last week’s hawkish Fed tone. Supportive dynamics include returning buybacks, rising M&A activity, subdued bond volatility, and neutral investor positioning.

Macro focus:

- ISM Manufacturing (Oct) expected at 49.5 vs 49.1 prior, while Fed’s Daly and Cook speak later today.

- Treasury borrowing forecasts (15:00 ET) expected to highlight modest upward Q4 revision and initial Q1 guidance.

- Light vehicle sales seen at 15.5M saar (vs 16.4M in Sept).

- Later this week: Refunding announcement & SCOTUS IEEPA case (Wed), ADP payrolls & ISM Services (Wed), and Univ. of Michigan sentiment (Fri).

Corporate highlights:

- NVIDIA (NVDA): Trump confirmed Blackwell AI chips restricted to U.S. customers.

- Microsoft (MSFT): CEO Nadella said chip supply no longer a constraint—data center power and space now the main bottleneck.

- Amazon (AMZN): Expanding push into grocery segment, seeking share gains against WMT and KR.

- Berkshire Hathaway (BRK.B): Operating income +36% y/y, driven by strong insurance underwriting.

- Pfizer (PFE): Sued Metsera (MTSR) and Novo Nordisk (NVO) to defend its obesity-drug deal.

- T-Mobile (TMUS): Partnering with Capital One (COF) to launch first co-branded credit card on the Visa (V) network.

U.S. equities finished higher Friday (U.S. Market Recap: Dow +0.09%, S&P 500 +0.26%, Nasdaq +0.61%, Russell 2000 +0.54%), capping a strong October as the S&P 500 posted its sixth consecutive monthly gain and breadth turned positive after three down days. The market digested the final batch of major tech earnings, ongoing Fed commentary, and global trade headlines. Treasury yields were mixed with a steeper curve, while the Dollar Index rose 0.3%, gold slipped 0.5% but held above $4,000/oz, Bitcoin gained 3.8%, and WTI crude rose 0.7%.

Economic data was light: Initial claims for the week ended Oct. 25 came in around 218K, showing continued labor resilience, while Chicago PMI improved to 43.8 from 41.3. Fed speakers adopted a hawkish tone, with Dallas Fed’s Logan, Kansas City’s Schmid, and Cleveland’s Hammack all suggesting limited urgency for further cuts after the October 25 bp move. Markets trimmed expectations for a December cut to ~60%. Meanwhile, the Trump–Xi one-year trade truce stabilized sentiment, halving fentanyl-related tariffs to 10% and delaying Chinese rare-earth restrictions, though analysts see the détente as fragile. Looking ahead, OPEC+ meets this weekend (likely production hike), followed by ISM manufacturing (Mon), ISM services and ADP payrolls (Wed), and University of Michigan sentiment (Fri).

Earnings season remains robust — S&P 500 Q3 blended EPS growth now +10.7%, up from +7.9% at quarter-end, with 83% of companies beating estimates. Strong AI-related capex trends persisted, while consumer caution and margin pressure reemerged in discretionary and staples names.

Sector Highlights

Outperformers: Consumer Discretionary +4.08%, Energy +0.64%

Underperformers: Materials −0.86%, Utilities −0.77%, Consumer Staples −0.48%, Tech −0.32%, Communication Svcs −0.31%, Healthcare −0.09%, Real Estate +0.05%, Financials +0.18%, Industrials +0.21%

Information Technology:

- AAPL (+choppy) posted a modest beat with Dec Q revenue guidance +10–12% y/y, led by double-digit iPhone growth and strong Services margins.

- AMZN (+9.6%) the standout — AWS growth accelerated to +20% (fastest in 11 quarters) with margin expansion and capacity additions (3.8GW).

- WDC (+8.8%) beat EPS/revenue on strong Cloud demand, raised dividend 25%.

- TEAM (+5.5%) beat across Cloud/Data Center, raised FY guide, announced $2.5B buyback.

- MPWR (−14.6%) and NET (+13.9%) diverged; the former faced margin pressure, while the latter beat on billings and large-customer growth.

Communication Services:

- META (−11.3%) fell on opex growth outlook despite solid AI engagement; record $125B bond demand underscored strong liquidity.

- NFLX (+2.7%) announced 10:1 stock split, reportedly weighing bid for WBD (+3.8%) studio assets.

- RDDT (+7.5%) surged on top-line and EBITDA beats.

- TWLO (+19.5%) rallied after raising FY25 guide and reporting strong customer metrics.

Consumer Discretionary:

- AMZN’s AWS-driven rally lifted sector sentiment.

- CMG (−18.2%) and COLM (−3.6%) weakened on slowing traffic and soft guidance.

- RKT (+4.5%) gained on upbeat Q4 revenue outlook; mortgage volumes improving with easing rates.

- NWL (−28.0%) slumped on tariff pressure and weak Q4 guidance.

Financials:

- CBOE (+strong) rose on trading volume strength.

- CG (−5.8%) fell on weak performance fees despite fundraising gains.

- AON (+positive) advanced on better brokerage margins; AJG (−4.8%) lagged on soft organic growth.

- BHF (+sharp) jumped on $4B go-private talks.

Energy:

- CVX (+outperformer) led integrated majors after beating on upstream results and refining margins.

- Broader E&P complex gained on rising crude and stable crack spreads; OPEC+ production hike expectations kept prices in check.

Healthcare:

- ABBV (−4.5%) missed on Humira decline; raised FY EPS outlook on Skyrizi/Rinvoq.

- ILMN (+24.9%) soared after raising FY guidance; solid mix shift and clinical momentum.

- DXCM (−14.6%) fell on margin pressure and weak patient growth.

- HIMS (+3.2%) rose after JPMorgan disclosed 8% stake.

Industrials:

- IR (−weak) and EME (−noted earlier) pressured by soft macro indicators.

- CAT held gains earlier in week on strong datacenter-linked power gen demand.

- Freight and logistics names such as CHRW (+positive) benefited from improving margins.

Materials:

- FSLR (+14.3%) beat on strong backlog; raised FY guide at low end.

- LYB (+positive) gained on refining-linked strength.

- FMC (earlier in week −46%) remained under pressure from weak ag pricing and dividend cut.

Real Estate:

- Sector flat (+0.05%) as data center REITs supported by AI power demand offset weakness in retail and office. Mortgage rates near 6% buoyed residential REITs late in month.

Utilities:

- (−0.77%) Slightly weaker amid steeper yield curve; defensive rotation limited by higher-for-longer narrative. Nuclear and grid-modernization names continued to attract investor interest post-U.S. nuclear partnership announcement.

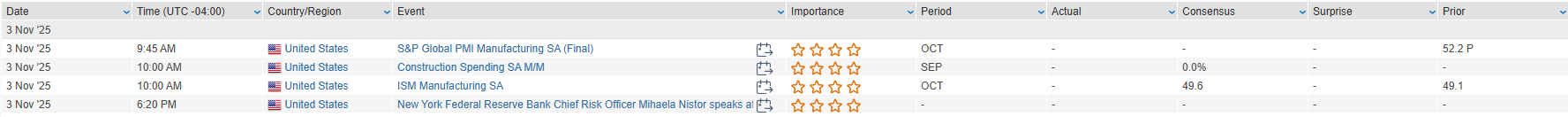

Eco Data Releases | Monday November 3rd, 2025

S&P 500 Constituent Earnings Announcements | Monday November 3rd, 2025

Data sourced from FactSet Research Systems Inc.