January 26, 2026

S&P futures were down 0.2% Monday morning, though off worst premarket levels, following a choppy week that ended modestly lower. Big tech held up late last week, while momentum, high-beta, and retail-favorite names lagged. European markets were mostly lower after a mixed Asian session. Treasuries were firmer with modest curve flattening (yields −1–2 bp). The Dollar Index fell 0.5%, extending last week’s slide to its weakest level since May 2025, while yen strength dominated FX amid intervention chatter. Gold jumped 2.0% above $5,000/oz, silver surged 6.9% (up nine of the last ten sessions), Bitcoin fell 1.7%, and WTI crude edged up 0.2%.

Headline risk remained elevated over the weekend. Markets focused on Trump’s threat of 100% tariffs on Canada should Ottawa deepen free-trade ties with China, alongside rising U.S. government shutdown risk after Senate Democrats warned they may block DHS funding. Attention now turns to a heavy earnings week, with META, MSFT, and TSLA reporting Wednesday after the close and AAPL on Thursday. Wednesday’s FOMC meeting is expected to result in a hold, though speculation continues that Trump could announce his Fed Chair nominee, with Rick Rieder now leading prediction markets.

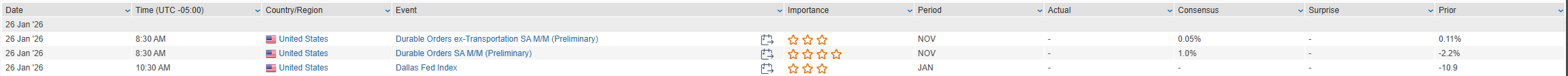

On the data front, November durable-goods orders and the January Dallas Fed manufacturing index are due today. Treasury supply is also in focus, starting with a $69B 2-year auction, followed by 5- and 7-year sales later in the week. Overseas, markets are alert to potential yen intervention, after reports of a NY Fed rate check and renewed warnings from Japanese officials about speculative currency moves.

Corporate news was light:

- STLD is the main earnings report today ahead of a busy week.

- Talks between MRK and RVMD reportedly cooled due to valuation disagreements.

- USAR rallied after Reuters reported the White House is considering taking a 10% stake.

U.S. equities finished mixed on Friday (Dow −0.58% | S&P 500 +0.03% | Nasdaq +0.28% | Russell 2000 −1.82%), closing a volatile, holiday-shortened week. The Russell 2000 (−1.82%) gave back all of its early-week gains, snapping a 14-session streak of outperformance vs. the S&P 500, the longest stretch since 1996. Positioning and “run-it-hot” enthusiasm cooled, particularly in small caps and cyclicals.

Cross-asset signals leaned defensive. The Dollar Index fell 0.86%, its worst weekly decline since May, while gold rose 1.46% to $4,985/oz and silver jumped 5.2% above $100, extending a powerful commodities breakout. WTI crude gained 3.2% to $61.26. Treasuries were firmer, though yields edged higher (10Y +2 bp to 4.23%).

Economic data was mixed but non-disruptive. Final January UMich sentiment improved to 56.4, while flash PMIs came in a bit soft. Markets remain focused on Wednesday’s FOMC meeting (hold expected) and the prospect of a Fed Chair nomination next week, with prediction markets shifting toward Rick Rieder.

Sector Highlights

Leadership skewed toward inflation-sensitive and defensive areas, with Materials (+0.86%), Consumer Discretionary (+0.73%), Consumer Staples (+0.65%), Energy (+0.61%), and Technology (+0.54%) finishing higher. Real Estate (+0.30%) and Communication Services (+0.14%) were modestly positive.

On the downside, Financials (-1.38%) were the clear laggard as banks and credit-card issuers sold off, followed by Industrials (-0.80%), Healthcare (-0.56%), and Utilities (-0.40%)

Information Technology

- Intel (INTC) −17.0%: Q4 results beat, but Q1 revenue and EPS guided below consensus; management cited internal CPU supply constraints and slower 18A ramp.

- NVIDIA (NVDA) +1.5%: Shares rose after reports that Chinese authorities told large domestic tech firms they can prepare orders for H200 AI chips.

- Microsoft (MSFT): Outperformed within Big Tech ahead of earnings; software peers lagged on valuation and AI productivity concerns.

Financials

- Capital One Financial (COF) −7.6%: Q4 earnings missed on higher expenses tied to Discover integration; NII held up, and investors focused on the $5.15B acquisition of fintech Brex.

- Truist Financial (TFC) +1.8%: Q4 mixed but credit metrics stable.

- Banks, insurers, asset managers broadly underperformed as rate-cut expectations flattened.

Consumer Discretionary

- Amazon (AMZN): Reports the company plans to cut ~14,000 jobs across AWS, retail, Prime Video, and HR.

- Walt Disney (DIS): Management reiterated plans to name a new CEO in early 2026.

- Airlines, homebuilders, casinos, trucking, and apparel stocks were among the session’s weakest groups.

Consumer Staples

- Clorox (CLX): Announced $2.25B cash acquisition of GOJO Industries, expanding its professional hygiene footprint.

- Staples retailers, dollar stores, and QSRs outperformed defensively.

Industrials

- CSX (CSX) +2.4%: Q4 EPS missed and FY26 revenue guide light, but sentiment improved around cost controls and margin initiatives.

- Machinery and trucking names lagged with the small-cap unwind.

Energy

- Energy equities advanced alongside crude.

- Exxon Mobil (XOM): Benefited from the +3.2% move in WTI and weaker dollar.

Materials

- Newmont (NEM): Precious-metals miners continued to outperform as gold and silver hit new records.

- Mosaic (MOS) −4.5%: Preliminary Q4 phosphate and potash volumes below expectations; fertilizer demand flagged as soft.

Healthcare

- Intuitive Surgical (ISRG): Analysts constructive on fundamentals post-earnings, but shares ended lower.

- Broader pharma/biotech lagged modestly.

Communication Services

- Retail-favorite names held up better, while quantum-computing exposures remained under pressure.

Eco Data Releases | Monday January 26th, 2026

S&P 500 Constituent Earnings Announcements | Monday January 26th, 2026

Data sourced from FactSet Research Systems Inc.