December 31, 2025

S&P futures are down ~0.2% in very quiet final-session trading after U.S. equities fell for a third straight day on Tuesday. Asian markets were mixed with several exchanges closed for holidays, while Europe is modestly lower (~0.2%). Treasuries are firmer with long-end yields down 2 bp. The dollar is up 0.1%. Precious metals are under pressure (gold −1.1%, silver −8%+) following another CME margin hike. Bitcoin futures are up 1%, and WTI crude is slightly higher (+0.2%).

With the last trading day of 2025, there are no meaningful directional catalysts. Focus areas include continued volatility in precious metals, reports of strong Chinese demand for Nvidia H200 chips (pending formal approval), signs of expansion in China’s manufacturing sector for the first time since March, elevated compensation at OpenAI, and progress on China’s U.S. soybean purchase commitments.

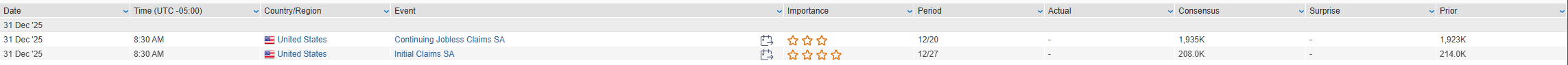

Data & Calendar: Initial jobless claims are the lone U.S. release today. Markets are closed Thursday for New Year’s Day; final December manufacturing PMI is due Friday. Next week brings ISM manufacturing (Mon), ADP/ISM services/JOLTS/factory orders (Wed), claims and productivity (Thu), and the January employment report with housing data and preliminary UoM sentiment (Fri).

Corporate: News flow is sparse. Reuters reports Nvidia asked TSMC to boost H200 output as Chinese orders for 2026 reportedly exceed 2M units. Michael Burry said he is not short Tesla despite calling the stock “overvalued.” Hyatt guided 2025 EBITDA to the low end of its range due to hurricane-related damage in Jamaica.

U.S. equities drifted lower Tuesday (Dow −0.20% | S&P 500 −0.14% | Nasdaq −0.24% | Russell 2000 −0.76%), with major indexes finishing near the lows after trading in a tight range for most of the day. Risk appetite faded modestly, with small caps, high-beta, momentum, and most-shorted stocks underperforming, while defensives and select commodity-linked areas held up better. There was little evidence of a seasonal tailwind as markets prepare to close out 2025, echoing the muted late-December patterns of the prior two years.

Macro developments offered no decisive catalyst. December FOMC minutes reinforced a cautious and divided Fed, with most policymakers still anticipating rate cuts in 2026 if disinflation continues, but without urgency. The committee maintained its median projection for one cut next year and continued $40B/month in Treasury bill purchases. Treasury yields were narrowly mixed with mild curve steepening, while the dollar firmed modestly.

Economic data were mixed. October Case-Shiller and FHFA home prices exceeded expectations, while December Chicago PMI improved but remained in contraction. Precious metals rebounded sharply after Monday’s selloff, reflecting continued hedging demand amid elevated geopolitical uncertainty, which again failed to materially move markets.

Sector Highlights

Sector leadership skewed defensive and commodity-linked. Energy led the S&P 500, followed by Communication Services, Utilities, Real Estate, and Materials, supported by resilience in cash-flow-oriented and inflation-hedge exposures. Healthcare also held up relatively well. On the downside, Consumer Discretionary, Financials, Industrials, Technology, and Consumer Staples lagged, reflecting pressure on cyclicals, rate-sensitive financials, and higher-beta growth segments as year-end de-risking continued.

Information Technology

- META rose after announcing the acquisition of Manus, a Singapore-based autonomous AI-agent developer, for more than $2B.

- NVDA was reported to be in advanced talks to acquire AI21 Labs for approximately $2–3B, highlighting continued consolidation across the AI ecosystem.

- MSFT reshuffled senior leadership to broaden and decentralize its AI strategy.

Communication Services

- WBD underperformed after reports indicated the company plans to formally reject Paramount Skydance’s hostile bid this week.

- Media and telecom names modestly outperformed amid defensive rotation and deal-related speculation.

Consumer Discretionary

- WMT experienced temporary outages across its mobile app and website, affecting thousands of customers.

- ETSY fell following a price-target cut tied to valuation caution and uncertainty around marketing initiatives and leadership transition.

- UAA jumped after Fairfax-affiliated investors disclosed significant share purchases.

Financials

- Banks, investment banks, asset managers, and credit-card issuers broadly lagged, reflecting ongoing pressure on cyclically sensitive financial exposures.

Energy

- Energy stocks outperformed despite crude prices finishing slightly lower, supported by ongoing geopolitical risk and renewed interest following recent volatility.

- TE (T1 Energy) rose after confirming continued eligibility for Section 45X tax credits and completing a $160M sale of production tax credits.

Healthcare

- Managed care names outperformed in a defensive bid, while biotech stocks lagged alongside broader risk-off positioning.

- CALM declined following a price-target cut linked to normalization expectations.

Industrials

- Rails, machinery, and engineering & construction stocks underperformed as cyclical exposure was reduced into year-end.

Materials

- Commodity chemicals and precious-metals miners outperformed as gold and silver staged sharp rebounds.

Utilities

- Utilities posted modest gains, benefiting from defensive positioning and stable cash-flow characteristics.

Real Estate

- REITs edged higher, supported by defensive demand, though gains remained constrained by interest-rate uncertainty.

Eco Data Releases | Wednesday December 31st, 2025

S&P 500 Constituent Earnings Announcements | Wednesday December 31st, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.