November 14, 2025

S&P futures −0.7% in Friday morning trading after U.S. equities tumbled Thursday amid a momentum unwind that hit AI names, retail favorites, and other high-beta trades. The Nasdaq 100 has now fallen in five of the past six sessions. Healthcare remained the week’s top gainer (+4.5%) as rotation into defensives continued. Asia broadly weaker overnight (KOSPI −4%, Nikkei and Hang Seng −1.5%+), while Europe off ~1%. Treasuries mixed with a steeper curve, DXY +0.15%, gold −0.6%, Bitcoin −1.8%, and WTI crude +2.5%.

The week’s sharp reversal reflects a broader de-risking tied to AI skepticism, stretched valuations, crowded positioning, hawkish Fed tone, and an ongoing data vacuum. Some traders also cited risk-off positioning ahead of NVDA earnings next week despite upbeat previews. Fed commentary remained hawkish, with Kashkari warning the economy is stronger than expected and suggesting another pause in December.

Elsewhere, the White House confirmed tariff rollbacks on bananas, coffee, and beef under new Latin America trade frameworks. China’s October data showed a record drop in fixed-asset investment, while UK gilt yields surged after the government abandoned its planned income tax hike.

Corporate highlights:

- AAPL iPhone 17 sales in China up 20%+ y/y in first month post-launch.

- AMAT beat on Q3 earnings but guided cautiously, with shipment acceleration delayed to 2H26.

- WBD rallied as PSKY, CMCSA, and NFLX reportedly prepare bids for assets.

- STUB fell sharply after Q3 beat driven by pull-forward effects and lack of Q4 guidance.

- UAA announced restructuring and the end of its Curry Brand partnership.

- CDTX near sale to MRK, per reports.

- BZH beat on closings and expense control, while GM guided cautiously on continued pricing pressure.

On the policy front, Fed’s Bostic and Schmid speak later today. Both have emphasized inflation risks and argued that policy remains only modestly restrictive, reinforcing a hawkish lean into year-end.

U.S. equities fell Thursday (Dow −1.65% | S&P 500 −1.66% | Nasdaq −2.29% | Russell 2000 −2.77%), closing just above session lows as a momentum unwind and renewed AI sentiment volatility drove a broad risk-off tone. The equal-weight S&P 500 (RSP) again outperformed the cap-weighted index by roughly 50 bp, with defensive and value-oriented pockets faring best. The S&P remains on track for a slight weekly gain, though the Nasdaq and Russell 2000 are pacing for declines.

Market weakness was led by big tech, particularly TSLA, NVDA, and GOOGL, while AI enablers, profitless tech, most-shorted, and high-beta stocks also sold off. Healthcare, packaging (SEE), China tech, networking (CSCO), and department stores provided rare bright spots. Treasury yields rose 3–5 bp amid hawkish Fedspeak, which continued to erode expectations for a December rate cut—now below 50%, the lowest since easing began in September. The Dollar Index fell 0.3%, gold slipped 0.5%, Bitcoin dropped 3.4% to below $100K, and WTI crude gained 0.3%.

The day’s narrative centered on positioning pressure, a momentum unwind, and a rotation toward defensives after several sessions of cyclical outperformance. Healthcare remains the top-performing sector this week (up ~6%), benefiting from valuation support and stabilized earnings revisions. Meanwhile, the data vacuum persists—September NFP may be released next week, but October CPI and NFP won’t arrive until December, leaving markets reliant on sentiment and positioning.

Sector Highlights

The market showed broad risk aversion with only a few sectors managing gains:

- Outperformers: Industrials (+1.52%), Utilities (+1.40%), Real Estate (+1.31%), Financials (+1.31%), Materials (+0.75%), Energy (+0.31%), Healthcare (+0.02%), Consumer Staples (0.00%)

- Underperformers: Consumer Discretionary (−2.73%), Technology (−2.37%), Communication Services (−1.74%)

Industrials and Utilities led on defensive rotation and value appeal. Financials benefited from bank strength tied to easing capital rules and improved credit sentiment. Healthcare extended gains for a sixth session, while Energy was supported by stable oil prices. On the downside, Technology and Consumer Discretionary were hit hardest by profit-taking in large-cap AI and retail favorites, while Communication Services weakened alongside digital platforms and media names.

Information Technology

- CSCO (+4.6%) rose after beating Q1 estimates and raising FY guidance; highlighted 13% product order growth and a record $1.3B in AI infrastructure orders.

- Kioxia’s weak results weighed on memory names, and momentum tech continued to unwind.

- DLO (−6.8%) fell despite a revenue beat, with analysts citing high expectations and softer Mexico trends.

Communication Services

- DIS (−7.8%) dropped after FQ4 revenue missed, driven by weakness in linear and DTC, offsetting solid sports results and better Disney+ subs.

- BABA reportedly planning a major revamp of its mobile AI app, adding agentic-AI shopping assistants modeled after ChatGPT.

- Palantir CEO warned of “cost-value mismatches” in AI investments, feeding the AI skepticism theme.

Consumer Discretionary

- PLNT (+3.2%) gained on upbeat long-term growth outlook from Investor Day.

- DDS (+9.6%) rallied on better-than-expected comps and margin expansion.

- NKE (+2.9%) upgraded to Overweight at Wells Fargo, citing margin recovery and inventory normalization.

- FLUT (−14.3%) tumbled on EBITDA and revenue guidance cuts tied to customer-friendly U.S. sports outcomes.

- DLTR (−2.9%) downgraded to Sell at Goldman Sachs, citing pricing and value perception concerns.

Consumer Staples

- SEE (+16.8%) surged on reports it is in talks to be taken private by CD&R.

- Food and beverage names generally outperformed on defensive rotation and steady consumption trends.

Healthcare

- ARCT (−33.8%) plunged after a sharp Q3 earnings miss and lower EBITDA guidance.

- PFE reportedly preparing to sell its remaining $500M stake in BioNTech (−7%), extending pressure on vaccine peers.

- Pharma and biotech otherwise saw selective buying amid stabilizing earnings revisions.

Financials

- Big banks and asset managers slipped, but credit cards and insurance held firm.

- Broader sector strength reflected value rotation and relative resilience amid higher rates.

Industrials

- TTEK (+15.3%) beat earnings on strong U.S. federal/state project demand; guided Q1 and FY in line.

- ARDT (−33.8%) fell sharply after posting a surprise loss and lowering EBITDA guidance.

- Transportation names lagged, with airlines and logistics under pressure from softer freight data.

Energy & Materials

- WTI crude +0.3% on reports Russia offsetting drone damage via spare refining capacity; OPEC’s balanced 2026 forecast limited upside.

- SPB (+9.7%) rose despite a light quarter, with analysts encouraged by improved FY26 outlook and H&G stabilization.

- Industrial metals mixed; aluminum prices hit records on tighter U.S. inventories tied to tariff constraints.

Real Estate & Utilities

- Rate-sensitive groups outperformed as yields moderated and investors sought defensive exposure.

- Utilities +1.4% marked their strongest gain in two months, driven by rotation into low-volatility income plays.

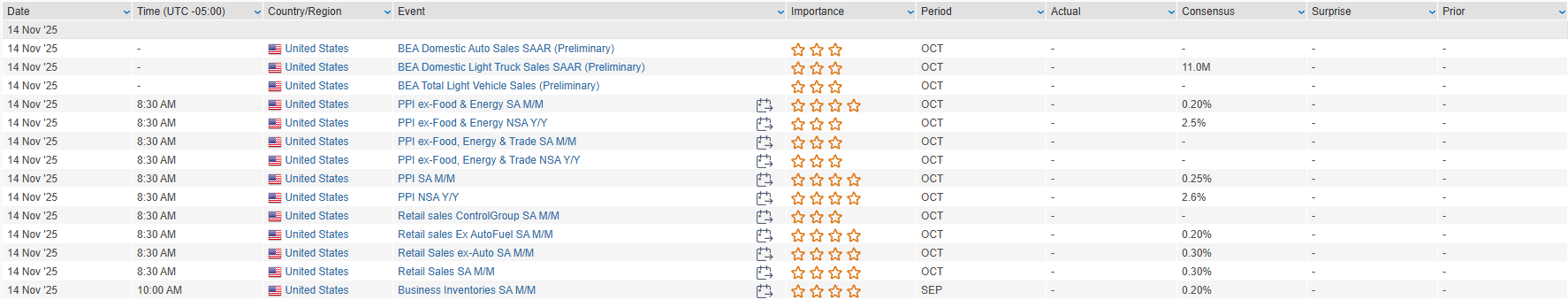

Eco Data Releases | Friday November 14th, 2025

S&P 500 Constituent Earnings Announcements | Friday November 14th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.