November 10, 2025

S&P futures +1% in Monday morning trading after last week’s pullback ended a three-week winning streak. Retail favorites, most-shorted, AI-linked, crypto, nuclear, and quantum names led the declines last week, while regional banks, insurers, energy, pharma, and staples held up better. Overnight, Asia rallied (South Korea +3%, Japan/Hong Kong +1%+), and Europe followed higher (+1.7%). Treasuries weaker (yields +4 bp), DXY flat, gold +1.9%, Bitcoin +2.7% (after −8% last week), and WTI crude +0.6% after six declines in eight weeks.

Risk sentiment improved on reports of Senate progress toward ending the government shutdown, though recent weakness still reflects concerns about AI capex intensity, stretched valuations, and consumer softness. Weekend press emphasized the AI spending overhang, muted reaction to strong Q3 earnings, Fed’s policy dilemma, slowing small-business hiring, and housing affordability headwinds.

Corporate updates:

- NVDA requested additional wafers from TSM to meet Blackwell GPU demand.

- TSM reported October sales +16.9% y/y, roughly in line but slowest since Feb-2024.

- PFE won the bidding war for MTSR in a $10B+ deal; NVO said it will seek other obesity/diabetes targets.

- V and MA reportedly reached a settlement with merchants on interchange-fee litigation.

- UPS and FDX grounded their MD-11 (BA) fleets after last week’s Kentucky crash.

- TSN little changed despite renewed White House scrutiny of meatpackers.

Macro calendar: Light day with no major data. Fed’s Musalem speaks at 9:45 a.m., expected to reiterate his view that policy is “between modestly restrictive and neutral.” Treasury auctions $58B in 3-year notes.

This week features:

Stocks reversed early losses to finish near highs Friday (Dow +0.16% | S&P 500 +0.13% | Nasdaq -0.21% | Russell 2000 +0.58%), lifting breadth (equal-weight S&P outperformed by ~70 bp) even as the S&P 500 and Nasdaq snapped three-week winning streaks. Travel/leisure, select cyclicals, and insurers led; mega-cap tech was mixed with TSLA a notable laggard. Rates were narrowly mixed with a modest long-end steepening (~+2 bp), the Dollar Index -0.2%, gold +0.4%, Bitcoin +2.8% (after briefly slipping below $100K), and WTI +0.5%.

The intraday turnaround was tied to headlines suggesting ongoing shutdown talks (Democrats floated an ACA-subsidy extension; GOP rejected but weekend negotiations remain possible). Meanwhile, the tape continues to grapple with AI scrutiny, “beats not rewarded” dynamics, and labor-softening headlines—yet the medium-term bullish backdrop (double-digit EPS growth, prospective Fed easing, resilient macro, AI capex, buybacks/seasonality, M&A) remains intact.

UMich (Nov prelim) missed: 50.6 vs 54.2 expected; 1-yr inflation 4.7%, 5-yr 3.6%. Fed Vice Chair Jefferson urged a patient, meeting-by-meeting path; Williams flagged potential balance-sheet expansion for reserves; Miran offered little new (stablecoins focus). Next week’s data vacuum persists (CPI/retail sales delayed). NFIB is Tuesday; Treasury auctions: $58B 3-yr (11/10), $42B 10-yr (11/12), $25B 30-yr (11/13).

Sector Highlights

Leadership rotated to defensives and rate-sensitives: Energy (+1.56%), Utilities (+1.37%), Real Estate (+1.34%), Materials (+1.28%), Consumer Staples (+1.25%), Financials (+0.70%), Industrials (+0.47%). Laggards: Communication Services (-0.84%), Technology (-0.33%); Consumer Discretionary (+0.04%) and Health Care (+0.12%) trailed the day’s winners. The pattern fit the week’s themes—multiple compression in AI-adjacent growth versus bids for cash-flow stability and yield.

Technology

- SNDK: Beat and guided above, citing data-center momentum and hyperscaler demand.

- AKAM +14.7%: Beat; raised FY revenue; Cloud Infrastructure Services growth accelerated to +39% y/y.

- MCHP -5.2%: In-line Q2; Dec-Q guide light; flagged order deferrals to Mar-Q despite improving bookings.

- FROG +27.0%: Beat/raise; accelerating cloud growth and AI opportunity.

- OLED -7.7%: Miss; weaker China sales; FY revenue guided to low end.

- XYZ (Block) -7.7%: Beat on most metrics; selloff on GPV–GP spread scrutiny and crowded positioning.

Communication Services

- TTWO -8.1%: Beat/raise, but GTA VI delayed to Nov 19, 2026.

- DV -14.4%: Revenue light; lowered growth guide.

- Media/Platforms: Mixed; some pressure where investment ramps remain in focus.

Consumer Discretionary

- EXPE +17.6%, ABNB higher: Beats with upbeat U.S. demand commentary and better Q4 setups.

- PTON +14.2%: Beat; FQ2 revenue guide better; FY EBITDA raised.

- MNST +5.2%: Sales/GM/EPS ahead; price actions and innovation tailwinds.

- TXRH: Strong traffic/comps; food inflation weighed on margins.

- SG -7.5%: Miss; FY25 cut; softer comps among 25–35 year-olds.

- DKNG: Miss/guide down on customer-friendly outcomes and fewer MUPs.

- TSLA: Shareholders approved Musk’s pay package.

Consumer Staples

- Beverages outperformed: MNST details above.

- JBS lower after announced investigation into foreign-owned meatpackers.

Health Care

- GMED +35.9%: Beat/raise; Spine strength; FY lifted; Nevro deal accretive in 2025.

- Select managed care/hospitals stable; no major index movers beyond stock-specific prints.

Financials

- AFRM +11.6%: Beat/raise; higher GMV and operating margin outlook; Affirm Card adoption highlighted.

- Insurers bid alongside Friday’s defensive tilt; moneycenters softer on the day.

Industrials

- Parcels/Logistics firmer with reopening/travel read-throughs; machinery/E&Cs mixed.

Materials

- CE higher on strong FCF; CC down on light EBITDA guide.

- MP +12.8%: Beat; expects profitability to return in Q4-25; rare-earths reshoring narrative supportive.

Energy

- Sector led as crude rose; defensives plus commodity sensitivity outperformed broader tape.

Real Estate & Utilities

- REITs and Utilities rallied with the long end contained and a reach for yield; CEG +2.0% steady despite a modest EPS miss and narrowed FY guide.

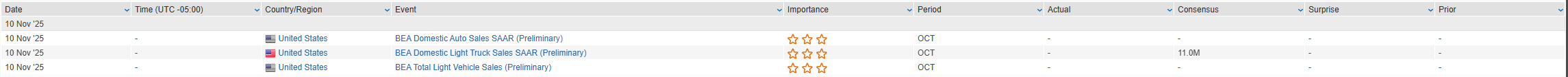

Eco Data Releases | Monday November 10th, 2025

S&P 500 Constituent Earnings Announcements | Monday November 10th, 2025

Data sourced from FactSet Research Systems Inc.