December 19, 2025

S&P futures are up 0.3% Friday morning after U.S. equities rallied Thursday, snapping a four-day losing streak. AI, semis, Big Tech, momentum and retail-favorite stocks led the rebound, with some cyclicals also participating, while energy, banks and staples lagged. Asian markets were mostly higher overnight (South Korea, Taiwan and Japan outperforming), while Europe is modestly firmer (~+0.1%). Treasuries are weaker with curve steepening (long-end yields +~3 bp). The dollar is up 0.2%, driven by yen weakness following a less-hawkish-than-feared BoJ rate hike. Gold is down 0.3%, bitcoin futures are up 2.9%, and WTI crude is off 0.3%.

Markets are trying to extend Thursday’s bounce, with AI sentiment improving after Micron’s earnings-driven rally and fresh OpenAI funding headlines. Risk appetite is also supported by strength in crypto and expectations that today’s options expiration could clear one of the final technical overhangs of 2025, shifting focus to favorable year-end seasonality. Offsetting positives, earnings and guidance updates remain mixed, keeping dispersion elevated.

Company news

- NVDA – U.S. government reportedly launched a formal review that could allow initial shipments of H200 chips to China, reinforcing easing export expectations.

- OpenAI – Reportedly exploring a capital raise of up to $100B, implying a valuation as high as $830B.

- META – Developing new AI models, including an image/video-focused model (“Mango”) and a new text model (“Avocado”), expected in 2026.

- ORCL – Along with OpenAI, received regulatory approval to power a new Michigan data center; also in headlines tied to TikTok’s U.S. divestiture process.

- NKE – Shares pressured after better fiscal Q2 results were overshadowed by softer Q3 guidance, attributed to China headwinds and continued Classics rationalization.

- FDX – Fiscal Q2 beat and modest guidance raise; Street constructive on Express (FEC) tailwinds, but freight softness and 2H cost pressures capped upside.

- KBH – Latest homebuilder to disappoint on guidance, adding to concerns around 2026 housing estimates.

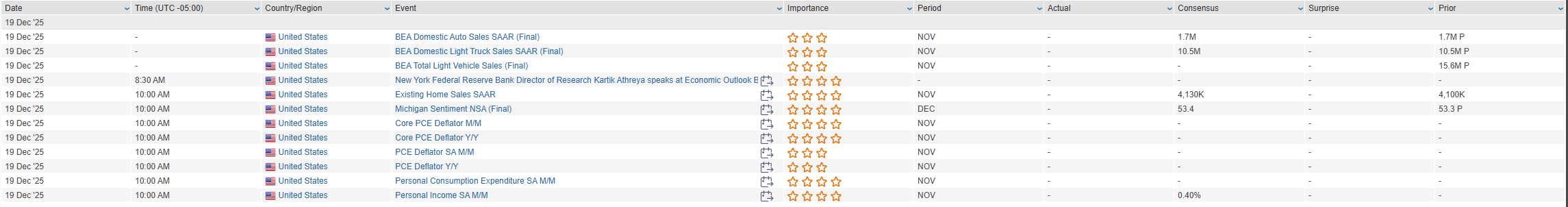

Macro calendar

- Today: November existing home sales and final December University of Michigan sentiment/inflation expectations.

- Next week: Holiday-shortened with limited data; Treasury auctions $69B 2-year, $70B 5-year, and $44B 7-year notes early in the week.

U.S. equities rebounded after Wednesday’s selloff (Dow +0.14%, S&P 500 +0.79%, Nasdaq +1.38%, Russell 2000 +0.62%), led by Big Tech, semis, and AI-linked names, though indices faded from intraday highs and remain on track for weekly declines. The macro backdrop was supportive as disinflation regained traction: November core CPI printed at 2.6% y/y, the coolest reading since March 2021 and well below expectations, reinforcing the dovish Fed narrative despite lingering caveats from missing October data. Treasuries rallied (yields down 2–4 bp), while the dollar edged higher. Market pricing for 2026 rate cuts was little changed (~59 bp), suggesting the CPI upside surprise helped sentiment more than expectations.

Globally, central banks were active: the BoE delivered a hawkish cut, while the ECB held rates at 2% and upgraded growth forecasts. Other data were mixed—initial claims were in line, continuing claims slightly higher, and the Philly Fed surprised to the downside—pointing to uneven growth but not derailing the broader risk rebound. AI sentiment improved materially on Micron’s results and renewed OpenAI funding headlines, following a period of heightened scrutiny around AI infrastructure, capex, and profitability. Favorable seasonality into year-end remains a supportive technical.

Sector Highlights

Cyclically sensitive growth sectors led the rebound. Consumer Discretionary, Communication Services, and Information Technology outperformed on the tech/AI bounce and strength in retail and internet names. Utilities also posted gains amid the rate rally. Energy lagged despite a modest uptick in crude, while Consumer Staples, Real Estate, Financials, Materials, and Healthcare trailed the broader market, reflecting rotation back toward growth and higher-beta exposures.

Information Technology

- Micron (MU): Surged on a major fiscal Q1 beat and strong Q2 guide; highlighted AI-driven memory supercycle with ~20% DRAM ASP increases, HBM sold out through FY26, ongoing supply tightness into 2026+, and raised HBM TAM to ~$100B by 2028.

- Accenture (ACN): Fiscal Q1 beat on revenue; operating margin light and FY26 guide unchanged, though AI bookings momentum remained a positive.

- Core Scientific (CORZ): Upgraded at Citizens after failed CoreWeave deal refocused strategy; seen as undervalued HPC datacenter play.

Communication Services

- Trump Media & Technology (DJT): Jumped after announcing an all-stock merger with fusion power company TAE Technologies, valuing the deal at over $6B.

- Warner Bros. Discovery (WBD): Renewed M&A chatter as a shareholder reportedly pitched a sale of some or all cable assets; market skepticism persists around a bidding war.

- Warner Music Group (WMG): Upgraded at Morgan Stanley on higher expected streamer payments and relative underperformance.

Consumer Discretionary

- Lululemon (LULU): Higher on reports activist Elliott built a $1B+ stake and is pushing for leadership change; company also disclosed plans to enter six new international markets in 2026.

- Darden Restaurants (DRI): Supported by better comps and a raised revenue outlook as value offerings drove traffic.

- Birkenstock (BIRK): Fell after FY26 guidance came in below expectations due to FX and tariff headwinds despite solid Q4 results.

- CarMax (KMX): Flagged pricing and marketing actions as near-term profitability headwinds.

- Shake Shack (SHAK): Upgraded at JPMorgan on valuation and constructive management dialogue.

- Etsy (ETSY): Increased buyback authorization by $750M to ~$1B, citing valuation appeal.

Industrials

- GE Vernova (GEV): Upgraded at Jefferies on valuation and improved confidence in earnings durability across power and electrification.

- Cintas (CTAS): Strong fiscal Q2 beat across revenue and margins; raised FY26 EPS and revenue guidance.

- Enerpac Tool Group (EPAC): Missed earnings and revenue; UK softness weighed, though FY26 guidance reaffirmed.

- United Airlines (UAL): Initiated overweight at Wells Fargo on improving industry dynamics and premium/loyalty upside.

Energy

- BP: Announced CEO transition; stock lagged amid broader sector underperformance.

- Woodside Energy (WDS): Declined after CEO Meg O’Neill announced plans to depart to lead BP.

Healthcare

- Insmed (INSM): Sharply lower after Phase IIb study of brensocatib failed to meet endpoints.

- Cytokinetics (CYTK): Upgraded at Goldman Sachs ahead of anticipated aficamten trial data.

Financials

- Howard Hughes Holdings (HHH): Announced ~$2.1B acquisition of Vantage Group Holdings, expanding into specialty insurance/reinsurance.

Consumer Staples

- Instacart (CART): To pay $60M in consumer refunds to settle an FTC lawsuit over alleged deceptive pricing practices.

Utilities

- Sector benefited broadly from the Treasury rally and lower yields.

Eco Data Releases | Friday December 19th, 2025

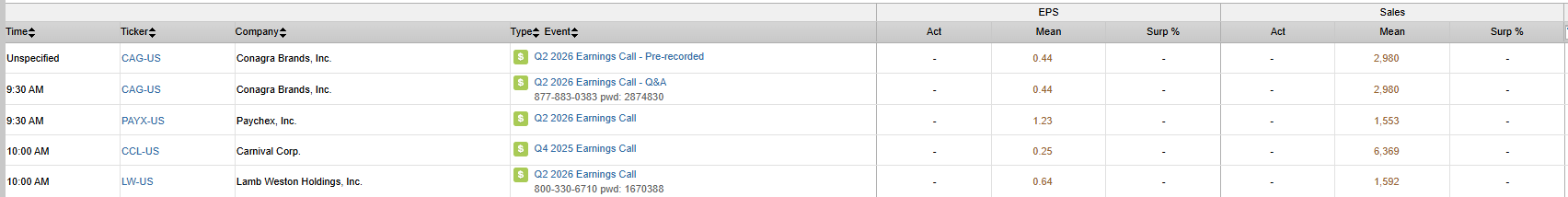

S&P 500 Constituent Earnings Announcements | Friday December 19th, 2025

Data sourced from FactSet Research Systems Inc.