December 3, 2025

S&P futures are up 0.1% after U.S. equities finished mostly higher on Tuesday, led by select tech, AI-linked names, retail favorites, and 12-month winners. Breadth was mixed, with nearly 60% of the S&P 500 declining. Asian trading was split—Japan gained more than 1% while Hong Kong fell more than 1%. Europe opened higher by ~0.5%. Treasuries are unchanged to slightly firmer, the dollar is down 0.3%, gold is up 0.3%, Bitcoin futures are up 1.8%, and WTI crude is up 1.5%.

No major catalysts are driving markets, with attention shifting to next week’s AI events and the upcoming Fed meeting. Tech earnings produced mixed reactions but MRVL stood out with strong AI momentum. Media reports continue to build around Kevin Hassett as Trump’s likely Fed Chair nominee. Stabilization in crypto and rates after early-month pressures has also been noted. The broader narrative continues to emphasize AI-driven dispersion, strong early holiday spending, light December volumes, easing systematic selling following last month’s rebound, and constructive year-end seasonality.

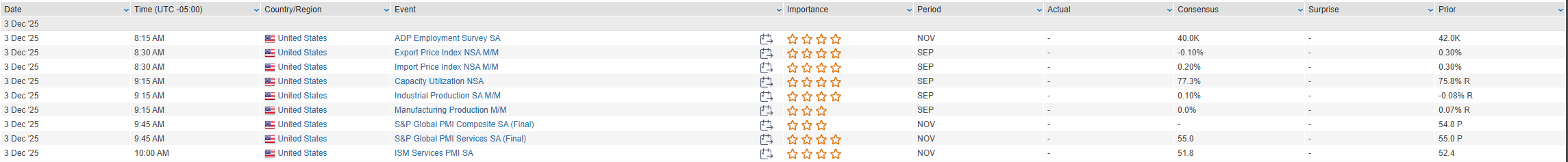

This morning brings ADP private payrolls (expected +10K) and ISM Services (expected 52.0 vs 52.4 prior). Thursday features initial claims and Challenger job cuts. Friday includes PCE, income/spending, and University of Michigan sentiment. The Fed remains in its quiet period ahead of the December 10 FOMC meeting, with markets pricing just under a 90% probability of a 25 bp rate cut.

Company highlights:

- MRVL: Beat expectations; raised FY27 guidance; positive FY28 outlook (+40% DC) and Celestial AI acquisition.

- CRWD: Positive quarter but investors focused on a high bar and in-line Q4 revenue guide.

- PSTG: Beat and guided above consensus, though scrutiny on reinvestment pace and missing hyperscaler announcement.

- MCHP: Positive December-quarter preannouncement.

- OKTA: Beat/raised; some disappointment around Q4 cRPO and no formal FY27 guide.

- GTLB: Under pressure as Q3 beat underwhelmed and federal demand softened.

- ASAN: Takeaways skewed toward improving retention metrics.

- BOX: Pressured after an in-line Q4 revenue guide and lighter margin outlook.

- AEO: Beat/raised; strong momentum in Aerie.

- ACHC: Weak after another guidance cut tied to higher PLGL costs.

- NKE: Announced senior management changes.

U.S. equities were mostly higher on Tuesday (Dow +0.39% · S&P 500 +0.25% · Nasdaq +0.59% · Russell 2000 –0.17%), though the major indices finished off intraday highs following Monday’s pullback that ended a five-session winning streak. Risk appetite improved across large-cap tech, AI beneficiaries, and higher-beta areas, while precious metals, staples, and Energy lagged after Monday’s strength. Treasuries were unchanged to slightly firmer at the short end after yields surged on Monday. The dollar rose 0.1%, gold fell 1.3% to near session lows, Bitcoin futures rebounded 6.5% after a 7% decline the prior day, and WTI crude slipped 1.2%.

Market narrative remained centered on AI-driven disruption headlines, crypto volatility, and rate stabilization after a sharp rise in global yields tied to hawkish BoJ expectations, U.S. corporate supply, inflation concerns, and positioning. Sentiment around consumer resilience improved marginally after strong Cyber Monday data, although bifurcation across income tiers remains a theme.

Sell-side conference activity was heavy, with major AI and industrial companies offering incremental commentary on capex pipelines, product deliverables, and 2026 outlooks. Meanwhile, political reporting continued to flag Kevin Hassett as frontrunner to replace Powell as Fed Chair.

There was no economic data on Tuesday. Key releases ahead include ISM Services and ADP (Wed), weekly claims + Challenger (Thu), and PCE, income/spending, and University of Michigan sentiment (Fri). The Fed remains in its quiet period ahead of the December 10 FOMC meeting, with futures pricing an ~87% chance of an additional 25 bp rate cut.

Sector Highlights

Sector moves were mixed but skewed toward cyclical leadership. Industrials (+0.87%) and Technology (+0.84%) were the top performers, buoyed by strong AI headlines and upbeat aerospace commentary. Communication Services (+0.37%) also outperformed on renewed M&A momentum. On the downside, Energy (–1.28%), Materials (–0.83%), and Utilities (–0.72%) lagged as crude retreated and metals softened. Defensive groups such as Healthcare, Consumer Staples, and Real Estate posted modest declines, while Financials (–0.05%) and Consumer Discretionary (–0.01%) were essentially flat.

Information Technology

- NVDA: Highlighted upside to its $500B Blackwell/Rubin pipeline at a sell-side conference.

- AMZN (AWS): Announced Trainium3 UltraServers and future adoption of Nvidia NVLink Fusion for AI workloads.

- AMD & HPE: Expanded collaboration on AI infrastructure.

- AAPL: Reportedly revamping its AI organization; INTC rose on reports it may soon supply Apple with advanced chips.

- MRVL: In advanced talks to acquire Celestial AI for up to $5B, per The Information.

- MDB +22.2%: Beat-and-raise quarter; Atlas growth reaccelerated; FY guidance raised.

- CRDO +10.2%: Massive beat-and-raise; guided Q3 revenue ~40% above consensus; strong AEC and hyperscaler traction.

- TER +5.7%: Upgraded to Buy at Stifel; sees accelerating growth into 2026 tied to AI-era test demand.

- NET +2.1%: Initiated Overweight at Barclays; cited exposure to cloud and AI inference trends.

Communication Services

- WBD +2.8%: Received second-round bids for studio/streaming assets, including a mostly cash offer from NFLX and a revised bid from CMCSA.

- DIS: CEO succession seen entering final stages; Josh D’Amaro and Dana Walden viewed as leading candidates.

- NFLX: Active in the WBD auction process; submitted a mostly cash offer.

- Mistral AI: Released new open-source model lineup aimed at competing with ChatGPT and Gemini.

- Kalshi: Raised $1B at $11B valuation.

- Electronic Arts: Saudi PIF set to take 93% ownership in a $55B deal.

Consumer Discretionary

- SIG –6.8%: Earnings beat overshadowed by conservative guidance and softer consumer confidence commentary.

- TSLA: Ongoing negative sentiment after recent short thesis from prominent hedge fund manager.

- COST: Joined peers suing the White House over tariff policy.

- FUN +1%: Upgraded to Buy at Truist; praised management/activist alignment.

Consumer Staples

- PG –1.1%: CFO highlighted significant October U.S. sales declines (volume and value) and expects November to be similarly weak.

- UNFI +4.7%: Earnings beat; margin tailwinds from network optimization and mix; reaffirmed FY guidance.

- Food & HPC categories broadly lagged on defensive rotation.

Financials

- Larger-cap banks outperformed; sector benefited from stabilization in yields.

- Instacart (CART) –2.9%: Amazon testing “ultrafast” delivery in two cities, raising competitive concerns.

Industrials

- BA +10.1%: Guided to low-single-digit billions in 2026 FCF; expects y/y increases in 737 and 787 deliveries.

- XPO –5.6%: November LTL tonnage per day down 5.4% y/y; declines in both shipments and weight per shipment.

- A&D broadly mixed despite solid order commentary.

Energy

- Sector underperformed as WTI –1.2% unwound Monday’s rally; no major company-specific news.

Materials

- No major corporate-level headlines; group traded lower alongside weaker metals pricing.

Healthcare

- JANX –53.3%: Updated JANX007 Phase 1 data disappointed; concerns on dosing, regulatory timelines, and efficacy.

- SYM –21.5%: Downgraded to Sell at Goldman; valuation stretched after strong YTD gains.

- Managed care companies among outperformers earlier in the session but faded into the close.

Real Estate

- Sector drifted lower on higher rate expectations; no notable company-specific headlines.

Eco Data Releases | Wednesday December 3rd, 2025

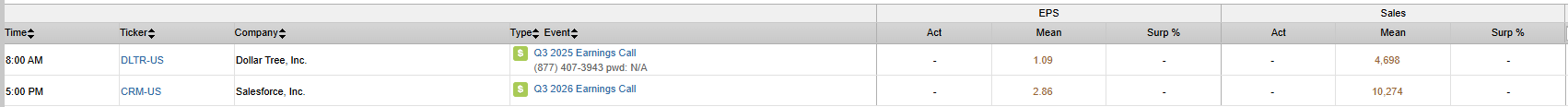

S&P 500 Constituent Earnings Announcements | Wednesday December 3rd, 2025

Data sourced from FactSet Research Systems Inc.