March 11, 2025

S&P 500 futures are up 0.4%, attempting to stabilize after Monday’s sharp selloff, which marked the S&P’s worst YTD performance for the third time in six sessions and the Nasdaq’s worst decline since 2022. The S&P is now down 8.5% from its February peak. Asian markets were mostly lower, with South Korea lagging, while China outperformed. European markets are up ~0.6%. Treasuries are firmer, with yields down 1-2 bps across the curve. The dollar index fell 0.5%, while gold (+0.6%), Bitcoin futures (+2.8%), and WTI crude (+0.7%) all gained.

The market is attempting a technical bounce, though systematic selling remains heavy, with CTAs now reportedly short and long-only funds reducing exposure. Many analysts remain skeptical of the rebound, citing Trump 2.0 policy uncertainty, economic cracks (highlighted by Delta’s profit warning), multiple compression, negative earnings revisions, sticky inflation, and fading confidence in U.S. equity outperformance.

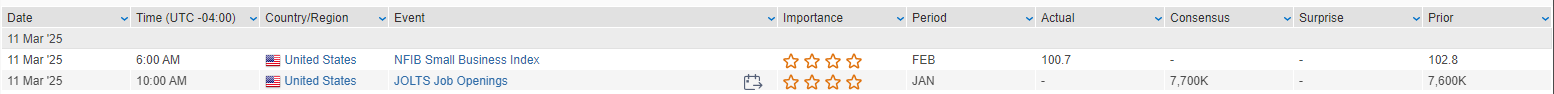

On the economic front, NFIB small business optimism fell to 100.7 in February (-2.1 pts), though remains above its 51-year average of 98.0. The Uncertainty Index rose to 104, its second-highest reading on record. JOLTS job openings data is due today, along with a $58B 3-year Treasury auction. Investors are focused on Wednesday’s CPI report, followed by PPI, jobless claims, and long-term Treasury auctions later in the week.

Corporate News

- Oracle (ORCL): Q3 and Q4 guidance came in light, but AI-driven RPO growth remains strong despite capacity constraints.

- Delta (DAL): Warned of weaker Q1 results, citing reduced consumer and corporate confidence due to macro uncertainty.

- Vail Resorts (MTN): Lowered FY EBITDA guidance, citing FX headwinds and weaker Q3 visitation, though expects a spring rebound.

- Illumina (ILMN): Announced cost-cutting measures to offset weakness in China.

- Asana (ASAN): Shares dropped sharply as margin upside was overshadowed by a CEO succession plan and a softer growth outlook

U.S. equities experienced a sharp selloff on Monday, with the S&P 500 (-2.70%) and Nasdaq (-4.00%) posting their worst sessions of the year. The Nasdaq’s decline was its steepest since September 2022, as technology stocks suffered broad-based losses. The S&P 500 is now down nearly 9% from its February 19 record close, while the Nasdaq has fallen ~14% from its December peak. The equal-weighted S&P 500 (RSP) declined but outperformed the cap-weighted index by ~130 bps, signaling weakness concentrated in megacap growth stocks.

The “Mag 7” stocks saw steep losses, with Tesla (TSLA) particularly weak. Other laggards included semiconductors, software, tech hardware, airlines, credit cards, investment banks, travel/tourism, and China tech. Some defensive and rate-sensitive sectors held up better, including REITs, utilities, food & beverage, energy, managed care, hospitals, pharma/biotech, exchanges, insurers, homebuilders, and telecom.

Treasuries rallied, reversing part of last week’s sharp rise in yields. The dollar index edged up 0.2%, recovering from its worst weekly performance since November 2022. Gold fell 0.5%, while Bitcoin futures plunged 9.6%, dropping below $80K. WTI crude declined 1.5%, reversing earlier gains amid fresh Russia-Ukraine headlines.

Key Market Themes

Growth Concerns & “Trump 2.0” Uncertainty:

The selloff reflected ongoing concerns over economic growth and uncertainty surrounding Trump’s trade policies. Over the weekend, Trump acknowledged the U.S. economy may experience a “period of transition”, while Treasury Secretary Bessent described the current phase as a “detox period.” These cautious remarks align with softening economic data, including the Citi Economic Surprise Index, which has been negative since mid-February, and rising concerns about consumer spending resilience.

Inflation & Labor Market Expectations:

The NY Fed’s February Survey of Consumer Expectations showed a slight uptick in 1-year inflation expectations to 3.1%, while the 3-5 year outlook remained stable at 3%. The survey also noted that the probability of job losses decreased slightly, while quit rates dropped to their lowest levels since July 2023, indicating a cooling labor market.

Upcoming Economic Data & Treasury Issuance:

Investors are bracing for a busy week of key economic releases, including:

- Tuesday: January JOLTS job openings.

- Wednesday: February CPI inflation report (key focus for rate expectations).

- Thursday: PPI inflation & weekly jobless claims.

- Friday: Preliminary March consumer sentiment & inflation expectations.

Additionally, the market will absorb $119B in new Treasury issuance, with auctions for 3-year notes (Tuesday), 10-year notes (Wednesday), and 30-year bonds (Thursday).

Market Positioning & Volatility:

Strategists are flagging downside risks due to a combination of economic uncertainty and earnings growth concerns. Several major banks have adjusted their market forecasts:

- JPMorgan warned that its S&P 500 year-end target of 6,500 may not materialize due to policy uncertainty.

- RBC cut its bear case target for the index to 5,600, citing flat corporate earnings growth.

- Morgan Stanley expects the S&P 500 to fall to 5,500 in H1 due to earnings headwinds from tariffs and lower fiscal spending, before rebounding to 6,500 by year-end.

- FactSet data showed Q1 S&P 500 earnings growth estimates have fallen by 3.7 percentage points since Q4, marking a larger decline than historical averages.

Geopolitical Developments:

A Bloomberg report suggested Russia may be open to ceasefire talks with Ukraine, provided progress is made on a final peace settlement framework. Meanwhile, Trump’s administration is in early talks with China for a potential leaders’ summit in June.

Sector Performance & Notable Company News

Technology (-4.34%)

- ServiceNow (NOW, -7.9%): Announced the $2.9B acquisition of Moveworks, weighing on shares.

- Paycom Software (PAYC, +2.1%): Upgraded to Overweight at KeyBanc, citing improved execution and potential margin expansion in 2025.

Communication Services (-3.54%)

- Social media platform X suffered multiple service outages, raising concerns about platform stability.

Consumer Discretionary (-3.90%)

- Redfin (RDFN, +67.9%): To be acquired by Rocket Mortgage (RKT) in a $1.75B all-stock deal, representing a 115% premium to Friday’s close.

- Rocket Mortgage (RKT, -15.4%): Shares fell following the announcement, as the company expects $200M in synergies by 2027.

- Cracker Barrel (CBRL, +3.6%): Upgraded to Buy at Truist, citing a successful turnaround strategy and menu innovation.

Consumer Staples (+0.69%)

- Protagonist Therapeutics (PTGX, +45.9%): Announced strong Phase 3 results for its oral psoriasis drug, icotrokinra, positioning it as a potential alternative to injectables.

Industrials (+1.60%)

- Beacon Roofing Supply (BECN, +6.7%): Confirmed discussions with QXO regarding a possible acquisition.

- Emerson Electric (EMR, -5.7%): Downgraded to Underweight at Barclays, citing exposure to a weak oil & gas capex cycle and concerns that recent margin expansion is unsustainable.

Energy (+0.94%)

- Baker Hughes reported that U.S. oil & gas companies are unlikely to increase spending this year, reflecting caution in the energy sector.

Financials (+2.29%)

- CME Group (CME, +3.0%): Upgraded to Outperform at Raymond James, with analysts citing higher futures trading volumes in a volatile market.

Healthcare (+1.10%)

- Novo Nordisk (NVO, -9.4%): CagriSema trial data disappointed, showing weaker weight-loss results compared to competitors.

- Dexcom (DXCM, -9.2%): Received an FDA warning letter following inspections at California and Arizona facilities, though management does not expect any material financial impact.

Real Estate (+1.02%)

- REITs outperformed amid a defensive rotation, benefiting from falling Treasury yields.

Eco Data Releases | Tuesday March 11th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday March 11th, 2025

no constituents report today

Data sourced from FactSet Research Systems Inc.