March 13, 2025

S&P 500 futures are flat, recovering from overnight lows, after U.S. equities finished mostly higher Wednesday. Tech and cyclicals outperformed, though broad market breadth was weak, with two-thirds of S&P 500 stocks closing lower. Treasuries were slightly weaker at the long end, while the dollar was little changed. Gold rose 0.2%, Bitcoin futures gained 0.4%, and WTI crude fell 0.6%.

The market remains hesitant after Wednesday’s underwhelming bounce, despite cooler CPI data and no new tariff threats from Trump. Concerns over Trump 2.0 policy uncertainty, government shutdown risks, and weaker consumer trends persist. Senate Democrats oppose the House-passed CR, increasing shutdown risks. Desks also flag CTA supply pressure, liquidity constraints, and technical deterioration.

Key Events Today

- U.S. PPI & Initial Jobless Claims

- PPI (Feb): Expected +0.2% m/m (vs. +0.4% prior); core PPI seen at +0.3%.

- Initial claims: Expected 227K (vs. 221K prior).

- $22B 30-Year Treasury Bond Auction

- Trump meeting Senate Republicans on tax cuts

- Canada & U.S. trade talks amid USMCA tensions

Corporate News

- Adobe (ADBE – Pre-Market Down): Q1 beat but stock lower despite AI disclosures and reiterated FY25 guidance.

- Intel (INTC +4.6%): Appointed Lip-Bu Tan as CEO, boosting investor sentiment.

- UiPath (PATH -23%): Weak Q4 ARR, FY26 guidance hurt by U.S. federal sector weakness.

- SentinelOne (S -7%): Missed Q4 ARR, guided FY26 lower, though highlighted positive platform traction.

- American Eagle (AEO -9%): Cautioned on weaker QTD trends due to softer demand, colder weather, and issued below-consensus guidance

U.S. equities closed mostly higher Wednesday, with the S&P 500 (+0.49%) and Nasdaq (+1.22%) rebounding modestly from recent weakness. However, the S&P remains nearly 9% below its February 19 record high. Big Tech led gains, with Nvidia (NVDA) and Tesla (TSLA) outperforming, while Apple (AAPL) lagged. Semiconductors, software, energy, credit cards, banks, biotech, and industrial metals were among the strongest performers, while airlines, food & beverage, hospitals, managed care, and media underperformed.

The February CPI report showed cooler-than-expected inflation, easing stagflation concerns. However, markets continue grappling with trade uncertainty, as the White House imposed 25% tariffs on Canadian steel and aluminum overnight, prompting retaliatory tariffs from Canada (€20B) and the EU (€26B). China also summoned Walmart (WMT) executives over reports that the company asked suppliers to absorb tariff costs. Despite the initial positive CPI reaction, investors remain skeptical about the economic outlook, as tariff risks, slowing growth, and tighter financial conditions weigh on sentiment.

Treasuries weakened, with the long end of the curve higher for six of the past seven sessions. The dollar index edged up 0.1%, while gold (+0.9%) and WTI crude (+2.2%) rose. Bitcoin futures declined 0.6%. The Bank of Canada cut rates by 25 bps, marking its seventh consecutive rate cut.

Sector & Company News

Technology (+1.56%)

- Nvidia (NVDA) and Tesla (TSLA) led tech gains, with strong rebounds from recent declines.

- Intel (INTC, +4.6%): TSMC (TSM) reportedly exploring a joint venture with Nvidia (NVDA), AMD (AMD), and Broadcom (AVGO) to operate Intel factories, a move seen as a potential boost for U.S. semiconductor production.

- HubSpot (HUBS, +3.5%): Upgraded to Overweight at Barclays, citing AI product monetization opportunities, customer growth, and recent price increases.

- Rubrik (RBRK, +6.1%): Upgraded to Buy at Rosenblatt Securities, citing strong subscription growth expectations and valuation upside.

Communication Services (+1.43%)

- Google (GOOGL) launched new AI models for the robotics industry, expanding its presence in industrial automation.

- Verizon (VZ, -1.9%): Downgraded to Peer Perform at Wolfe Research, following a downbeat outlook at Deutsche Bank’s TMT Conference.

Consumer Discretionary (+1.02%)

- Tesla (TSLA) rebounded despite Evercore ISI cutting its full-year delivery forecast.

- Crocs (CROX, +3.6%): Upgraded to Buy at Loop Capital, citing optimistic management tone at a recent investor conference and stronger-than-expected direct-to-consumer (DTC) growth for Hey Dude.

- Vivid Seats (SEAT, -23.1%): Q4 results beat, but FY25 guidance was weak, with management flagging competitive pressure and planned investments to protect market share.

Financials (+0.20%)

- Capital One (COF, +3.1%): Upgraded to Outperform at Evercore ISI, noting the market is underpricing potential earnings upside from its Discover Financial (DFS) acquisition.

Healthcare (-1.02%)

- Summit Therapeutics (SMMT, +7.6%): Evercore ISI initiated coverage with an Outperform rating, citing promising data from its HARMONi-2 study in lung cancer.

- Myriad Genetics (MYGN, +1.6%): Upgraded to Overweight at Piper Sandler, with analysts expecting a stronger growth trajectory under new CEO Raha.

Industrials (Flat)

- Archer-Daniels-Midland (ADM) exploring the sale of its futures brokerage arm to cut costs.

Consumer Staples (-2.02%)

- PepsiCo (PEP, -2.7%): Downgraded to Hold at Jefferies, citing continued weakness in its Frito-Lay business and a soft U.S. beverage market.

- Casey’s General Stores (CASY, +6.2%): Q3 revenue and EPS topped expectations, with strength across fuel, prepared foods, and inside store sales. FY25 EBITDA guidance also came in slightly above consensus.

Energy (+0.44%)

- WTI crude gained 2.2%, helped by reports that OPEC+ production surged, despite Kazakhstan exceeding its quota.

Geopolitics & Trade

- Trump and Commerce Secretary Lutnick reaffirmed a hawkish trade stance, with Trump calling April 2 a “big day” for reciprocal tariffs.

- EU announced swift retaliatory measures on $26B of U.S. industrial and agricultural goods.

- Canada imposed 25% counter-tariffs on over $20B of U.S. goods.

- Mexico refrained from immediate retaliation, though President Sheinbaum signaled she remains cautious about Trump’s approach.

- Ukraine agreed to a U.S.-brokered 30-day ceasefire proposal, now awaiting Russia’s response.

Eco Data Releases | Thursday March 13th, 2025

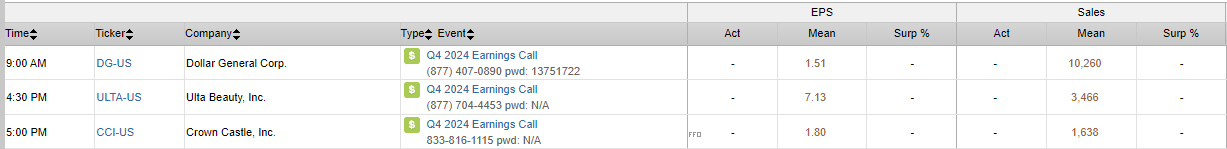

S&P 500 Constituent Earnings Announcements | Thursday March 13th, 2025

Data sourced from FactSet Research Systems Inc.