December 9, 2025

S&P futures are up 0.05% in Tuesday morning trading following Monday’s broad market decline, where six sectors fell more than 1% and tech was the only gainer on semiconductor strength. Treasuries are unchanged to slightly firmer on the long end after Monday’s rate backup pushed the 10-year yield to its highest level since September. The dollar is down 0.1%, gold is up 0.4%, Bitcoin futures are down 1.2%, and WTI crude is up 0.4%.

Headlines remain quiet as markets wait for Wednesday’s FOMC meeting, where a “hawkish cut” is now the consensus—a narrative reinforced by global policy signals, including the RBA holding rates while warning on inflation. AI disruption remains a major focus ahead of earnings from AVGO and ORCL and the release of OpenAI’s new model. Positioning has improved following November’s momentum unwind and SPX drawdown, but that has made the setup more challenging into year-end, even as systematic flows shift from headwind to tailwind and corporate buybacks should remain active over the next 10 days.

Today’s data includes the NFIB Small Business Optimism Index and October JOLTS job openings. Treasury will auction $39B in 10-year notes. Wednesday will bring Q3 ECI, the final FOMC decision of the year, the updated SEP, and Powell’s press conference. Thursday includes initial claims, the September trade balance, and a $22B 30-year auction. No data is scheduled for Friday, though several Fed speakers return.

Corporate highlights:

- NVDA: Trump confirmed approval for H200 sales to select customers in China; FT reported Beijing may impose limits.

- HD: Issued underwhelming FY26 guidance ahead of analyst day.

- PEP: Announced shareholder-value measures in settlement with Elliott; preliminary FY26 guidance exceeded expectations.

- KMI: FY26 EBITDA/EPS largely in line, though capex came in higher.

- TOL: Post-earnings laggard despite stronger closings; impairments and FY26 margin concerns weighed.

- GPK: Cut FY25 EPS guidance slightly and announced new inventory-reduction measures along with a CEO transition.

- ALEX: Agreed to go private in a $2.3B deal.

U.S. equities ended Monday lower (Dow –0.45% · S&P 500 –0.35% · Nasdaq –0.14% · Russell 2000 –0.02%) near session lows as markets positioned ahead of Wednesday’s FOMC meeting. A “hawkish cut” has become the consensus expectation, with the Fed likely to reduce rates by 25 bp while tightening forward guidance, raising the perceived bar for further easing. Treasury yields moved 2–3 bp higher, though Monday’s 3-year auction was well-received. The dollar inched up 0.1%, gold declined 0.6%, Bitcoin rose 1.5%, and WTI crude fell 2% after its brief move above $60 on Friday.

Market tone remained cautious as investors navigated shifting expectations around global central-bank policy, heavy Treasury supply, and elevated AI-related volatility ahead of AVGO and ORCL earnings and OpenAI’s new model release. AI headlines continued to highlight disruption (custom-chip competition), productivity benefits, and geopolitical dynamics (NVDA H200 export approvals). Sentiment indicators showed substantial improvement: AAII’s Bull–Bear spread jumped sharply, hedge-fund buying accelerated, and CTA positioning moved back into the 76th percentile.

The NY Fed Survey of Consumer Expectations showed steady inflation expectations across horizons, modest improvement in labor-market perceptions, and deterioration in household financial outlooks. This week’s data calendar remains light, with JOLTS and NFIB on Tuesday. Trade commentary focused on Beijing’s compliance with the Phase One agreement and potential implications of a forthcoming Supreme Court decision on IEEPA-related tariff refunds.

Sector Highlights

Technology led the S&P 500 with a +0.93% gain, supported by semis and networking strength. Industrials were marginally positive at +0.14%, helped by transports and capital-goods names. All other sectors declined, with the steepest losses in Communication Services (–1.77%), Materials (–1.66%), Consumer Discretionary (–1.53%), and Utilities (–1.30%). Healthcare, Energy, Staples, Real Estate, and Financials all finished lower as the market shifted defensively ahead of the FOMC decision.

Information Technology

- MRVL –7.0%: Pressured after reports MSFT may shift custom-chip development to AVGO.

- AVGO +2.8%: Benefitted from same MSFT report.

- NVDA +1.7%: Commerce Dept. to allow H200 sales to China.

- IBM +29.1%: Announced acquisition of CFLT for $31/sh (~$11B EV).

- CFLT +29.1%: Surged on IBM deal.

- S –14.4%: Beat on Q3, but guided soft and announced CFO transition.

- OKLO –6.3%: Announced up to $1.5B equity offering.

- CRWV –2.3%: Announced $2B convertible note offering.

- MU +4.1%: Susquehanna raised PT to $300 on improving DRAM/NAND pricing and opex execution.

- LITE: Extended strategic agreement with IQE.

- GOOGL: Mixed sentiment; AI leadership noted via Gemini’s engagement outpacing ChatGPT.

Communication Services

- WBD +4.4%: PSKY launched $30/sh hostile tender offer; follows Trump’s weekend antitrust concerns over NFLX bid.

- PSKY –9.8%: Shares fell despite the $108B hostile bid.

- NFLX –3.4%: Pulled back further as takeover battle escalated.

- META: Delayed “Phoenix” AR glasses to 2027; continued positive narrative on AI positioning.

- SATS +7.6%: Moving higher on reports SpaceX exploring IPO at $800B valuation.

Consumer Discretionary

- TSLA –3.4%: Downgraded to Equal-Weight at MS on valuation and softer EV demand.

- LCID –4.9%: Downgraded to Underweight; profitability not expected until 2028.

- RIVN –1.7%: Downgraded to Underweight at MS on deteriorating EV demand.

- LEN –2.6%: Downgraded to Underweight at Barclays on margin risk under rigid production model.

- WHR: $1B sale of India business collapsed.

- GAP –3.9%: Insider sale of 250K shares.

Consumer Staples

- No major earnings drivers, though tariff-exposed HPC and staples names generally lagged.

Healthcare

- WVE +147%: Strong Phase 1 data for obesity drug WVE-007; fat-loss efficacy similar to GLP-1s without muscle loss.

- GPCR +102%: Positive topline data for aleniglipron showed 11.3% placebo-adjusted weight loss at 36 weeks.

- NRIX +18.7%: Positive early-stage leukemia data.

- ARWR +11.7%: Initiated Phase 1/2a study for Alzheimer’s/tauopathies.

- INSP +5.3%: Upgraded at Oppenheimer after CMS reimbursement improvement.

- LLY: Mounjaro to be added to China’s 2026 national insurance list.

Industrials

- LUV: Cut FY25 EBIT outlook on shutdown and fuel impacts; bookings normalized.

- MMM –2.1%: Downgraded to Hold on valuation.

- ITT –1.3%: Announced acquisition of SPX FLOW for $4.775B.

Financials

- No major earnings, though banks and IBs were relative outperformers on higher yields.

Energy & Materials

- Energy lagged with crude down 2%.

- FLNC –4.6%: Downgraded on concerns around data-center pipeline expectations.

- Copper/aluminum names were relative outperformers early but faded.

Eco Data Releases | Tuesday December 9th, 2025

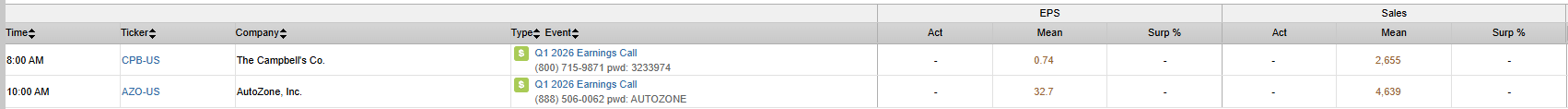

S&P 500 Constituent Earnings Announcements | Tuesday December 9th, 2025

Data sourced from FactSet Research Systems Inc.