November 21, 2025

S&P futures up 0.1% in Friday morning trading, recovering from earlier weakness after Thursday’s sharp slide—the S&P’s largest intraday reversal since April’s tariff-driven volatility. Big Tech lagged yesterday, with NVDA unable to hold post-earnings gains; retail favorites, high beta, most-shorted, and momentum baskets also underperformed. Major indices are tracking weekly declines. Overseas markets were weak, with Europe mostly lower after a soft Asian session. Treasuries are firmer with a modest curve steepening (yields down 1–3 bp). The dollar +0.1%, gold −0.6%, Bitcoin −3.7%, and WTI crude −2.1% (on pace for a 4%+ weekly drop).

The market is attempting another stabilization, though sentiment remains fragile. The S&P is now more than 5% off its 28-Oct high, and nearly two-thirds of the index closed yesterday below their 50-day moving averages—its weakest breadth since April. Thursday’s mixed September payrolls report did little to clarify the December FOMC outlook, while AI-skepticism persists (circularity, debt loads, slowing returns on investment). Pressure from stretched systematic longs, softer retail flows, pockets of consumer fatigue, and fading momentum have all contributed to ongoing risk aversion, with bullish factors (earnings strength, seasonality, fiscal impulse) struggling to gain traction.

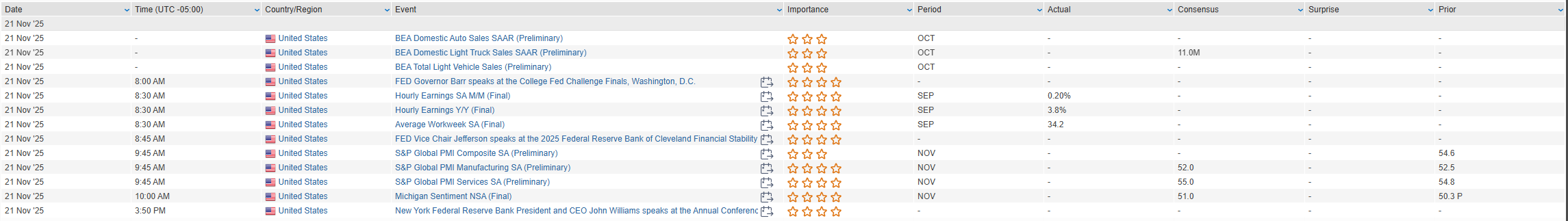

Today’s macro focus includes S&P Global PMIs and final November UMich sentiment (including inflation expectations). Fedspeak remains heavy with Williams, Barr, Logan, and Collins on the docket. Overnight, the Philadelphia Fed’s Paulson said she is more concerned about labor-market cooling than inflation but remains cautious about cutting prematurely. Japan approved a $135B stimulus package, broadly in line with reports, while investors continue to track U.S.–EU diplomacy around Ukraine and the related drag on crude. With Thanksgiving ahead, volume is expected to slow; delayed U.S. data releases next week include September retail sales and durable goods, plus November consumer confidence. Black Friday spending trends will also be a focal point.

- INTU – Beat expectations and guided next-quarter revenue above consensus, citing strong payments growth and momentum in its Online Ecosystem.

- ROST – Reported strong customer engagement, raised comp guidance, and said tariff impacts will be negligible in Q4.

- VEEV – Beat and raised, though noted fewer top biopharma customers expected to adopt Vault CRM going forward.

- CPRT – Revenue came in light as softer claims volumes were only partly offset by higher total-loss frequency.

- ESTC – Beat and raised, but management highlighted signs of cloud consumption deceleration.

- GPS – Delivered better comps and margins, with most brands performing well except for ongoing weakness at Athleta.

- POST – Revenue was in line, but FY26 adjusted EBITDA guidance came in below Street expectations

U.S. equities fell Thursday, extending the recent momentum unwind as the S&P 500 dropped 1.56% and the Nasdaq fell 2.15%. Major indices are now pacing for their worst weekly performance since April’s “Liberation Day” selloff, with Big Tech, semis, and AI-linked trades back under pressure despite Nvidia’s strong beat-and-raise. The move unfolded against a backdrop of deepening macro uncertainty: a notable softening in labor conditions, reduced expectations for near-term Fed easing, and rising signs of consumer fatigue.

Labor data added to growth worries. September nonfarm payrolls rose 119K, above consensus, but the prior two months were revised down by 33K—including August revised to a slight contraction. The unemployment rate ticked up to 4.4%, the highest since October 2021. Average hourly earnings grew just 0.2%, below expectations, and continuing claims jumped to 1.974M, a fresh cycle high. Initial claims (220K) were better than expected, but the combined data skewed toward a weaker labor backdrop. The Philadelphia Fed Index unexpectedly contracted, with new orders negative and price indicators mixed—prices paid accelerated but prices received fell. Countering the gloom, existing home sales rose to their fastest pace since February, supported by improved buyer demand at lower mortgage rates.

Cross-asset performance sent mixed signals: Treasuries firmed with yields down 2–4 bp, the dollar was flat, gold slipped 0.6%, and Bitcoin fell 3.2% to its lowest since April. WTI crude dipped 0.4%, but remained off the lows. Global political and trade developments—including a U.S. proposal to end the Ukraine war, new U.S. drilling expansion plans, improved soybean and wheat sales to China, and additional tariff discussions—added further noise but little directional conviction.

Sector Highlights

Defensives led the market as investors rotated away from high-beta and AI-linked exposures. Consumer Staples (+1.11%), Energy (+1.07%), Financials (+0.90%), Healthcare (+0.62%), Utilities (+0.52%), Communication Services (+1.07%), and Real Estate (-0.37%) all outperformed the S&P. Meanwhile, growth and cyclical sectors bore the brunt of selling: Technology (-2.66%), Consumer Discretionary (-1.73%), Industrials (-1.70%), and Materials (-1.62%) were the worst performers as valuation stress and AI skepticism weighed heavily on the risk-on segments of the market.

Information Technology

- NVDA: Beat Q3 revenue by ~$2B and guided Q4 ~$3B above consensus; strong visibility toward $500B+ in Blackwell/Rubin compute demand through 2026; shares fell as broader AI skepticism overshadowed the beat.

- PANW: Underperformed as beat/raise failed to impress; announced $3.35B acquisition of Chronosphere.

- KLIC: Beat and guided above; noted improving semi end-markets and stronger orders.

- J (Jacobs): Lower-quality beat with weaker EBITDA and softer net service revenue growth.

- BBWI: Missed across the board; cut FY outlook citing consumer weakness and tariff costs.

- DLB: Posted solid Q4 but soft Q1 guide; FY26 outlook in line.

Consumer Staples

- WMT: Strong Q3 comps and EPS; raised FY26 outlook; noted improving eCommerce and stable consumer behavior despite pressure at the low end.

Consumer Discretionary

- JACK: Missed Q4; analysts highlighted macro pressures on traffic and same-store sales.

- BBWI: (Also categorized in Discretionary) reiterated consumer softness and tariff headwinds.

Health Care

- ABT: Confirmed $21B acquisition of EXAS at $105/share.

- EXAS: Jumped on deal announcement.

- PACS: Surged on revenue beat, constructive FY outlook, and resolution of internal audit overhang.

Industrials

- F (Ford): Shares fell after another fire at Novelis’ aluminum plant—the third in two months.

Communication Services

- WBD: Preliminary bids due; board pushing for ~$30/share vs. $23.50 prior offer.

- VZ: Confirmed 13K+ job cuts as part of a restructuring effort.

Materials

- No major corporate catalysts besides ongoing tariff impact sensitivity.

Financials

- NDAQ: Upgraded to overweight at Morgan Stanley on expected cyclical revenue acceleration.

Eco Data Releases | Friday November 21st, 2025

S&P 500 Constituent Earnings Announcements | Friday November 21st, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.