November 11, 2025

S&P futures -0.2% in Tuesday morning trading after U.S. equities rallied sharply Monday, with the S&P posting its biggest gain in four weeks. The Mag 7 led gains, while AI, retail favorites, most-shorted names, and airlines outperformed. Hospitals and managed care lagged on renewed uncertainty around Trump’s ACA comments.

Overseas, Asian markets were mixed, while Europe traded up ~0.5%. The Treasury market is closed for Veterans Day, leaving yields steady; Dollar Index flat, gold +0.6%, Bitcoin -0.4%, and WTI crude +0.4%.

No major catalysts following Monday’s surge, but AI remains the dominant theme. Headlines focused on SoftBank’s $5.8B sale of its NVDA stake, optimism ahead of AMD’s investor day, CRWV’s guidance cut tied to data center delays, and discussion of AI capex impacts on bond markets. On the policy front, the Senate advanced legislation to reopen the government, with House approval expected Wednesday. Traders remain focused on the timing of delayed economic releases amid the shutdown.

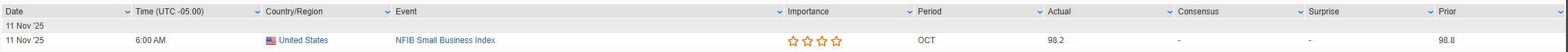

The NFIB small business optimism index slipped to 98.2 in October (vs. 98.8 prior), consistent with expectations, citing labor shortages and profitability pressures. Fed Governor Barr speaks today, likely to reiterate caution on tariff-related inflation risk.

Wednesday brings a heavy slate of Fedspeak (Williams, Harker, Waller, Bostic, Miran, Collins) and a $42B 10-year Treasury auction, followed by 30-year supply Thursday and additional Fed remarks through week’s end.

Corporate updates:

- NVDA rallied nearly 6% Monday as SoftBank exited its position.

- AAPL reportedly delaying next iPhone Air launch due to weaker demand.

- CRWV beat on Q3 results but fell after FY25 revenue and capex guide cut on capacity delays.

- OXY beat on better production and lower operating costs.

- PSKY rose on strong OIBDA guidance despite softer revenue.

- BBAI jumped on Ask Sage acquisition and strong biometric momentum.

U.S. equities opened the week with strong gains (Dow +0.81% | S&P 500 +1.54% | Nasdaq +2.27% | Russell 2000 +0.94%0, finishing near session highs in a broad-based rebound. The Nasdaq logged its best day since May 27, while the S&P 500 posted its strongest session since mid-October. Breadth was positive, though the equal-weight S&P underperformed the cap-weighted index by ~100 bp, highlighting renewed mega-cap leadership.

Momentum was driven by renewed optimism around government reopening efforts and a rebound in AI sentiment after last week’s steep selloff. Lawmakers made progress toward a bipartisan deal to end the government shutdown, though procedural hurdles remain. The AI complex, which lost roughly $800B in market cap last week, led Monday’s rally amid reports of improved positioning and sell-side defense of hyperscaler capex trends. Analysts highlighted that Microsoft, Google, Meta, and Amazon spent roughly $112B in Q3 capex (+80% y/y) and could collectively reach $550–600B by 2026, with Nvidia exposure exceeding 40% of revenue.

Macro data: None released Monday. The NFIB small business optimism index headlines Tuesday. Treasury’s $58B 3-year note auction saw robust demand, stopping through by 1 bp. Fed commentary tilted dovish: Governor Miran reiterated support for a 50 bp December cut, Musalem described policy as “near neutral,” and Williams noted growing divergence between high- and low-income consumption patterns.

Global markets: Asia and Europe rallied in sympathy with the U.S. rebound. Treasuries weakened modestly (2s +3 bp), the Dollar Index was flat, gold surged +2.8% to above $4,100/oz, Bitcoin +2.2%, and WTI crude +0.6% after six declines in eight weeks.

Sector Highlights

Leadership was squarely in Technology (+2.68%) and Communication Services (+2.53%), followed by Consumer Discretionary (+1.49%) and Materials (+1.05%). Defensives—Consumer Staples (-0.34%), Real Estate (-0.14%), and Utilities (-0.12%)—lagged. The session’s tone reflected growth rotation after last week’s valuation-driven risk-off trade, with cyclicals and AI-linked names reclaiming leadership.

Technology

- NVDA and GOOGL led the Mag 7 rebound amid renewed AI optimism and strong data-center demand expectations.

- TSM reported October sales +16.9% y/y, slightly above trend but slowest since Feb-2024.

- LSCC +5.6% after CEO stock purchase disclosure.

- MNDY -12.3%: Q3 beat overshadowed by soft Q4 revenue guidance; FY25 outlook modestly trimmed.

- VG +7% on a Q3 beat; TSEM guided Q4 sales slightly ahead.

Communication Services

- RUM +11.4%: Mixed Q3 but gained on a $100M ad commitment from Tether and planned AI infrastructure acquisition.

- HUBS -3.0%: Downgraded to Neutral; analysts cited slowing growth and concerns about AI disruption.

- TTWO -8.1%: Solid results and raised guidance overshadowed by GTA VI delay to Nov-2026.

Consumer Discretionary

- QSR: Announced partial sale of its China Burger King unit.

- CELH +7.3%: Authorized $300M share buyback.

- RUN +7.1%: Upgraded to Buy at Guggenheim.

- FUN -9.3%: Downgraded at Morgan Stanley; analysts cited macro and execution headwinds.

- TSN +2.3%: FQ4 beat; Chicken strong, FY26 revenue guidance in line; dividend raised.

Consumer Staples

- THS +22.7%: Agreed to be acquired by Investindustrial for $22.50/share in cash (18% premium).

- TSN (as above) also benefited from defensive bid.

Health Care

- PFE won the $10B+ bidding war for MTSR (-14.8%); deal includes CVR worth up to $20.65/share.

- NVO said it will continue exploring obesity/diabetes acquisitions.

- COGT +119%: Phase 3 GIST trial success; median progression-free survival well above standard therapy.

- CNC -8.8%, ELV -4.4%: Managed care weak amid ACA subsidy uncertainty.

Financials

- V and MA settled longstanding merchant interchange-fee litigation, potentially saving retailers over $200B.

- HOOD +4.2%: Planning fund offering tradeable shares of private AI companies (FT).

- BALL -5.3%: CEO resignation overshadowed reaffirmed guidance.

Industrials

- UPS and FDX grounded MD-11 fleets (BA) after Kentucky crash.

- Parker Hannifin (PH) in talks to acquire Filtration Group for ~$9B.

- Surgery Partners (SGRY) -25.4%: In-line results but FY guidance lowered amid softer volume/mix trends.

Materials

- MP +9.5%: Upgraded to Buy at Deutsche Bank; highlighted as only fully integrated Western rare-earth supplier.

- Ag chemicals and metals (copper/aluminum) also outperformed on stronger China data.

Energy

- Sector modestly higher (+0.9%) alongside crude recovery; utilities offtake contracts and uranium/nuclear names continued to attract flows.

Real Estate & Utilities

- Both sectors lagged broader gains amid higher yields; rotation into growth and cyclicals limited defensives.

Eco Data Releases | Tuesday November 11th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday November 11th, 2025

Data sourced from FactSet Research Systems Inc.