November 20, 2025

S&P futures up 1.1% Thursday morning after U.S. equities finished mostly higher on Wednesday, breaking the S&P’s four-day slide. GOOGL and NVDA led gains, while crypto, retail-favorites, most-shorted names, small-caps, and value lagged. Asian markets were sharply higher (Japan +2.5%, Korea +2%), and Europe is up ~0.7%. Treasuries are slightly weaker with yields +1 bp. Dollar flat, gold −0.6%, Bitcoin +1.3%, WTI crude +1.2%.

Risk sentiment improved on NVDA’s major beat and raise, helping stabilize markets after a sharp momentum unwind tied to AI-skepticism concerns. Hawkish Fed repricing remains a headwind: December cut odds fell below 30% following BLS confirmation that October NFP will not be published and November NFP arrives only on 16-Dec, after the December FOMC. Markets continue to monitor stretched systematic longs, softening labor data, weakening retail impulse, and 2026 tariff risks. Bulls lean on double-digit earnings growth, improving revisions, seasonality, buybacks, and fiscal support.

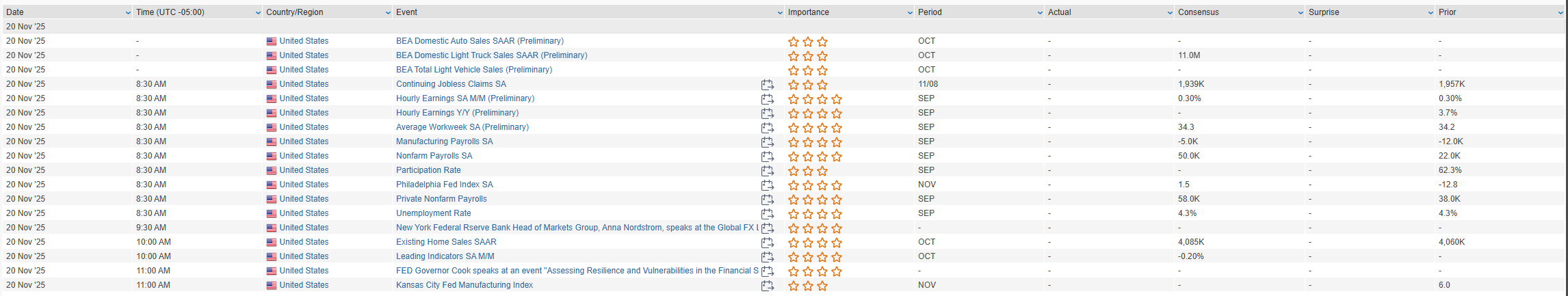

A delayed September jobs report hits this morning (Street: ~+50K), alongside jobless claims, the November Philly Fed survey, and October existing home sales. Fed speakers today include Hammack, Cook, and Goolsbee, with Miran and Paulson tonight.

- NVDA: Q3 beat by ~$2B with a major Q4 raise; highlighted accelerating compute demand and ~$500B Blackwell/Rubin visibility through 2026.

- WBD: Preliminary takeover bids due this morning.

- PANW: Shares fell despite a beat-and-raise; announced $3.35B acquisition of Chronosphere.

- KLIC: Beat and guided above consensus, citing improving end-market trends and stronger order activity.

- JACK: Missed fiscal Q4 expectations

U.S. equities finished mostly higher on Wednesday (Dow +0.10%, S&P 500 +0.38%, Nasdaq +0.59%, Russell 2000 –0.04%), stabilizing after a four-day S&P 500 decline. The session was dominated by anticipation ahead of NVDA earnings after the close, Thursday morning’s WMT earnings, and the delayed September NFP report. Markets attempted to steady despite renewed volatility around AI sentiment, stretched systematic-long positioning, uncertainty around Fed easing prospects, and persistent concerns about consumer resilience. Stabilization narrative centered on expectations for a strong NVDA beat/raise, exhaustion in the momentum unwind, elevated put-buying as a contrarian indicator, and supportive corporate-buyback flows. Trade headlines added marginal relief with reports that new semiconductor tariffs may not be imminent.

The October FOMC minutes offered no major surprises, reiterating that “many” officials favored leaving rates unchanged through year-end and highlighting the committee’s sharp divide over the December decision. Fed Governor Miran discussed balance-sheet considerations but did not address December policy. Treasury markets weakened slightly, with yields up ~1 bp, and today’s 20Y auction tailed by 0.2 bp on softer demand. Looking ahead, markets are focused on Thursday’s September employment report (Street at ~50K payrolls) and Friday’s November flash PMIs. The BLS confirmed it will not publish October payrolls, increasing uncertainty around the Fed’s near-term path.

Sector Highlights

Sector performance skewed toward cyclicals and rate-sensitive groups. Technology (+0.93%) and Communication Services (+0.72%) led the market, helped by semiconductor strength and a rally in GOOGL ahead of Gemini 3.0. Materials (+0.46%) and Financials (+0.42%) also outperformed. On the downside, Energy (–1.30%) fell with crude, while Utilities (–0.81%), Real Estate (–0.79%), and Consumer Staples (–0.61%) lagged amid a modest rise in yields and weaker defensive flows. Healthcare (–0.14%) paused after recent outperformance, and Consumer Discretionary (+0.05%) and Industrials (+0.36%) were mixed.

Information Technology

- NVDA rose ahead of earnings, where the Street expects a significant beat/raise supporting the broader AI-infrastructure cycle.

- GOOGL surged on strong initial reception of the new Gemini 3.0 model and Berkshire’s ~$4B stake disclosure.

- SEMR jumped after agreeing to be acquired by ADBE for ~$1.9B at a 78% premium.

- ON announced a $6B share-repurchase authorization.

- U rallied on new partnerships with Epic Games and broader cross-platform integration.

- DLB beat fiscal Q4 but guided cautiously for Q1.

- NET fell after widespread service outages.

Communication Services

- TJX posted strong comp growth with merchandise margins a bright spot.

- WBD gained after reports the board is seeking offers closer to $30/sh for its sale discussions; PSKY’s prior offer stood at $23.50.

- IPAR declined on soft 2026 guidance tied to macro pressures and inventory destocking.

Consumer Discretionary

- LOW rose after a Q3 EPS beat and encouraging early-November trends.

- TGT fell on a Q3 comp decline (–2.7%), unexpected GM compression, and lowered EPS guidance.

- WSM beat earnings and reaffirmed FY guidance, though segment-level comps at Pottery Barn and West Elm missed.

- LZB surged on a clean beat, dividend increase, and plans to exit non-core businesses.

Consumer Staples

- SEMR acquisition by ADBE (noted above) also affects Staples-adjacent digital-commerce categories.

- COCO benefited earlier this week from tariff rollback expectations, though little incremental today.

Energy

- WTI crude fell 2.3%, pressuring integrateds and E&Ps.

- CEG rose after being awarded a $1B federal loan to restart Three Mile Island Unit 1.

Financials

- Banks, IBs, credit cards, and asset managers outperformed on rotation.

- PE firms strengthened, with semis-cycle optimism helping multi-sector managers.

- B traded higher after reports Elliott built a large stake with break-up optionality in focus.

Industrials

- DY beat on accelerating fiber builds and strong data-center-related demand; FY26 revenue outlook raised.

- VIK posted solid Q3 results with strong forward bookings (96% of 2025 capacity sold).

- WSM housing-adjacent categories tied to discretionary spending remained mixed.

Health Care

- EXAS rallied on news ABT may be nearing a takeover.

- MRK gained after positive Phase 2 results for WINREVAIR.

- AGIO plunged >50% after its RISE UP Phase 3 trial failed key secondary endpoints despite meeting the primary.

Materials

- MP gained on a Goldman Sachs Buy initiation and JV announcements with U.S. and Saudi partners, highlighting strategic importance of rare earths.

- FCX rose following news of large-scale production restart at Grasberg and clarity on its longer-term plan.

Real Estate

- REITs broadly lagged alongside higher yields, with rate-sensitivity weighing on the group.

Eco Data Releases | Thursday November 20th, 2025

S&P 500 Constituent Earnings Announcements | Thursday November 20th, 2025

Data sourced from FactSet Research Systems Inc.