December 29, 2025

S&P futures are down 0.2% in thin Monday morning trade after a strong prior week that saw the S&P 500, Dow, and Nasdaq each gain more than 1%. Asian markets were mostly lower on light volumes, though South Korea rallied over 2%, closing just shy of record highs. European markets are narrowly mixed. Treasuries are firmer with yields down 1–2 bp and a modest curve steepening. The dollar is little changed. Precious metals are pulling back sharply, with gold down 1.8% and silver off 3.3% after briefly hitting a record near $84/oz. Bitcoin is flat, while WTI crude is up 2.3% amid fading expectations for a near-term Ukraine peace deal.

With 2025 winding down, market action remains subdued and headline-driven. Geopolitics is the main focus, as the U.S. and Ukraine cited progress in recent Trump–Zelensky discussions but acknowledged a deal may still be weeks away, with territorial concessions the key hurdle. Iran’s president warned the country is engaged in an “all-out war” with the U.S., Europe, and Israel, ahead of a Trump–Netanyahu meeting at Mar-a-Lago. China also announced new military exercises around Taiwan, adding to geopolitical noise.

Broader themes circulating in recent headlines include Santa Claus rally dynamics, the recent metals surge (especially silver), signs of labor market softening via weak hiring, AI skepticism showing up in credit markets, a divided Fed, a pickup in global M&A, reports of roughly $1T in outflows from actively managed funds, potential Western sanctions on Turkish oil terminals, and continued deterioration in China’s industrial profits.

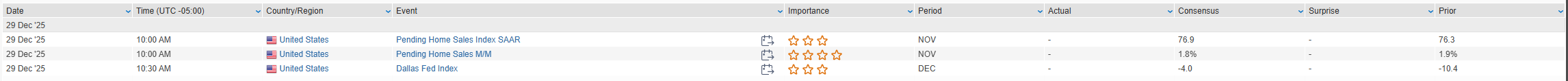

On the U.S. data calendar, today brings November pending home sales and the December Dallas Fed manufacturing survey. Tuesday features October home price indexes (FHFA, Case-Shiller), December Chicago PMI, and the December FOMC minutes (key event of the shortened week). Initial jobless claims are released early on Wednesday. Markets are closed Thursday for New Year’s Day, with final December manufacturing PMI due Friday.

U.S. equities drifted slightly lower on Friday (Dow −0.04% | S&P 500 −0.03% | Nasdaq −0.09% | Russell 2000 −0.54%) to close out the shortened holiday week, with major indexes oscillating narrowly around flat throughout the session. Despite the modest Friday dip, the Dow, S&P 500, and Nasdaq all posted solid weekly gains, leaving the S&P near record highs as the market heads into the final trading days of 2025.

The broader narrative remains unchanged. Equities continue to be supported by a solid macro backdrop, resilient consumer spending, robust corporate earnings, expectations for at least one Fed rate cut in coming months, and favorable year-end seasonality. Offsetting forces include strong recent economic data (notably Q3 GDP) raising the bar for additional Fed easing, persistent scrutiny of AI growth and infrastructure economics, and an unsettled geopolitical environment.

Asset markets were mixed. Treasuries steepened modestly, with long-end yields up ~2 bp. The dollar was little changed. Gold rose another 1.1% to fresh record highs, while silver (+7.7%) and copper (+4.7%) surged, reflecting strong metals momentum. Bitcoin futures gained 0.4%. WTI crude fell 2.8% on the day but still logged a weekly gain.

There was no U.S. economic data, Fedspeak, or major earnings. Internationally, BoJ Governor Ueda reiterated that rate hikes are likely to continue if growth and inflation evolve as expected, and Japan’s 2026 budget is projected to return to surplus for the first time since 1998. Geopolitically, the U.S. reported strikes against ISIS targets in Nigeria, while China announced largely symbolic sanctions on 20 U.S. defense firms tied to Taiwan arms sales.

Sector Highlights

Outperformance was led by Materials (+0.59%), aided by strength in industrial metals, followed by Technology (+0.21%), Real Estate (+0.13%), and Healthcare (+0.13%).

Underperformers included Consumer Discretionary (−0.44%), Energy (−0.28%), Financials (−0.22%), Communication Services (−0.21%), and Industrials (−0.20%), reflecting pressure on cyclicals, energy, and select growth pockets amid thin liquidity.

Information Technology

- NVIDIA (NVDA) rose after reports it is acquiring AI chip startup Groq’s assets for roughly $20B, though Groq characterized the arrangement as a non-exclusive licensing agreement.

- Snowflake (SNOW) was reported to be in talks to acquire application-monitoring firm Observe for approximately $1B.

Communication Services

- Warner Bros. Discovery (WBD) slipped after reports it is open to discussions if Paramount Skydance raises its $30/share hostile bid, signaling continued deal uncertainty.

Consumer Discretionary

- Target (TGT) gained after the Financial Times reported the retailer is under activist pressure from Toms Capital Investment Management, though the stake size was not disclosed.

- Coupang (CPNG) advanced after stating that all leaked customer data from a recent breach has been recovered and deleted, with only ~3,000 accounts ultimately affected.

Energy

- Energy equities lagged as WTI crude fell 2.8% on the day, despite remaining higher on the week.

Industrials / Defense

- No major company-specific developments, though China’s sanctions on U.S. defense firms remained in focus at a headline level.

Eco Data Releases | Monday December 29th, 2025

S&P 500 Constituent Earnings Announcements | Monday December 29th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.