December 4, 2025

S&P futures are little changed after U.S. equities advanced on Wednesday, led by small caps with the Russell 2000 up nearly 2%. Retail favorites, high-beta names, most-shorted stocks, and value trades outperformed. Asian markets were mixed overnight—Japan rallied more than 2% while Mainland China slipped slightly. Europe opened higher by ~0.4%. Treasuries are weaker with yields up ~2 bp. The dollar is flat, gold is down 0.1%, Bitcoin futures are off 0.4%, and WTI crude is up 0.5%.

The market remains without a strong directional catalyst as December begins. Investors continue to point to volatility compression, seasonal tailwinds, and favorable flow dynamics as drivers of a slow grind higher later in the month. However, the backdrop remains complex: the Fed is widely expected to cut rates by 25 bp next week but may deliver hawkish guidance, AI remains a central bullish pillar but faces scrutiny over ROI and competitive pressures, and macro resilience is being tested by softening labor data and widening consumer bifurcation.

Corporate updates:

- CRM: Higher on strength in NNAOV growth, which outpaced AOV growth for the first time since FY22.

- SNOW: Takeaways upbeat, though shares pressured by deceleration in product-revenue growth.

- GWRE: Fiscal Q1 beat; raised FY26 outlook; continued cloud momentum.

- PATH: Boosted by better ARR and NNARR returning to growth.

- FIVE: Strong 14%+ comp growth, tariff mitigation, and solid holiday-season start.

- PVH: Beat and raised bottom end of FY25 EPS guidance, though Q4 outlook soft.

- META: Hired Apple design executive Alan Dye to lead user interface.

- COST: November sales comps appeared below expectations.

- PSKY: Increased breakup fee in WBD offer to $5B.

- MS: Reportedly exploring reductions in data-center exposure.

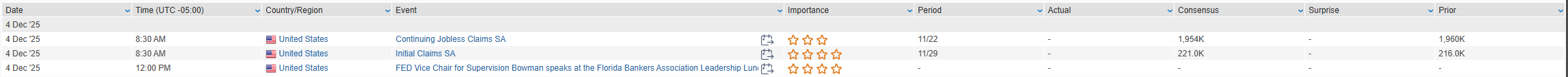

Economic data:

Initial claims and Challenger job cuts are due this morning (claims seen rising to 222K

U.S. equities posted broad gains on Wednesday (Dow +0.86% · S&P 500 +0.30% · Nasdaq +0.17% · Russell 2000 +1.91%), extending the week’s upward momentum, though the indices finished slightly off their highs. Leadership came from retail-investor favorites, high-beta/value stocks, and cyclicals, while Big Tech was mostly lower aside from a notable rise in TSLA. Treasury yields eased across the curve, down 2–3 bp, continuing the stabilization trend after early-month volatility. The dollar fell for a seventh straight session (–0.5%), gold rose 0.3%, Bitcoin gained 2.2% after a strong rebound the prior day, and WTI crude added 0.5%.

The macro narrative remained relatively unchanged ahead of next week’s Fed and major AI events. Markets continued to digest modest crypto and rate stabilization, AI-related dispersion in equity performance, and an improving holiday-shopping backdrop. Labor-market softening also gained attention after the ADP private-payrolls decline, supporting expectations for a dovish December FOMC meeting. Meanwhile, stronger-than-expected ISM Services and ongoing commentary about Kevin Hassett as the likely Fed-chair pick rounded out the policy backdrop.

Data releases:

- ADP private payrolls: –32K vs. +10K expected (prior +42K), with weakness concentrated among small businesses.

- ISM Services: 52.6 vs. 51.8 consensus, best print since February; stronger employment, softer new orders, easing prices paid.

- S&P Global Services PMI: Above consensus.

- Industrial Production (Sep): +0.1% m/m, in line.

Thursday brings initial claims and Challenger job cuts; Friday includes PCE, income/spending, and Michigan sentiment. The Fed remains in its quiet period, with markets pricing just under a 90% probability of another 25 bp cut on December 10.

Sector Highlights

Wednesday’s action featured strong cyclical and value leadership. Energy (+1.83%), Financials (+1.27%), and Industrials (+0.95%) led the market, supported by improving rate stability, solid travel and freight commentary, and renewed demand for value and high-beta exposures. Consumer Discretionary (+0.83%), Materials (+0.51%), and Healthcare (+0.46%) also posted steady gains.

On the softer side, Technology (–0.42%) lagged due to weakness in software and mixed tech-earnings reactions. Defensive sectors—Utilities (–0.32%), Communication Services (+0.09%), Consumer Staples (+0.16%), and Real Estate (+0.21%)—underperformed as investors shifted toward cyclical risk exposure.

Information Technology

- MSFT –2.5%: Initially hit by report of lowered AI-software targets due to customer pushback (later denied).

- MRVL +7.9%: Strong quarter; raised FY27 guidance; upbeat FY28 outlook (+40% DC growth); positive commentary on Celestial AI acquisition and CPO positioning; upgraded at Summit Insights.

- CRWD: Positive quarter but investor focus on high expectations and in-line Q4 revenue guide.

- PSTG –27.3%: Beat but guided FY26 with heavy reinvestment; downgraded at Susquehanna pending visibility on hyperscaler scaling timeline.

- MCHP +12.2%: Raised Q3 ranges; noted stronger-than-expected November bookings and positive setup for March 2026 quarter.

- OKTA: Beat and raised; some disappointment around Q4 cRPO and no FY27 guide.

- GTLB –12.8%: Q3 positive but underwhelming vs. expectations; flagged softness in U.S. federal and SMB markets.

- ASAN +7.8%: Broad beat and raise; improving NRR across cohorts; highlighted AI Studio and AI Teammates as drivers.

- BOX +6.7%: Beat with in-line Q4 guide; margin guide light but buyback raised $150M.

- INTC +8.7% (prior session impact): Ongoing tailwind from reports it may supply AAPL with advanced chips.

Communication Services

- NFLX –4.9%: Lower on report WBD is leaning toward its bid for studio/streaming assets.

- WBD +2.8% (previous session): Still in second-round auction; NFLX viewed as preferred bidder.

- DIS: Ongoing focus on CEO succession developments.

- Roblox: Access blocked in Russia due to child-safety concerns.

- Fanatics: Launched prediction-market platform across 24 states.

Consumer Discretionary

- TSLA +4.1%: Benefitted from Politico report that Trump administration is considering executive orders aimed at U.S. robotics expansion.

- NKE: Announced senior management changes.

- DLTR +3.6%: Beat and raised; momentum in multi-price strategy; strong Halloween season; Q4 outlook ahead of consensus.

- AEO +15.1%: Strong beat and raise; Aerie momentum impressive; holiday season off to strong start.

- W –6.1%: Downgraded at Jefferies on valuation and a slower holiday start.

- M: Beat and raised, though Q4 guide viewed as high-bar.

Financials

- Moneycenter banks and credit cards were among Wednesday’s outperformers.

- FISV +5.9%: CFO purchased 17K shares.

Industrials

- BA –1.4%: FTC requiring significant Spirit AeroSystems divestitures to complete $8.3B merger; delays expected.

- DAL +3.6%: Strong travel demand commentary into early 2026; government-shutdown impact smaller than feared.

- ACHR +9.2%: Announced plans for Miami air-taxi network.

Energy

- Sector outperformed despite modest WTI gain; no major corporate-specific headlines.

Materials

- Copper prices hit record highs globally (macro impact).

Healthcare

- BMY +5.6%: Moving ahead with ADEPT-2 Phase 3 psychosis trial in Alzheimer’s patients.

- ACHC –10.9%: Cut 2025 EBITDA guidance again due to higher PLGL costs.

- Healthcare distributors, hospitals were sector laggards.

Real Estate

- Slightly higher alongside broader cyclicals; no notable corporate headlines.

Eco Data Releases | Wednesday December 4th, 2025

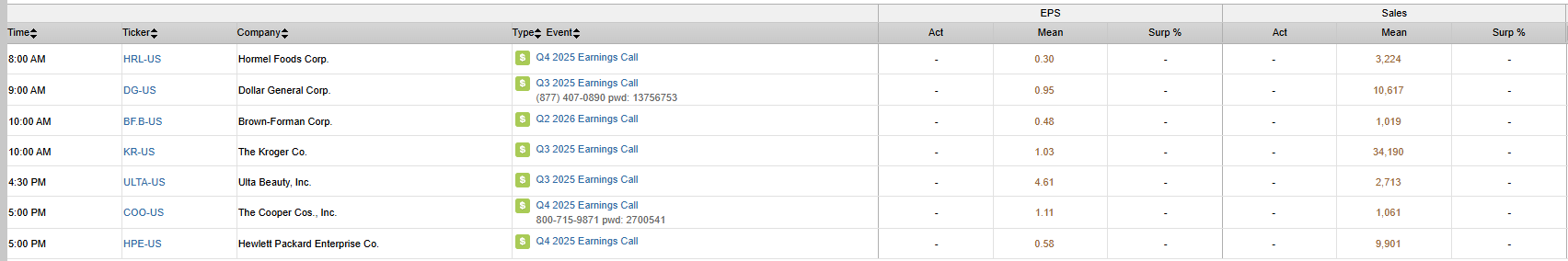

S&P 500 Constituent Earnings Announcements | Wednesday December 4th, 2025

Data sourced from FactSet Research Systems Inc.