January 23, 2026

S&P futures −0.1%, off worst premarket levels, after U.S. equities closed higher Thursday. Small caps led again, with the Russell 2000 outperforming the S&P 500 for a 14th straight session to start 2026. Most-shorted, retail favorites, and the Mag 7 outperformed. Strength also seen in software, HPCs, credit cards, managed care, and pharma/biotech. Asia higher overnight (Taiwan, South Korea, Singapore at record highs). Europe lower ~−0.4%. Treasuries firmer with modest curve flattening (long-end yields −~2 bp). DXY flat (yen volatility around BoJ). Gold +0.2%, Silver +2.4%, Bitcoin −0.2%, WTI +1.7%.

Macro & Policy (brief)

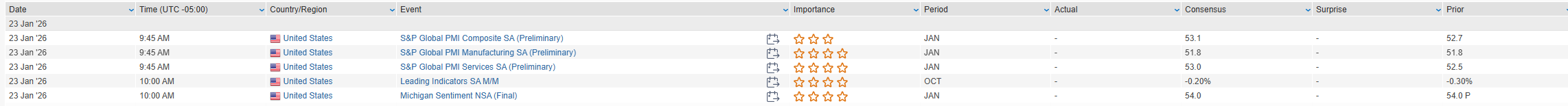

No major drivers this morning as markets continue to look past geopolitics, focusing on broadening leadership and small-cap outperformance while awaiting a pickup in Q4 earnings, including big tech next week. BoJ held overnight with a slightly hawkish tilt; no spillover to global risk. White House affordability push quieter, and Trump scrapped support for using 401(k)s for housing down payments. Fed chair pick could come next week; markets favor Warsh over Rieder. Today brings S&P Global flash PMIs and final UMich sentiment/inflation expectations; FOMC hold expected Wednesday.

Company News

- INTC – Pressured on weaker Q1 guide; gross margins down tied to internal CPU supply constraints (stock up ~150% over past year).

- ISRG – Higher on strong Q4 results and expectations for continued momentum.

- COF – PPNR light on weaker efficiency ratio; positives around $5B+ acquisition of Brex.

- CSX – FY26 guide light; constructive commentary on cost controls and margin initiatives.

- NVDA – Higher after reports China allowed large tech firms to prepare orders for H200 chips.

- AMZN – Reportedly planning ~14K job cuts across AWS, retail, Prime Video, and HR.

- DIS – Said it expects to name a new CEO early this year.

- CLX – Announced $2.25B all-cash acquisition of GOJO Industries.

U.S. equities extended gains on Thursday (Dow +0.63% | S&P 500 +0.55% | Nasdaq +0.91% | Russell 2000 +0.76%), as markets leaned further into the “TACO” de-escalation narrative after President Trump softened his stance on Greenland and details around a NATO framework continued to emerge. The easing in geopolitical risk reinforced the buy-the-dip mindset and refocused attention on the White House’s “run-it-hot” growth posture, a clear tailwind for small caps and cyclicals. The Russell 2000 notched a fresh all-time high, outperforming the S&P 500 for a 14th straight session—the longest streak since 1996.

Macro data reinforced the resilient-growth narrative but also pushed markets toward a flatter rate-cut path. Weekly jobless claims remained subdued, Q3 GDP was revised higher, and both headline and core PCE printed a steady 0.2% m/m, keeping the market priced for just ~42 bp of cuts through year-end. Rates reflected this tension with mild curve flattening and higher front-end yields, while the dollar slid 0.5%, helping fuel another surge in gold (+1.6%) and silver (+4.0%) to fresh records. Attention now turns to flash PMIs and next week’s FOMC, alongside rising speculation around a Fed Chair nomination (Rieder gaining on Warsh).

Sector Highlights

Leadership skewed risk-on, with Communication Services (+1.57%) and Consumer Discretionary (+1.22%) leading as growth and high-beta exposures rebounded. Technology (+0.70%) and Financials (+0.68%) also outperformed, reflecting improved sentiment toward AI-linked names and banks amid a flatter rate-cut path. Materials (+0.62%) benefited from the renewed bid in metals.

On the lagging side, Real Estate (−1.10%) and Utilities (−0.73%) underperformed as rates remained firm and defensives were de-emphasized. Industrials (−0.51%) and Consumer Staples (−0.14%) trailed, while Healthcare (+0.03%) and Energy (+0.27%) were modestly positive but still lagged the broader tape.

Information Technology

- Meta Platforms (+) and Tesla (+4.2%) led Mag 7 strength; Tesla also benefited from comments that unsupervised FSD Robotaxi rides are now operating for the public in Austin.

- Datadog (+6.3%) upgraded at Stifel on expectations for another outsized quarterly beat and accelerating core growth.

- Oracle (+2.5%) rose after U.S. and China reportedly signed off on the sale of TikTok’s U.S. business to a consortium led by Oracle.

- Mobileye (−3.3%) guided FY26 revenue and operating income below the Street despite in-line Q4 results.

Health Care

- Corcept Therapeutics (+13.7%) surged after its Phase 3 ovarian-cancer trial met the primary endpoint for overall survival.

- Abbott Laboratories (−10.0%) sold off after Q4 results showed weaker organic growth in Nutrition and Diagnostics and a below-consensus Q1 EPS guide.

- Elanco Animal Health (+2.5%) upgraded at Piper Sandler on improving customer checks.

Consumer Discretionary

- Life Time Group (+3.3%) beat on preliminary Q4 results and guided FY metrics above consensus.

- Capri Holdings (+1.2%) upgraded at TD Cowen on price-point strategy and margin expansion potential.

- Uber Technologies (−2.0%) fell after Tesla’s Robotaxi comments raised fresh autonomy concerns.

Consumer Staples

- Procter & Gamble (mixed) posted slightly light organic growth but better EPS; FY26 guide reiterated with a low bar helping sentiment.

- McCormick (−8.1%) missed on margins and guided FY26 EPS below consensus, citing commodity inflation and tariff headwinds.

Industrials

- General Electric Aerospace (−7.4%) beat and raised but sold off on valuation concerns and a high bar into the print.

- Adtran (+6.6%) jumped on a positive Q4 preannouncement citing strong demand and execution.

- CACI International (+) beat on EBITDA/FCF and boosted FY26 guidance despite bookings disruption from the government shutdown.

- Knight-Swift Transportation (+) rose despite an EPS miss, with investors encouraged by early signs of rate stabilization.

- Landstar System (−) preannounced weaker results due to higher insurance costs and claims.

Financials

- Northern Trust (+) beat with NII and fees ahead of expectations.

- Huntington Bancshares (−6.0%) pressured by higher-than-expected nonperforming assets despite decent NII.

Energy

- Kinder Morgan (+) beat and highlighted leverage to the data-center power buildout, though the broader sector lagged as WTI fell 2.1%.

Eco Data Releases | Friday January 23rd, 2026

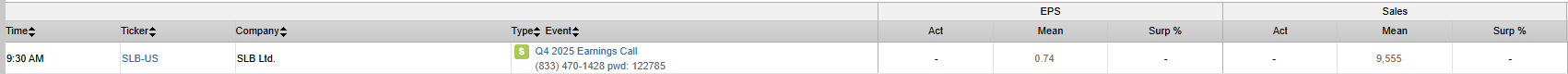

S&P 500 Constituent Earnings Announcements | Friday January 23rd, 2026

Data sourced from FactSet Research Systems Inc.