December 18, 2025

S&P futures are up 0.4% Thursday morning following Wednesday’s sharp pullback, when the S&P 500, Nasdaq, and Russell 2000 all fell more than 1%. The prior session saw pressure in big tech, semis, AI infrastructure, and retail-investor favorites, while defensives and cyclicals such as energy, regional banks, chemicals, and staples held up better. Asian markets were mostly lower overnight, led by weakness in South Korea and Japan, while European equities are modestly higher. Treasuries are firmer with yields down 1–2 bp, the dollar is slightly stronger, gold is lower, bitcoin futures are higher, and WTI crude is modestly firmer.

The bounce is being driven by improved tech and AI sentiment after a strong Micron earnings report, alongside supportive OpenAI funding headlines. This follows an intense round of scrutiny around AI infrastructure, though the prevailing view is that the recent selloff has been more technical than fundamental. The broader bullish framework—expectations for double-digit earnings growth, a still-resilient macro backdrop, a Fed easing bias, and sustained AI capex with rising focus on productivity—remains intact, reinforced by favorable seasonal tailwinds into year-end.

Macro focus today includes initial jobless claims, November CPI, and the December Philly Fed survey. CPI is expected to be noisy due to the absence of October data, with headline inflation seen ticking up to ~3.1% y/y and core CPI holding near 3.0% y/y, though risks skew slightly cooler. Abroad, both the ECB and BoE announce rate decisions, with the BoE widely expected to ease. Friday brings existing home sales and final University of Michigan consumer sentiment and inflation expectations.

Company-specific news

- MU (Micron): Shares jumped after a significant fiscal Q1 beat and strong Q2 guidance; highlights included ~20% blended DRAM ASP growth, HBM sold out through FY26, continued supply tightness into 2026+, and an expanded HBM TAM of ~$100B by 2028.

- OpenAI (private): Reportedly exploring a new capital raise at a valuation around $750B.

- LULU (Lululemon): Higher on reports activist Elliott has built a $1B+ stake and is pushing for former Ralph Lauren CFO/COO Jane Nielsen to become CEO.

- WBD (Warner Bros. Discovery): Renewed M&A speculation after reports a shareholder approached Standard General about acquiring part or all of the company’s television assets.

- CART (Instacart): Under pressure on reports of an FTC investigation related to its Eversight pricing tool.

U.S. equities finished mostly lower (Dow −0.62%, S&P 500 −0.24%, Nasdaq +0.23%, Russell 2000 −0.45%) but recovered from intraday lows, with the S&P 500 posting a third consecutive decline while the Nasdaq outperformed on strength in select mega-cap technology (notably TSLA and META). A heavy slate of macro data failed to provide a clear directional catalyst, reinforcing a “wait-and-see” tone ahead of key upcoming events. November nonfarm payrolls increased by 64K, modestly above consensus, but prior months were revised lower and the unemployment rate rose to 4.6%, reinforcing the narrative of a cooling—but not collapsing—labor market. Retail sales were mixed, with headline growth flat m/m but control-group sales surprising to the upside, offering some reassurance on consumer resilience. December flash PMIs softened to 53.0, the slowest pace since June, pointing to decelerating but still expansionary activity across services and manufacturing.

Rates provided some support as Treasuries rallied across the curve, with yields down 3–4 bp, while the dollar slipped modestly. Commodities were a notable macro drag: WTI crude fell nearly 3% to its lowest level since early 2021 amid optimism around Russia–Ukraine peace negotiations, weighing on energy equities and inflation expectations. Markets are now focused on a dense near-term catalyst set, including Micron earnings, November CPI, an expected Bank of Japan rate hike, and continued speculation around President Trump’s Fed chair selection, all against a backdrop of favorable seasonality but elevated uncertainty around the policy and growth outlook for 2026.

Sector Highlights

Sector performance was mixed. Technology led modestly as mega-cap resilience offset broader growth pressure, while Consumer Discretionary and Communication Services also finished higher. Energy was the clear underperformer following the sharp selloff in crude, and Healthcare lagged on guidance-related weakness in large-cap pharma. Real Estate, Financials, Industrials, Consumer Staples, and Utilities all ended lower, reflecting cautious positioning and a defensive tilt ahead of CPI and central bank developments.

Information Technology

- TSLA, META: Drove relative Nasdaq outperformance on continued optimism around AI, autonomy, and platform scale.

- OKTA: Upgraded to Buy at Jefferies on valuation, improving execution, and secular agentic AI tailwinds.

- CGNX: Upgraded to Buy at Goldman Sachs, citing an inflection in organic growth and margin recovery.

- IONQ: Initiated Buy at Jefferies on accelerating government and enterprise adoption.

- ITW: Downgraded to Sell at Goldman Sachs on expectations for below-peer growth.

- RDNT: Pressured after a short report questioned the sustainability of its AI-related revenue.

Healthcare

- PFE: Shares fell after guiding 2026 EPS roughly 5% below consensus, citing Covid product declines and patent expirations.

- HUM: Lower following insurance leadership changes; FY25 guidance reaffirmed.

- ELAN: Higher on disclosed insider purchases.

- BMY: Benefited from constructive sell-side commentary around its pipeline and longer-term earnings visibility.

Financials

- UBS: Upgraded to Buy at BofA on prospects for more lenient capital requirements and strong wealth and capital markets momentum.

- PYPL: Advanced after applying to become a U.S.-chartered bank to expand small-business lending capabilities.

- WM: Announced a $3B share repurchase authorization and a 14.5% dividend increase.

Consumer Discretionary

- LUV: Upgraded to Overweight at Barclays on improved commercial strategy and fading market-share concerns.

- VITL: Sold off on a negative preannouncement tied to ERP-related order disruptions.

- ULCC: Lower after naming an interim CEO and reiterating Q4 guidance.

Consumer Staples

- EL: Rose after BofA added the stock to its U.S. 1 List, citing improving fundamentals into 2026.

- KHC: Announced Steve Cahillane as incoming CEO, effective January 1.

Communication Services

- CMCSA: Gained on reports of unusual options and swaps activity, fueling speculation of activist involvement.

- NFLX: Highlighted by plans to expand into video podcasts via a partnership with iHeartMedia.

Industrials

- ADM: Downgraded to Underweight at Morgan Stanley on continued weakness in its Crushing segment.

- SEDG: Upgraded to Equal Weight at Morgan Stanley, with analysts arguing fundamentals may be bottoming as residential solar conditions improve.

Energy

- Broad sector weakness as crude prices slid sharply on geopolitical developments, pressuring upstream and services names across the complex.

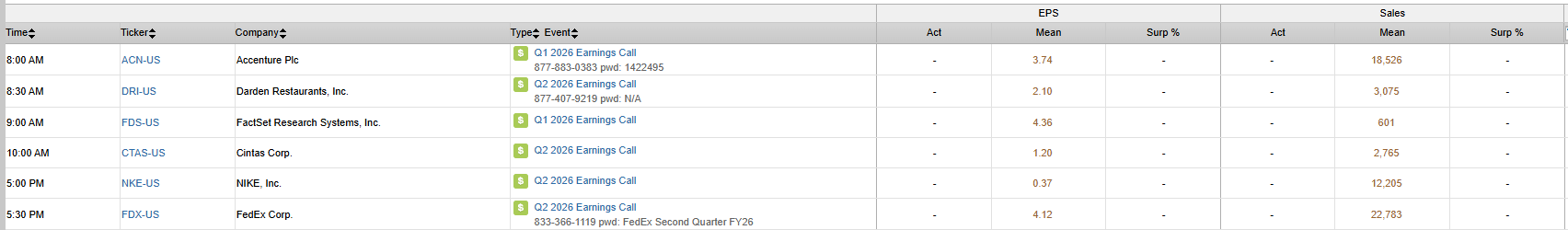

Eco Data Releases | Thursday December 18th, 2025

S&P 500 Constituent Earnings Announcements | Thursday December 18th, 2025

Data sourced from FactSet Research Systems Inc.