January 7, 2026

S&P futures −0.2% in Tuesday morning trading after U.S. equities finished higher on Tuesday. Prior session leadership was firmly pro-cyclical, with memory, semiconductors, machinery, metals, chemicals, regional banks, health care, and consumer discretionary leading, while crowded short baskets were notable outperformers. Mag 7 stocks were mixed and lagged, and energy came under pressure.

Overnight, Asian markets weakened, led lower by Japan and Hong Kong, while European equities slipped ~0.2%. Treasuries were firmer, with yields down 2–3 bp at the long end. The dollar index was little changed. Gold fell 0.6%, silver dropped 2.4%, Bitcoin futures slid 1.7%, and WTI crude declined 0.9%.

Headline flow was very light. The most notable development was President Trump’s comment that Venezuela could supply 30–50 million barrels of oil to the U.S., pressuring crude prices. The market reaction appeared muted by the view that any barrels would likely come from pre-blockade production currently in storage, limiting near-term supply implications. More broadly, markets appear to be pausing after sharp recent gains in metals, crypto, and Asian equities.

While pro-cyclical rotation and Mag 7 dispersion remain dominant themes, investor attention is increasingly shifting toward near-term catalysts, including Friday’s employment report, the Fed chair selection, Supreme Court rulings related to IEEPA and Fed governance, and the start of Q4 earnings season.

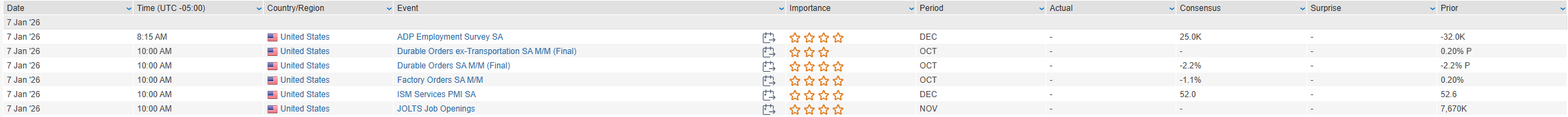

On the data front, ADP private payrolls, ISM services, JOLTS job openings, and factory orders headline Wednesday’s calendar. Consensus looks for December NFP of ~+55K (vs. +64K prior) and the unemployment rate ticking down to 4.5% from 4.6%.

Corporate Headlines

- Alphabet (GOOGL) — Financial press highlighted renewed optimism around the company’s AI strategy and competitive positioning.

- Meta Platforms (META) — China reportedly reviewing its $2B acquisition of AI startup Manus for potential violations of technology export controls.

- Samsung Electronics — Warned that memory prices are trending higher, supporting the broader memory and storage trade.

- Chevron (CVX) — Reportedly working with Quantum Energy Partners on a joint bid for Lukoil’s international assets, valued at ~$22B.

- Baidu (BIDU) — AI chip unit Kunlunxin reportedly selected banks for a Hong Kong IPO that could raise up to $2B.

- Mobileye Global (MBLY) — Shares boosted after confirming a $900M cash-and-stock acquisition of Mentee Robotics.

- Embraer (EMBJ) — Announced record Q4 deliveries, supporting momentum in aerospace.

- Airbus (AIR) — Reported fiscal Q2 results ahead of expectations and raised FY26 organic revenue growth guidance.

U.S. equities extended their early-year advance on Tuesday (Dow +0.99% | S&P 500 +0.62% | Nasdaq +0.65% | Russell 2000 +1.37%), finishing near session highs. The Dow Jones Industrial Average set a new all-time high, while the S&P 500 logged its first record close since December 24, reflecting continued follow-through from Monday’s pro-cyclical rotation. Market breadth was strong, with leadership in industrials, materials, healthcare, consumer discretionary, and select technology, while defensives and energy lagged.

The session reinforced a rotation away from mega-cap growth and toward cyclical and value-sensitive areas, supported by expectations for broadening earnings growth in 2026, ongoing discussion of OBBBA-related fiscal impulse, and tariff lapping/relief dynamics. Strength in memory, storage, and semiconductor equipment stood out following commentary tied to AI demand, while metals continued to benefit from a mix of technical momentum, fiscal expectations, and geopolitical uncertainty.

In rates, Treasuries weakened modestly, with yields up ~1 bp across the curve. The dollar index rose 0.3%. Precious metals surged, with gold up 1.0% and silver jumping 5.7% to a fresh record above $80/oz, while copper also rallied sharply. Bitcoin futures fell 1.9% after Monday’s gains. WTI crude dropped 2.0%, weighing on the energy sector.

On the macro data front, final December S&P Global Services PMI came in slightly below consensus and the preliminary reading; employment dipped marginally while prices accelerated sharply. Fed commentary was mixed: Governor Miran argued policy remains restrictive and suggested 100 bp+ of cuts may be needed this year, while Richmond Fed President Barkin said policy is near neutral but emphasized risks on both the inflation and labor sides of the mandate. Attention now turns to a busy remainder of the week, culminating with December payrolls on Friday.

Sector Highlights

Materials (+2.04%) and Health Care (+1.96%) led the market, followed by Industrials (+1.38%), Consumer Discretionary (+0.94%), and Technology (+0.66%), reflecting continued cyclical leadership and AI-adjacent strength. Energy (−2.81%) was the clear laggard alongside Communication Services, while Financials, Utilities, and Real Estate posted more modest gains. Overall, sector action reinforced the theme of broadening participation beneath the index level as 2026 begins.

Information Technology

- NVIDIA (NVDA) — Said Vera Rubin is now in full production and on track to ship in 2H; H200 demand from China remains strong. Shares were little changed, though commentary drove sharp moves across AI-linked suppliers.

- SanDisk (SNDK) +27.6% — Rallied after NVDA CEO highlighted rising memory and storage requirements tied to AI workloads; Western Digital (WDC) and Seagate Technology (STX) also surged.

- Microchip Technology (MCHP) +11.7% — Raised December-quarter guidance for the second time in a month, citing broad-based recovery and improving bookings.

- Veeva Systems (VEEV) — Announced a $2B share repurchase authorization.

- OneStream (OS) +28.4% — Agreed to be taken private by Hg for ~$6.4B in cash.

- Trane Technologies (TT) −2.5% — Fell alongside other data-center cooling names after NVDA commentary suggested higher temperature tolerance in next-gen chips.

Industrials

- Lockheed Martin (LMT) +2.0% — Signed a framework agreement with the U.S. government to accelerate production and delivery of PAC-3 MSE interceptors.

- Vistra (VST) +4.1% — Rose after agreeing to acquire Cogentrix Energy’s portfolio of 10 natural-gas plants (~5.5 GW).

- Ingersoll Rand (IR) — Announced acquisition of Scinomix, expanding automation workflow capabilities.

- Trinity Industries (TRN) +9.8% — Completed restructuring of its railcar partnership and raised FY25 EPS guidance.

Health Care

- Arrowhead Pharmaceuticals (ARWR) +10.9% — Reported encouraging early-stage obesity trial data, including meaningful reductions in visceral and liver fat.

- UnitedHealth Group (UNH) +2.0% — Initiated at outperform at Evercore, citing confidence in turnaround execution.

- Certara (CERT) +5.9% — Upgraded at Leerink on expectations for contract expansion.

Consumer Discretionary

- Amazon (AMZN) — Among the stronger Mag 7 performers on the day.

- Tesla (TSLA) −4.1% — Lagged after CES commentary from NVDA raised concerns around increasing competition in autonomous driving.

- Brinker International (EAT) +4.3% — Upgraded at UBS on sustained comp momentum and execution.

- D.R. Horton (DHI) −1.4% — Downgraded at Wells Fargo amid concerns around inventories and margin pressure.

Financials

- American International Group (AIG) −7.5% — Shares fell after announcing CEO Peter Zaffino will transition to Executive Chair by mid-2026.

- Regional banks, exchanges, and asset managers generally outperformed as the pro-cyclical rotation extended.

Energy

- Integrated oil companies and E&Ps underperformed as WTI crude fell 2.0%, reversing part of the recent Venezuela-driven rally.

Eco Data Releases | Wednesday January 7th, 2026

S&P 500 Constituent Earnings Announcements | Wednesday January 7th, 2026

No constituents report today

Data sourced from FactSet Research Systems Inc.