December 2, 2025

S&P futures are up 0.2% after U.S. equities opened December with a broad pullback on Monday, finishing near session lows. Weakness was concentrated in crypto-exposed names, retail favorites, high-short-interest stocks, and 12-month winners, while Energy led the tape. Asian trading was mixed overnight: South Korea outperformed on lower U.S. tariff rates, while Mainland China lagged. Europe opened higher by ~0.5%. Treasuries are steady to slightly firmer after Monday’s backup in yields. The dollar is up 0.1%, gold is down 1.3%, Bitcoin futures are up 0.4% after a ~6% drop yesterday, and WTI crude is off 0.1%.

The broader market narrative is largely unchanged. AI competition remains front-and-center after OpenAI’s CEO declared a “code red” to accelerate ChatGPT development. Tech earnings helped sentiment, with strong post-earnings reactions in MDB and CRDO. Bond-market stabilization is getting attention following a solid 10-year JGB auction after yesterday’s BoJ-driven rate spike. Political headlines continue to flag Kevin Hassett as Trump’s expected pick for Fed Chair. Crypto remains pressured, with Bitcoin now down more than 30% from its early-October peak.

No economic data is scheduled for today. Wednesday brings ISM Services and ADP Payrolls; Thursday includes initial claims and Challenger job cuts; Friday features PCE, income/spending, and the University of Michigan sentiment/inflation-expectations survey. The Fed remains in its quiet period ahead of the December 10 FOMC meeting, with markets pricing an ~87% probability of another 25 bp rate cut.

Company highlights:

- MDB: Big post-earnings move higher after a beat-and-raise; Atlas growth reaccelerating.

- CRDO: Another strong beat-and-raise tied to AI-buildout demand.

- MRVL: Reported to be in advanced talks to acquire Celestial AI for up to $5B.

- NFLX: Submitted a mostly cash offer for WBD’s film and streaming assets in second-round bidding.

- DIS: Press reports highlight CEO succession entering final stages; Josh D’Amaro and Dana Walden viewed as leading candidates.

- TSLA: Identified as Michael Burry’s latest high-profile short, citing valuation and Musk’s pay package.

- COST: Joined a coalition suing the White House over tariff policy

U.S. equities declined on Monday (Dow –0.90% · S&P 500 –0.53% · Nasdaq –0.38% · Russell 2000 –1.25%), ending near session lows and breaking a five-day winning streak. The pullback occurred amid a broader risk-off tone driven by rising global rate expectations, particularly in Japan where upward pressure on JGB yields intensified on mounting expectations of a December BoJ tightening move. Crypto-related volatility also weighed on sentiment as Bitcoin futures fell another 5.8% after a roughly 17.5% monthly decline in November. Treasury markets saw a clear bear-steepening move, with long-end yields rising 8–9 bp, while gold gained 0.5% and the dollar was little changed.

On the data front, the November ISM Manufacturing Index disappointed at 48.2, missing consensus (49.1) and October’s 48.7 reading, with new orders and employment contracting and prices paid accelerating. Tariffs and trade uncertainty continued to dominate respondent commentary. In contrast, the S&P Global Manufacturing PMI rose to 52.2 from a 51.9 flash reading, signaling firmer underlying momentum.

The calendar turns heavier later this week: ISM Services and ADP (Wed); claims and Challenger job cuts (Thu); and PCE, income/spending, and Michigan sentiment/inflation expectations (Fri). The Fed remains in its quiet period ahead of the December 10 FOMC meeting. Political headlines also drew attention as former President Trump said he has chosen his Fed Chair nominee, with Kevin Hassett still viewed as the frontrunner.

Sector Highlights

Sector moves skewed defensive-to-negative, with most groups finishing in the red. Energy (+0.91%) led the market on stronger crude prices, while Technology (+0.07%) and Consumer Discretionary (+0.02%) eked out slight gains. Staples and Materials saw mild declines. The weakest performers were Utilities (–2.35%), Industrials (–1.49%), Healthcare (–1.49%), and Real Estate (–1.39%), reflecting pressure from rising long-end yields and a broad unwind in defensive positioning. Communication Services (–1.01%) and Financials (–0.86%) also lagged as risk appetite deteriorated into the close.

Information Technology

- SNPS +4.9%: Announced strategic AI partnership with NVDA, including a $2B investment from Nvidia at $414.79/share.

- ACN +3.0%: Entered enterprise collaboration with OpenAI; will deploy ChatGPT Enterprise for tens of thousands of professionals.

- MU: Reportedly investing $9.5B+ to build a high-bandwidth memory (HBM) plant in Japan.

- ZS –3.3%: Downgraded to Market Perform at Bernstein, citing competitive pressures.

- JOBY –6.7%: Initiated at Sell at Goldman Sachs due to concerns about the business model despite certification progress.

Communication Services

- DIS: “Zootopia 2” delivered a strong domestic opening at ~$160M over the holiday weekend.

- CPNG –5.4%: Confirmed data breach affecting 33.7M accounts; regulatory scrutiny increasing.

- OMC: Announced 4,000+ job cuts and post-IPG takeover reorganization.

Consumer Discretionary

- MSTR: Cut guidance due to BTC price weakness; announced a $1.4B reserve fund.

- LULU: Media reports highlighted governance tensions between the founder/largest shareholder and the current CEO.

- DASH +3.6%: Director Alfred Lin disclosed indirect purchase of 514K shares.

Financials

- GS: Agreed to acquire Innovator Capital Management for ~$2B.

- NWL +4.4%: Announced 900 job cuts and a global productivity plan, reaffirming Q4 margin and cash-flow guidance.

- MSTR (crypto exposure): Weighed down by Bitcoin weakness (not in GICS Financials but market impact felt across crypto-adjacent names).

- Regional banks outperformed broadly, bucking the market trend.

Healthcare

- MRNA –7.0%: NYT reported an FDA memo linking Covid-19 vaccines to 10 child deaths, pressuring shares.

- UNH: Selling final portion of its South American business for $1B.

- Pharma, biotech, and managed care were all among the day’s laggards.

Industrials

- ODFL +3.2%: Upgraded to Outperform at BMO citing disciplined operations and strong pricing power.

- A&D names broadly weaker despite stable order trends.

- Airbus: Shares fell on reports of new A320 quality issues.

Energy

- Barrick (B) +2.4%: Exploring an IPO of a subsidiary holding its premier North American gold assets.

- Energy sector overall outperformed with WTI +1.3% supporting E&Ps and refiners.

Consumer Staples

- Beverage, protein, and cosmetics names outperformed on defensive demand and stable input costs.

Real Estate

- REITs broadly lower amid rising yields; no major corporate headlines.

Eco Data Releases | Tuesday December 2nd, 2025

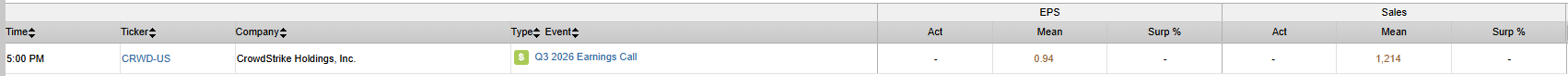

S&P 500 Constituent Earnings Announcements | Tuesday December 2nd, 2025

Data sourced from FactSet Research Systems Inc.