December 17, 2025

S&P futures are up 0.3% after U.S. equities finished mostly lower Tuesday, marking the S&P’s third straight decline since last Thursday’s record close. Energy and healthcare led declines, while Big Tech outperformed, with TSLA hitting a fresh record high. Asia traded mostly higher (South Korea and Greater China strongest), Europe up ~0.3%. Treasuries weaker (yields +2–3 bp), DXY +0.4%, gold +0.4%, Bitcoin −1.4%. WTI +2.5% after President Trump ordered a blockade of sanctioned Venezuelan tankers.

Key themes include the oil rebound, firmer yields and dollar, ongoing AI investment headlines, and further signs of housing softness. Directional catalysts remain limited; focus stays on favorable year-end seasonality, with some scrutiny around fading buybacks and rebounding sentiment/positioning after the mid-November unwind.

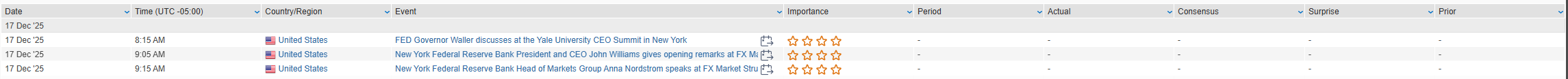

No major U.S. data today. Fedspeak from Waller, Williams, and Bostic; Waller also interviews with Trump for Fed chair. Claims, November CPI, and Philly Fed are due Thursday; existing home sales and final UofM on Friday.

Company news highlights:

- AMZN reportedly discussing a $10B+ OpenAI investment at a $500B+ valuation, with OpenAI using Trainium chips.

- GOOGL / Waymo in talks to raise up to $15B at a $400B valuation.

- TSLA faces a sales suspension in California tied to Autopilot/FSD marketing.

- WBD board expected to recommend against PSKY’s hostile bid; PSKY not planning a near-term bump.

- LEN lagged post-earnings on much weaker Q1 guidance, pressuring FY26 estimates.

- WOR fell on FQ2 EBITDA/EPS miss; announced $205M acquisition of LSI Group.

- MU reports after the close today; FDX, KMX, NKE Thursday; CAG, PAYX Friday.

U.S. equities were mostly lower Tuesday (Dow −0.62%, S&P 500 −0.24% (third straight decline), Nasdaq +0.23%, Russell 2000 −0.45%), though stocks finished well off worst levels. Big Tech provided relative support to the Nasdaq (notably TSLA and META), while broader risk appetite remained constrained. Treasuries rallied across the curve with yields down 3–4 bp, the dollar eased 0.2%, and WTI crude fell 2.7% to its lowest level since early 2021 amid growing optimism around Russia–Ukraine peace negotiations. Bitcoin futures rose 2.1%, while gold finished slightly lower in choppy trading.

A heavy data slate failed to generate a clear directional impulse, reinforcing the sense of mixed signals for both markets and policy.

- November NFP: +64K (vs. +50K consensus); October revised to −105K; August–September revised down a combined 33K.

- Unemployment rate: 4.6% (vs. 4.5% expected).

- October retail sales: Flat m/m headline; control group +0.8% (well above expectations).

- December flash PMI: 53.0, slowing to the weakest growth pace since June, with moderation in both services and manufacturing.

Fed-related headlines stayed in focus. Reports suggested Trump is interviewing Fed Governor Waller for chair, though Hassett remains a slight favorite. Fed commentary was mixed: Bostic warned further cuts could reignite inflation and hurt credibility. Attention now shifts to Micron earnings, November CPI, a likely BoJ rate hike, and further clarity on the Fed chair decision, all heading into a seasonally strong period for equities.

Sector Highlights

Sector moves reflected a clear oil-driven drag on Energy, which was the day’s worst performer (−2.98%). Healthcare also lagged following Pfizer’s weak 2026 outlook and some giveback from recent defensive rotation. Financials, Industrials, and Consumer Staples were also under pressure. On the upside, Technology led modestly, supported by select mega-cap strength, alongside small gains in Consumer Discretionary and Communication Services, while Materials finished slightly negative but outperformed most cyclical peers.

Overall, markets continue to grapple with cross-currents between slowing but resilient growth, softer labor signals, and an uncertain policy outlook, with near-term direction likely dictated by CPI, Micron earnings, and central bank developments

Information Technology

- Tesla (TSLA): Continued to outperform, supporting the Nasdaq.

- PayPal (PYPL): Applied to become a U.S. bank, a move aimed at expanding small-business lending.

- Micron (MU): High-profile earnings due Wednesday after the close.

- Apple (AAPL): Reportedly planning a major expansion of its smartphone product lineup over the next two years.

- Databricks (Private): Raising $4B at a $134B valuation, up ~34% from August.

Healthcare

- Pfizer (PFE): Shares lagged after guiding 2026 EPS ~5% below consensus, citing declining Covid-related revenues and patent expirations; sales outlook essentially flat.

- Humana (HUM): Reaffirmed FY25 guidance but announced insurance segment leadership changes; stock declined.

- Elanco (ELAN): Shares rose on disclosed insider purchases by the CEO and CFO.

Consumer Discretionary

- Kraft Heinz (KHC): Appointed Steve Cahillane as CEO effective Jan 1.

- Frontier Group (ULCC): Fell sharply after naming an interim CEO and reiterating Q4 guidance.

- Netflix (NFLX): Doubling down on video podcasts via a new iHeartMedia partnership launching in 2026.

Financials

- UBS (UBS): Upgraded to buy at BofA on expectations for more lenient capital rules and strong growth in wealth management and capital markets.

- Exchanges: Sector broadly outperformed amid selective rotation.

Industrials

- Ford (F): Raised 2025 operating profit outlook to $7B (from $6–6.5B) alongside a $19.5B EV writedown; free cash flow trending toward the high end of prior guidance.

- Illinois Tool Works (ITW): Downgraded to sell at Goldman Sachs on expectations of growth lagging peers.

Energy

- Energy complex broadly weak as crude oil slid nearly 3% to multi-year lows on peace-talk optimism; Russia’s crude export values also hit multi-year lows.

Communication Services

- Comcast (CMCSA): Shares jumped amid reports of unusual options and swaps activity, sparking speculation of potential activist involvement.

Staples

- Archer-Daniels-Midland (ADM): Downgraded to underweight at Morgan Stanley on continued weakness in the crushing segment.

Eco Data Releases | Wednesday December 17th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday December 17th, 2025

Data sourced from FactSet Research Systems Inc.