December 30, 2025

S&P futures are little changed Tuesday morning following Monday’s pullback, with U.S. equities finishing off worst levels. Precious and industrial metals equities were the primary laggards, while TSLA and NVIDIA weighed on the Mag 7. Energy, REITs, Utilities, and Consumer Staples finished higher. Asian markets were mixed in quiet overnight trading, while European equities are up 0.4%.

Treasuries are modestly weaker with yields up 1 bp. The dollar index is little changed. Gold is rebounding (+1%) after losing more than 4% Monday, while silver is up over 5% following a 9% decline. Bitcoin futures are up 0.8%. WTI crude is higher by 0.6%.

Markets remain largely devoid of catalysts as 2025 winds down. Key themes in focus include renewed Trump commentary on Fed leadership, elevated geopolitical uncertainty, depressed bond-market volatility, U.S. equity underperformance versus international peers, resilient U.S. economic growth in 2025, and expectations that OPEC will maintain its planned production pause at this weekend’s meeting.

Economic Calendar

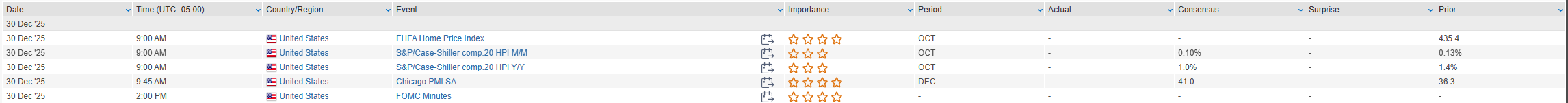

- Tuesday: FHFA and S&P Case-Shiller home price indexes (Oct), Chicago PMI (Dec), December FOMC minutes

- Wednesday: Initial jobless claims (released a day early)

- Thursday: Markets closed for New Year’s holiday

- Friday: Final manufacturing PMI (Dec)

At its December meeting, the Fed cut rates by 25 bp, tweaked forward guidance, maintained a median projection for one rate cut in 2026, and announced $40B per month in Treasury bill purchases.

Company Headlines

- Meta Platforms: Announced acquisition of Manus, a Singapore-based AI company focused on autonomous general-purpose agents; reports value the deal at over $2B, with Manus generating an estimated $125M annual revenue run rate.

- Microsoft: FT reported CEO Satya Nadella reshuffled senior leadership to broaden and deepen the company’s AI strategy.

- NVIDIA: Continues to face increased investor scrutiny despite AI remaining a structural tailwind; competitive pressures, component shortages, power constraints, and AI customer financing uncertainty remain key discussion points heading into 2026.

- Samsung Electronics: Reuters reported the U.S. approved annual licenses allowing the company to import chipmaking equipment into its China facilities in 2026.

- SK Hynix: Also received U.S. approval to bring semiconductor manufacturing equipment into China under annual licenses beginning in 2026.

U.S. equities closed lower Monday, Dow (-0.51%) | S&P 500 (-0.35%) | Nasdaq (-0.50%) | Russell 2000 (-0.57%), though indices finished off worst levels as liquidity thinned and positioning remained cautious. There were no major developments across core macro themes, but discussion centered on renewed weakness in metals, continued defensive rotation, and elevated geopolitical uncertainty. Recent optimism around favorable seasonal dynamics faded as investors continued to de-risk into the final sessions of 2025.

Treasuries firmed modestly, with yields down ~2 bp across the curve, reinforcing a softer global rate backdrop. U.S. bond-market volatility is on pace for its steepest annual decline since the financial crisis, underscoring the absence of systemic stress. The dollar index was little changed. Commodity markets were volatile: gold fell 4.6% and silver dropped 8.7%—its worst day since April—after the CME raised margin requirements following silver’s surge to a record ~$83/oz earlier in the session. WTI crude settled up 2.4% as prospects for a near-term Ukraine peace deal remained elusive. Bitcoin futures edged down 0.4%.

Economic Data & Calendar

Economic data was mixed. November pending home sales rose 3.3% m/m, beating consensus expectations (+1.8%) and October’s 1.9% gain, signaling tentative stabilization in housing activity. In contrast, the Dallas Fed manufacturing index for December printed at -10.9, weaker than forecasts (-4.0) and November (-10.4), reinforcing evidence of continued softness in regional manufacturing.

Tuesday’s calendar includes the FHFA and S&P Case-Shiller home price indexes for October, the Chicago PMI for December, and the release of the December FOMC minutes. Initial jobless claims will be released a day early on Wednesday ahead of the New Year’s holiday closure on Thursday. Friday’s final manufacturing PMI is the only data point to close out the week. Early-2026 catalysts remain centered on the Fed chair nomination, a Supreme Court tariff ruling, new LLM launches, and the upcoming government funding deadline.

Sector Highlights

Sector performance reflected a defensive tone. Energy led the market as crude prices strengthened, while Real Estate, Utilities, Consumer Staples, and Health Care outperformed amid lower yields and reduced risk appetite. Communication Services and Industrials showed modest relative strength. On the downside, Materials lagged sharply following the collapse in precious metals, while Consumer Discretionary, Financials, and Information Technology underperformed as investors trimmed exposure to higher-beta, cyclical, and semiconductors-linked areas.

Company & Industry Developments (GICS)

Energy

- Energy Fuels (UUUU) +2.9%: Reported 2025 uranium production of over 1.6M lbs, exceeding the top end of prior guidance by ~11%; expects to sell ~360K lbs of U₃O₈ in 4Q25, up ~50% Q/Q.

Materials

- Precious- and industrial-metals equities broadly weaker following CME margin hikes and sharp pullbacks in gold and silver prices.

Industrials

- Airlines, construction & engineering, and travel-related stocks lagged amid cyclical concerns and weak regional manufacturing data.

- Railroads outperformed within the sector.

Financials

- Banks and credit card issuers underperformed as lower yields weighed on rate-sensitive financials.

- P&C insurers showed relative resilience.

Information Technology

- Semiconductors were among the weakest tech sub-groups.

- NVIDIA lagged alongside TSLA among Mag-7 decliners.

- NVIDIA disclosed a $5B equity stake in Intel under a previously announced strategic agreement.

Communication Services

- Media stocks outperformed modestly as investors favored stable cash-flow profiles.

Consumer Discretionary

- Broad weakness across homebuilders, restaurants, travel, and leisure.

- Lululemon moved lower after founder Chip Wilson announced plans to launch a proxy fight aimed at reshaping the company’s board.

Consumer Staples

- Staples outperformed on a relative basis, led by beverages, as defensive positioning continued.

Health Care

- Ultragenyx Pharmaceutical (RARE) -42.3%: Phase 3 results for setrusumab failed to meet the primary endpoint in osteogenesis imperfecta; company announced plans for significant expense reductions.

- Praxis Precision Medicines (PRAX) +13.3%: FDA granted Breakthrough Therapy Designation for ulixacaltamide HCl in essential tremor.

- Novo Nordisk (NVO) -1.8%: Reportedly cutting Wegovy list prices by roughly 50% in select Chinese provinces.

- Palisade Bio (PALI) +15.4%: Initiated at overweight at Piper Sandler, citing valuation upside and progress on its oral PDE4 inhibitor.

Real Estate

- DigitalBridge Group +9.6%: SoftBank confirmed plans to acquire the company for $4B, or $16/share in cash, representing a ~15% premium to the prior close.

Utilities

- Utilities attracted steady defensive inflows amid falling yields and geopolitical uncertainty.

Eco Data Releases | Tuesday December 30th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday December 30th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.