January 14, 2026

S&P futures −0.4% following Tuesday’s equity decline. Financials, payments, and software led the downside in the prior session, while energy, consumer staples, and real estate outperformed. Overnight, Asian markets were mostly higher, led by Japan (+~1.5%) on renewed snap-election speculation, while China lagged after higher margin requirements. European markets +0.2%. Treasuries slightly firmer (yields −~1 bp). Dollar little changed. Gold +0.9%, silver +4.6%, Bitcoin futures +0.9%, WTI +0.7%.

Several near-term catalysts are in focus today: additional bank earnings, November retail sales and PPI, and a potential SCOTUS ruling on IEEPA tariffs. The White House affordability / Main St. vs. Wall St. push continues to drive dispersion, with homebuilders the latest pressure point after housing finance chief Pulte criticized buybacks and suggested possible financing restrictions. Geopolitics remain an overhang amid reports of internal and allied pushback against a U.S. strike on Iran. U.S.–China tensions are also back in focus following reports of restrictions on U.S./Israeli security software and tighter controls on NVDA H200 chips. Fed-independence concerns have faded for now as attention shifts toward fiscal tailwinds.

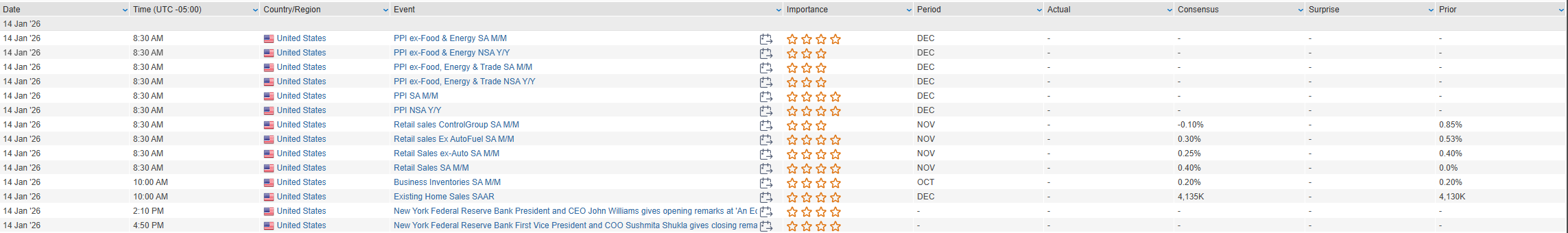

Today’s calendar: November retail sales, PPI, December existing home sales; Fed speakers Miran, Kashkari, Bostic, Williams. SCOTUS could issue an IEEPA ruling.

Company News

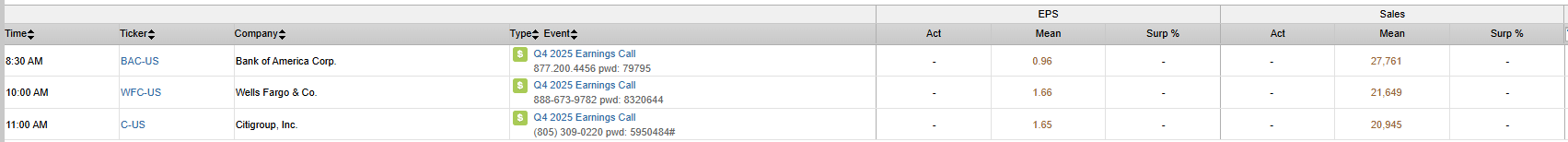

- BAC, C, WFC — Reporting Q4 earnings today.

- PANW, FTNT, CHKP, CYBR — Lower after reports Chinese authorities told firms to stop using U.S./Israeli security software.

- NVDA — Pressured on reports China is restricting imports/use of H200 chips.

- AAPL, QCOM — Monitoring potential shortages of high-end glass fiber.

- TSLA — CEO said FSD will shift to a monthly subscription model.

- KO — Reportedly abandoned the sale of Costa Coffee.

- BP — Warned of a $4–5B Q4 writedown.

U.S. equities finished lower Tuesday (Dow −0.80% | S&P 500 −0.19% | Nasdaq −0.10% | Russell 2000 −0.10%), though off intraday lows, as investors weighed early earnings reactions, sector rotation within technology, geopolitical escalation, and a benign inflation print. Leadership continued to rotate away from software and AI adopters toward semiconductors and AI enablers, while cyclicals and energy outperformed.

December CPI was broadly in line. Headline inflation rose 0.3% m/m, matching expectations, while core CPI increased 0.2%, slightly cooler than forecast. Shelter, airfares, and healthcare prices were firmer, while used vehicles declined. The NFIB Small Business Optimism Index ticked up to 99.5, with uncertainty falling to its lowest level since mid-2024.

Treasuries firmed modestly with some curve steepening; the $22B 30-year auction stopped through, extending a run of solid demand. The dollar strengthened, while yen weakness reflected renewed snap-election speculation in Japan. WTI crude jumped 2.8%, back above $60/bbl, on escalating Iran rhetoric. Bitcoin rose 3.1%, while precious metals were mixed.

Geopolitics remained a key overhang. President Trump urged continued protests in Iran and reiterated there would be no talks with Tehran until violence stops. Credit-card fee caps, affordability initiatives, and Fed-independence concerns stayed in focus, though market reaction remained contained.

Sector Highlights

Leadership skewed cyclical, with Energy (+1.53%) leading the S&P 500, followed by Consumer Staples (+1.08%), Real Estate (+0.82%), Utilities (+0.63%), Industrials (+0.51%), and Materials (+0.29%). Financials (−1.84%) were the weakest sector, pressured by earnings reactions and policy risk tied to credit-card fees. Consumer Discretionary (−0.51%) and Healthcare (−0.40%) also lagged. Technology (−0.13%) finished modestly lower, masking sharp internal dispersion between software weakness and semiconductor strengthFinancials

- JPM (−4.2%) declined despite a Q4 EPS beat, as investment-banking fees missed expectations and buybacks were light, offsetting better-than-expected FY26 NII guidance.

- BK traded lower following earnings (performance not specified).

- V (−4.5%) and MA (−3.8%) fell again amid renewed political pressure around interchange and swipe-fee limits.

- USB announced an agreement to acquire BTIG for $725M (performance not specified).

Information Technology

- INTC (+7.3%) and AMD (+6.4%) surged following upgrades citing tight server CPU supply and stronger hyperscaler demand.

- GOOGL (+1.2%) outperformed on bullish GenAI commentary, while MSFT and META lagged; META (−1.7%) reportedly plans further Reality Labs headcount reductions.

- ADBE (−5.4%), SNPS (−4.1%), and ARM (−3.0%) declined on downgrades tied to AI-driven competitive pressure and slowing software demand.

- SMCI (−5.0%) fell on renewed profitability concerns.

Communication Services

- RBLX (+10.5%) rallied after favorable 2026 outlook commentary.

- RDDT (+6.1%) advanced following an outperform initiation highlighting monetization upside.

- WBD (+1.7%) rose on reports that NFLX is discussing revised, potentially all-cash takeover terms.

Healthcare

- CAH (+2.8%) moved higher after raising FY26 EPS guidance.

- OPCH (+8.4%) surged after expanding its share-repurchase authorization.

- ARGX advanced after FDA acceptance of an additional Vyvgart application (performance not specified).

- RVTY (+6.0%) jumped on a positive guidance update.

- TVTX (−14.6%) plunged after the FDA requested additional clarification on clinical benefit.

- ABBV (−4.0%) announced a pricing agreement with the Trump administration aimed at avoiding tariffs.

Industrials

- LHX rallied on plans to pursue an IPO of its Missile Solutions business (performance not specified).

- KMT (+8.3%) gained following an upgrade tied to elevated tungsten prices and structural cost improvements.

Energy

- Energy stocks broadly outperformed alongside higher crude prices, supported by escalating Iran tensions and renewed focus on Venezuelan supply dynamics (individual stock performance not specified).

Consumer Discretionary

- CMG (−2.3%) declined despite reaffirming FY guidance, with scrutiny around executive transition and valuation.

- DAL lagged following a weaker FY26 outlook (performance not specified).

- PAR advanced following a commercial agreement with PZZA (performance not specified).

Materials

- ALB (+4.5%) rose after an upgrade citing a more constructive lithium outlook.

Eco Data Releases | Wednesday January 14th, 2026

S&P 500 Constituent Earnings Announcements | Wednesday January 14th, 2026

Data sourced from FactSet Research Systems Inc.