January 15, 2026

U.S. index futures are higher (S&P futures +0.3% | Nasdaq futures +0.7%) after Dow, S&P 500, and Nasdaq closed lower Wednesday, led down by big tech and banks. Breadth was better beneath the surface, with ~60% of S&P 500 constituents advancing and defensives outperforming. Overnight, Asia was mixed (Japan, Hong Kong, China lower; South Korea, Australia higher), while Europe is up ~0.4%. Treasuries and the dollar little changed. Gold −0.4%, silver −0.3%, bitcoin −0.8%. WTI −4.2%.

Key themes:

- AI/tech sentiment improved after TSM delivered a beat-and-raise with higher capex and upbeat AI commentary.

- Geopolitics eased, weighing on oil, as Trump signaled holding off on Iran strikes and a U.S.–Greenland agreement looked more likely.

- Fed independence concerns cooled after Trump said he has no plans to fire Chair Powell; Hassett and Warsh remain leading successors.

- Trade policy: Trump opted against tariffs on critical minerals, favoring negotiations.

Corporate news:

- GS, MS, BK report this morning.

- TSM surging on earnings beat, raised long-term guidance and capex.

- ADP authorized a $6B buyback; HLT boosted buybacks by $3.5B.

- FUL missed Q4 revenue and guided below for Q1 and FY26.

- AVO to acquire CVGW for $430M.

Today’s data & events:

- Initial claims, Philly Fed and Empire State manufacturing surveys.

- Fedspeak from Barr, Barkin, and Schmid.

- Friday: December industrial production and January NAHB housing index.

- Next week is light; PCE inflation (Thu) is the key release.

U.S. equities finished mostly lower Wednesday (Dow −0.09% | S&P 500 −0.53% | Nasdaq −1.00% | Russell 2000 +0.70%), though off worst levels, as markets digested a dense mix of earnings, macro data, policy headlines, and geopolitics. Index performance masked strong breadth, with the equal-weight S&P 500 outperforming the cap-weighted index by ~100 bp and Russell 2000 up +0.7%, reflecting continued rotation away from mega-cap growth.

Macro data was broadly uneventful but supportive. November retail sales rose +0.6% m/m, beating consensus (+0.4%), with the control group up +0.4% m/m. November PPI rose +0.2% m/m, in line, while core PPI was flat, below expectations. The data did little to shift policy expectations.

Fedspeak was active and mixed. Kashkari said January cuts are unlikely but acknowledged emerging labor-market softness; Bostic reiterated policy remains restrictive; Paulson suggested cuts later in the year may be appropriate; Miran again argued for up to 150 bp of cuts in 2026. The Fed’s Beige Book noted economic activity improving modestly across most districts.

Policy uncertainty remained elevated. The Supreme Court again deferred ruling on IEEPA tariffs, pushing expectations to next week. President Trump announced a 25% tariff on imported chips not used for U.S. AI infrastructure, keeping trade risk in focus. On geopolitics, Iran dominated headlines, though markets briefly stabilized after Trump said executions in Iran had stopped.

Rates and FX reflected a mild risk-off tilt. Treasuries rallied modestly, with yields down 1–4 bp and the curve flattening. The dollar was little changed. Gold (+0.8%) and silver (+6.4%) both set new record highs, underscoring demand for hedges amid policy and geopolitical noise. WTI crude settled +1.6%, before pulling back below $60 after Iran-related comments.

Sector Highlights

Sector leadership reflected a defensive and rotation-driven tape. Energy (+2.26%) led as crude initially firmed, followed by Consumer Staples (+1.18%), Real Estate (+1.08%), Utilities (+0.74%), and Healthcare (+0.70%), all benefiting from risk hedging and policy uncertainty. Cyclicals were mixed, with Industrials (+0.14%) modestly higher.

On the downside, Consumer Discretionary (-1.75%), Technology (-1.45%), and Communication Services (-0.55%) lagged, driven by mega-cap tech weakness, China-related headlines, and earnings-related pressure in travel and retail.

Financials

- BAC (-3.7%), WFC (-4.6%), C (-3.3%): All declined following Q4 results despite beats in several line items; investors focused on NII/NIM guidance, expense discipline, and credit card fee cap risk.

- CME (+2.5%): Upgraded to buy on positioning into earnings and increased volatility skew.

Information Technology

- NVDA: Pressured after reports Chinese customs authorities restricted entry of H200 chips, allowing purchases only when “absolutely necessary.”

- AAPL, QCOM: Reports flagged rising concern about shortages of high-end glass cloth fiber.

- TSLA: CEO Musk said FSD will move to a monthly subscription model.

- HON (+1.3%): Filed for IPO of majority-owned quantum computing unit Quantinuum.

- ISRG (-2.7%): Slid despite Q4 revenue beat as FY26 procedure growth guidance came in slightly conservative.

Energy

- SLB (+2.4%): Gained on reports of talks with U.S. officials and Chevron around expanding operations in Venezuela.

- BP (-): Warned of a $4–5B Q4 writedown, weighing on shares.

- Crude markets remained volatile amid Iran headlines and shifting U.S. policy signals.

Consumer Discretionary

- TCOM (-17%): Sharp drop after China launched an antitrust investigation for alleged monopolistic practices.

- RIVN (-7.2%): Downgraded on valuation after recent rally.

- KO: Reportedly abandoned the sale of Costa Coffee.

- Retail, travel, and lodging names broadly lagged amid earnings and affordability-policy concerns.

Healthcare

- TGTX (+6.0%): Strong gains after FY25 and FY26 revenue guidance topped expectations.

- BIIB (-5.0%): Disclosed ~$222M pre-tax IPR&D charge impacting Q4 EPS.

- Managed care names generally outperformed as defensives attracted flows.

Materials

- NTR (+7.9%): Jumped on an upgrade citing higher potash price forecasts.

- VMC (-4.0%): Downgraded on valuation and narrowing pricing upside in aggregates.

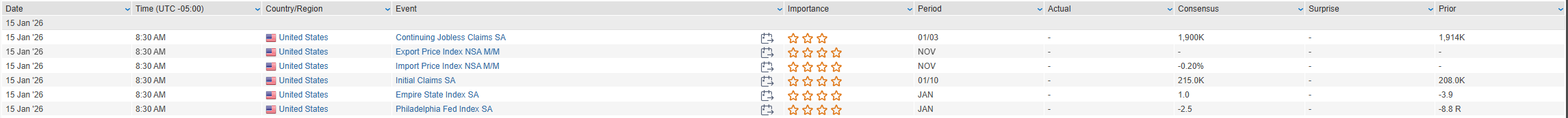

Eco Data Releases | Thursday January 15th, 2026

S&P 500 Constituent Earnings Announcements | Thursday January 15th, 2026

Data sourced from FactSet Research Systems Inc.