January 8, 2026

S&P futures −0.25% in Thursday morning trading following a mostly lower close Wednesday, with stocks ending near session lows. Pro-cyclical leaders that had recently outperformed—financials, semis, and industrials—came under pressure, while Mag 7 stocks held up better.

Overnight, Asian markets were mostly lower, led by Japan (−1.5%+), while European equities fell ~0.3%. Treasuries weakened modestly, with yields up 1–2 bp. The dollar index rose 0.1%. Gold fell 0.5%, silver dropped 2.7%, Bitcoin futures slipped 1%, and WTI crude rose 1%.

Markets remain in wait-and-see mode ahead of several high-profile catalysts, including Friday’s December jobs report, an expected Supreme Court ruling on IEEPA tariffs, the Fed chair selection (and SCOTUS hearing related to Fed’s Cook), and the start of Q4 earnings season next week (banks, ICR). Investor attention has also centered on the market impact of recent Trump social-media posts, particularly around defense spending and housing, as well as elevated geopolitical uncertainty spanning Venezuela, Greenland, Ukraine/Russia, and Japan/China. Recent themes of pro-cyclical rotation fatigue and Mag 7/AI dispersion remain in focus.

On the data front, Q3 nonfarm productivity and unit labor costs, initial claims, and the October trade balance are due today. Friday brings NFP (consensus +55K, UR seen slipping to 4.5%), along with UoM sentiment and housing starts. Markets also expect a SCOTUS decision on IEEPA tariffs as soon as Friday, with odds skewed toward the tariffs being struck down, though the White House has flagged alternative authorities.

Company News

- NVIDIA (NVDA) — Bloomberg reported China may approve imports of H200 chips as early as Q1, a potential positive for AI demand.

- Defense: RTX (RTX), Northrop Grumman (NOC), General Dynamics (GD), L3Harris Technologies (LHX) — All bounced on Trump’s push for a $500B increase in Pentagon spending, targeting a $1.5T budget.

- Samsung Electronics — Preliminary results beat expectations, though shares lagged amid already high expectations tied to memory strength.

- Exxon Mobil (XOM) — Earnings chatter pointed to weaker upstream results offset by stronger Energy Products margins.

- Costco Wholesale (COST) — Reported December U.S. comps +6.3%, above expectations.

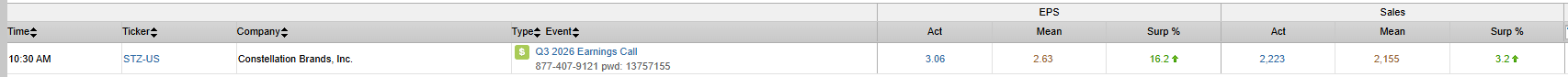

- Constellation Brands (STZ) — Beer depletions better than feared; FY26 guidance reiterated.

- Jefferies Financial Group (JEF) — Shares lagged post-earnings; DCM and fixed-income trading light, non-comp expenses a drag.

- Globus Medical (GMED) — Pre-announced better-than-expected Q4 revenue and issued initial 2026 guidance above consensus.

- Eli Lilly (LLY) — Confirmed acquisition of Ventyx Biosciences (VTYX) for $1.2B cash.

- AbbVie (ABBV) — Said it is not in talks to acquire Revolution Medicines (RVMD).

- Canadian Solar (CSIQ) — Pressured by announcement of a $200M convertible offering.

- Angi (ANGI) — Announced a global workforce reduction.

U.S. equities finished lower Wednesday (Dow −0.94% | S&P 500 −0.34% | Nasdaq +0.16% | Russell 2000 −0.29%), marking a pause after the recent pro-cyclical rotation. Losses were broad across economically sensitive areas—banks, industrials, energy, semiconductors, transports, machinery, and housing-linked groups—while defensives were mixed and mega-cap tech helped cushion the cap-weighted S&P 500. GOOGL was the standout among the Mag 7, contributing to Nasdaq’s modest outperformance.

Geopolitics dominated headlines again, centered on Venezuela, with markets largely limiting the impact to energy pricing (weaker crude, relative strength in refiners). A busier data slate did little to shift Fed expectations: ISM Services surprised to the upside, ADP payrolls came in softer, and JOLTS openings fell sharply, reinforcing mixed late-cycle signals. Recent winners—banks, semis, metals, and Asian equities—took a breather.

Rates were supportive at the long end: Treasuries were mixed with curve flattening, as long-end yields fell ~3–4 bp. The dollar index rose 0.1%. Gold (−0.8%) and silver (−4.2%) pulled back after recent strength. Bitcoin futures fell 1.9%. WTI crude dropped 2.0% amid evolving Venezuela developments.

Looking ahead, markets are focused on Friday’s employment report, alongside the Fed chair decision, SCOTUS rulings tied to IEEPA and Fed governance, and the start of Q4 earnings.

Economic Data

- ADP (Dec): +41K vs. 47K consensus (Nov revised −32K); wage growth steady for job-stayers (4.4%), higher for job-changers (6.6%).

- JOLTS (Nov): 7.146M openings, well below ~7.7M expectations; Oct revised lower.

- ISM Services (Dec): 54.4 vs. 52.0 consensus; highest since Oct ’24 with stronger new orders and employment.

Sector Highlights

Health Care (+1.01%) was the clear leader, benefiting from M&A speculation and a defensive bid. Communication Services (+0.79%) also outperformed, supported by strength in select mega-cap names. Technology was roughly flat but outperformed the broader tape on cap-weighting effects. On the downside, Utilities (−2.46%), Industrials (−1.90%), Materials (−1.63%), Financials (−1.43%), Real Estate (−1.37%), Energy (−1.19%), and Consumer Staples (−1.02%) lagged, reflecting a pause in the pro-cyclical rotation and renewed sensitivity to policy and geopolitical uncertainty.

Health Care

- Ventyx Biosciences (VTYX) +36.6% — Bloomberg reported talks to be acquired by Eli Lilly for ~$1B.

- Regeneron Pharmaceuticals (REGN) +4.6% — Upgraded to Buy at BofA; PT raised to $860 on improving Eylea HD outlook and Dupixent upside.

- AbbVie (ABBV) +4.2% — Reported to be in advanced talks to acquire Revolution Medicines (RVMD) (later denied).

- UnitedHealth Group (UNH) — Modestly higher amid defensive rotation within healthcare.

Communication Services

- Alphabet (GOOGL) — Relative outperformer; upbeat financial-press commentary highlighted progress in AI execution.

- GameStop (GME) +3.1% — Granted CEO Ryan Cohen performance-based options tied to profitability and market-cap targets.

- Warner Bros. Discovery (WBD) — Rejected a hostile bid from Paramount, as expected.

Energy

- Integrated oils, E&Ps, and oil services underperformed as crude fell on Venezuela headlines. Refiners outperformed on margin dynamics tied to cheaper feedstock.

Financials

- Blackstone (BX) −5.6% — Pressured after Trump comments about banning large institutional investors from buying single-family homes.

- Banks, IBs, insurers, PE, and cards lagged amid a pause in the cyclical trade.

Industrials

- Northrop Grumman (NOC) −5.5% — Hit by Trump comments opposing dividends and buybacks for defense companies.

- AAR (AIR) +2.1% — Earnings beat; margins and FY26 growth outlook ahead of expectations.

Information Technology

- Semis/semicap equipment broadly weaker as the cyclical trade paused.

- First Solar (FSLR) −10.3% — Downgraded at Jefferies on policy visibility and execution risks.

- CoStar Group (CSGP) −8.2% — FY26 guide below Street; announced $1.5B buyback.

- Meta Platforms (META) — China reportedly reviewing its $2B purchase of AI startup Manus.

Consumer Discretionary

- Albertsons (ACI) −6.0% — EPS beat but revenue/comps light; margins pressured by mix and fuel.

- Deckers Outdoor (DECK) −4.1% and Crocs (CROX) −4.0% — Downgrades cited promotional risk and cycle concerns.

- Wolverine World Wide (WWW) −4.3% — Downgraded on distribution and tariff risks.

Utilities / Real Estate

- Utilities and REITs lagged amid renewed risk-off tone and policy uncertainty.

Eco Data Releases | Thursday January 8th, 2026

S&P 500 Constituent Earnings Announcements | Thursday January 8th, 2026

Data sourced from FactSet Research Systems Inc.