November 25, 2025

S&P futures are down 0.2% Tuesday morning after U.S. equities rallied for a second straight session Monday, led by growth and momentum. The Nasdaq 100 logged its biggest one-day gain since May, with GOOGL and TSLA leading the Mag 7 and AVGO pushing semis higher. Consumer staples and energy were the only sectors in the red, with staples off more than 1%. Asian markets were mostly higher but faded into the close; China outperformed. Europe is modestly weaker (~0.1%). Treasuries are firmer (yields ~1 bp lower). Dollar index down 0.1%. Gold off 0.1%. Bitcoin down 2% after Monday’s 5% rebound. WTI crude down 0.5%.

AI remains the dominant market narrative following a report that GOOGL is in talks to sell or rent TPU chips to META, a headline weighing on NVDA and adding to chatter that Gemini 3 represents another industry “DeepSeek moment.” The Fed remains the other major focus: a financial-press report said Powell allies are laying groundwork for a December rate cut. Market-implied odds for a cut have rebounded to nearly 80%, up from sub-30% last week. Otherwise, macro narrative remains quiet ahead of a heavy slate of (delayed) consumption and inflation data this morning and another wave of retail earnings.

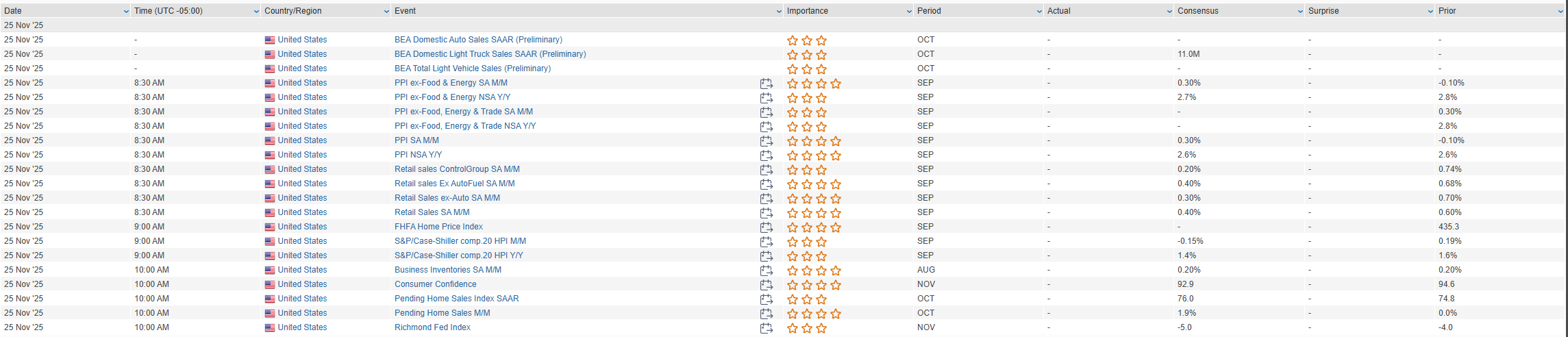

A busy economic calendar includes September retail sales (+0.4% m/m expected), core retail sales (+0.3%), PPI (+0.3%), core PPI (+0.2%), October pending home sales, and November consumer confidence. Treasury auctions $70B in 5-year notes today. Ahead: Thursday’s initial and continuing claims and September durable goods, plus Wednesday’s Beige Book and $44B 7-year auction.

Company News

- GOOGL higher, NVDA lower on report Google is in talks to sell/rent TPUs to Meta.

- A (Agilent): FQ4 organic growth ahead; Life Sciences strong but operating margin light.

- SYM: Surged on FQ4 beat and new Medline customer announcement.

- KEYS: Jumped on record AD&G orders, strong ESIG demand, and upbeat acquisition commentary.

- ZM: Beat and raised; Street positive on core stabilization and $1B buyback.

- WWD: FQ4 ahead, with Aerospace & Manufacturing growth the highlight.

- SMTC: Lower as optimistic data-center commentary overshadowed by weak gross-margin guidance.

- BLBD: FQ4 beat; FY26 outlook reiterated.

- SNDK: Higher on S&P 500 index inclusion.

U.S. equities rallied on Monday (Dow +0.44%, S&P 500 +1.55%, Nasdaq +2.69%, Russell 2000 +1.89%), with major indices closing near session highs and the S&P 500 outperforming equal-weight by over 100 bp thanks to strong mega-cap leadership. Big Tech—especially GOOGL and TSLA—drove the cap-weighted surge, while high-beta, momentum, most-shorted, and speculative themes (crypto, quantum computing, retail favorites) outperformed. Defensive and value-oriented pockets underperformed, including energy, homebuilders, staples retail, telecom, media, and waste services.

Treasuries strengthened with the long end down 3–4 bp, flattening the curve. The dollar was unchanged. Gold rose 0.4%. Bitcoin rebounded 5.3% after falling in eight of the prior nine sessions. WTI crude reclaimed earlier losses to close +1.3%.

The rebound extended Friday’s strength as investors leaned into growth/momentum leadership. Many viewed last week’s momentum unwind as mostly technical and now largely complete. Seasonals, cleaner positioning, and renewed AI enthusiasm—particularly around Google’s Gemini 3—supported risk appetite. Fed dynamics were also in focus: December rate-cut odds jumped above 80%, helped by dovish remarks from SF Fed’s Daly. Still, the market remains attuned to internal FOMC divisions heading into the 10-Dec meeting.

Economic updates were mixed. The Dallas Fed manufacturing survey printed at –10.4, below consensus, with worsening outlook components. Treasury’s $69B 2-year auction priced in line with expectations but drew stronger bid-to-cover and foreign demand. Looking ahead: a heavy data slate Tuesday (September retail sales, PPI, October pending home sales, November consumer confidence) and important labor and durable goods updates Wednesday. Markets are closed Thursday for Thanksgiving; Friday is empty. Fed enters blackout this week; no additional Fed speakers scheduled.

On the geopolitical front, Trump and Xi plan to meet in Beijing in April, marking a potential thaw in U.S.–China relations.

Sector Highlights

Sector leadership skewed solidly toward growth: Communication Services (+3.94%), Technology (+2.49%), and Consumer Discretionary (+1.86%) led the session. Defensive groups lagged, with Consumer Staples (–1.32%), Energy (–0.32%), and Real Estate (+0.19%) underperforming despite the market rally. Industrials, materials, financials, and health care posted moderate gains but did not match the pace of the mega-cap-driven advance.

Health Care

- NVO – Shares lower after Alzheimer’s GLP-1 trial showed no significant disease-progression reduction; one-year extension discontinued.

- MRK – Upgraded to Overweight at Wells Fargo; analysts highlight multiple 12–18 month catalysts offsetting Keytruda headwinds.

- INSP – CMS final rule raised reimbursement for Inspire V system by ~$10K; stock +30% on regulatory upside.

Consumer Staples

- USFD / PFGC – Terminated merger discussions; USFD announced $1B buyback.

- POST – Q4 revenue in line; FY26 adj. EBITDA guided below Street; weakness tied to cereal, granola, and pet categories.

Consumer Discretionary

- BABA – Strength on strong relaunch of Qwen AI app (10M+ downloads in first week).

- KSS – Reportedly preparing to appoint interim CEO Michael Bender permanently.

- GAP – Q3 EPS, comps, and margins beat; full-year guidance raised. Athleta remained a drag.

- BJ – Slight beat though comps came in light.

- CVNA – Upgraded to Outperform at Wedbush; analysts see recent selloff as overdone.

- TGNA – Lower after Trump said he “would not be happy” if FCC reversed national ownership cap needed for NXST merger approval.

Information Technology

- GOOGL – Continued strong performance on Gemini 3 enthusiasm and industry benchmark wins.

- AAPL – FT reported further evidence of underperforming iPhone Air sales.

- META – Court filings show executives knew of potential harm to children from social apps.

- GRND – Special committee ended talks on $18/sh take-private proposal.

- AVGO – Higher as investors viewed Gemini 3 rollout as supportive of Google’s long-standing Broadcom chip reliance.

- ESTC – Beat and raised but fell on concerns about cloud-consumption deceleration.

- VEEV – Beat and raised; stock lower after commentary that fewer top biopharma firms will adopt Vault CRM.

- NAVN – Positive initiations citing the company’s potential to disrupt the fragmented corporate travel space.

- GDOT – To be split in a restructuring agreement with Smith Ventures and CommerceOne.

- Anthropic – Launched Claude Opus 4.5, its third new model rollout in two months.

Communication Services

- PSKY / WBD – PSKY viewed as front-runner for WBD amid Ellison’s interest in CNN and favorable regulatory path.

- SSP – Confirmed unsolicited takeover bid from SBGI at $7/share (~70% premium).

- Sinclair / Scripps – Sinclair made formal $7/share offer for Scripps.

Industrials

- BHP – No longer pursuing a combination with Anglo American.

- FULT / BLFY – FULT to acquire BLFY for $11.67/share (67% premium); deal expected to close Q2-26.

- F – Novelis aluminum plant (a key Ford supplier) reported its third fire in two months.

- MP – Upgraded to Outperform at BMO; analysts see sustained demand even as U.S.–China tensions ease.

Financials

- FULT – As above, acquiring BLFY; stock down modestly on deal terms.

- Blue Owl – Considering reviving its private-credit fund merger plan if pricing improves.

- INSP – Strong CMS tailwind, as noted above.

Eco Data Releases | Tuesday November 25th, 2025

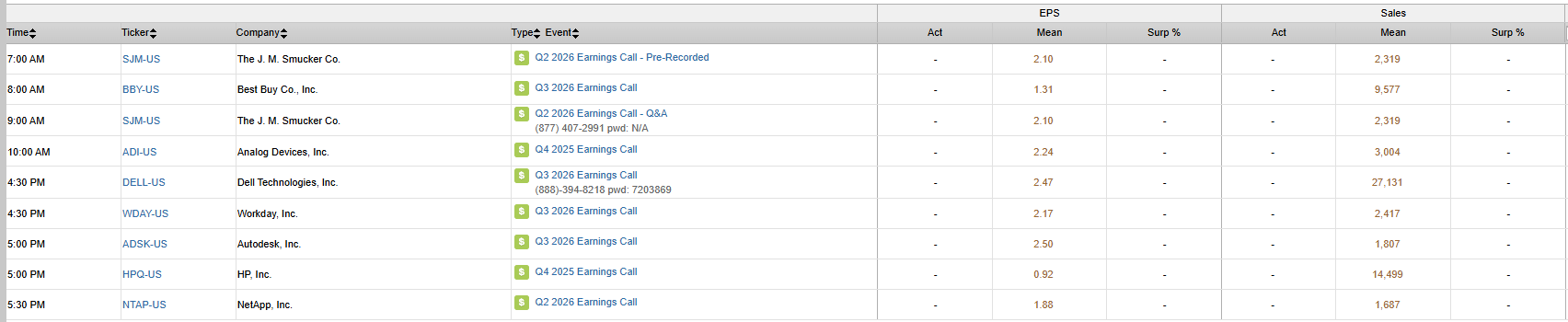

S&P 500 Constituent Earnings Announcements | Tuesday November 25th, 2025

Data sourced from FactSet Research Systems Inc.