January 27, 2026

S&P futures +0.3% after U.S. equities finished higher Monday, reversing early pressure. Leadership came from Mag 7, software, pharma, and precious metals, while small caps lagged for a second session; most-shorted and retail-favorite names also underperformed. Asia traded higher overnight (strength in South Korea and Greater China), Europe modestly firmer (~+0.2%). Treasuries flat to slightly weaker at the long end. DXY flat. Gold −0.1%, silver −0.3%, BTC −0.5%, WTI +0.5%.

Macro & Policy:

No clear directional catalyst. Markets continue to look through political/geopolitical noise, including renewed tariff rhetoric toward South Korea and still-elevated U.S. shutdown risk. Precious-metals rally paused. Yen/JGBs firmer but without renewed carry-trade stress. White House affordability speech expected today; “run-it-hot” growth narrative supported by reports of an upcoming tax-refund surge.

Today’s Data / Events:

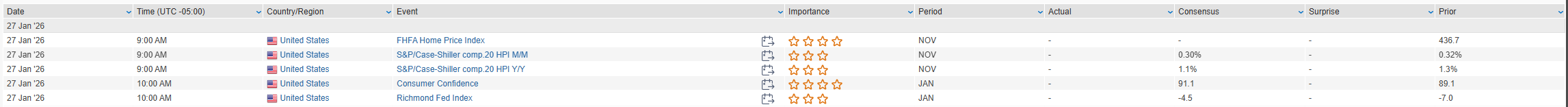

- S&P Case-Shiller (Nov), Conference Board Consumer Confidence (Jan)

- $70B 5-year Treasury auction

- Trump affordability speech (Iowa)

- Ahead: FOMC & Powell (Wed); unit labor costs, claims, trade balance, factory orders (Thu); PPI (Fri)

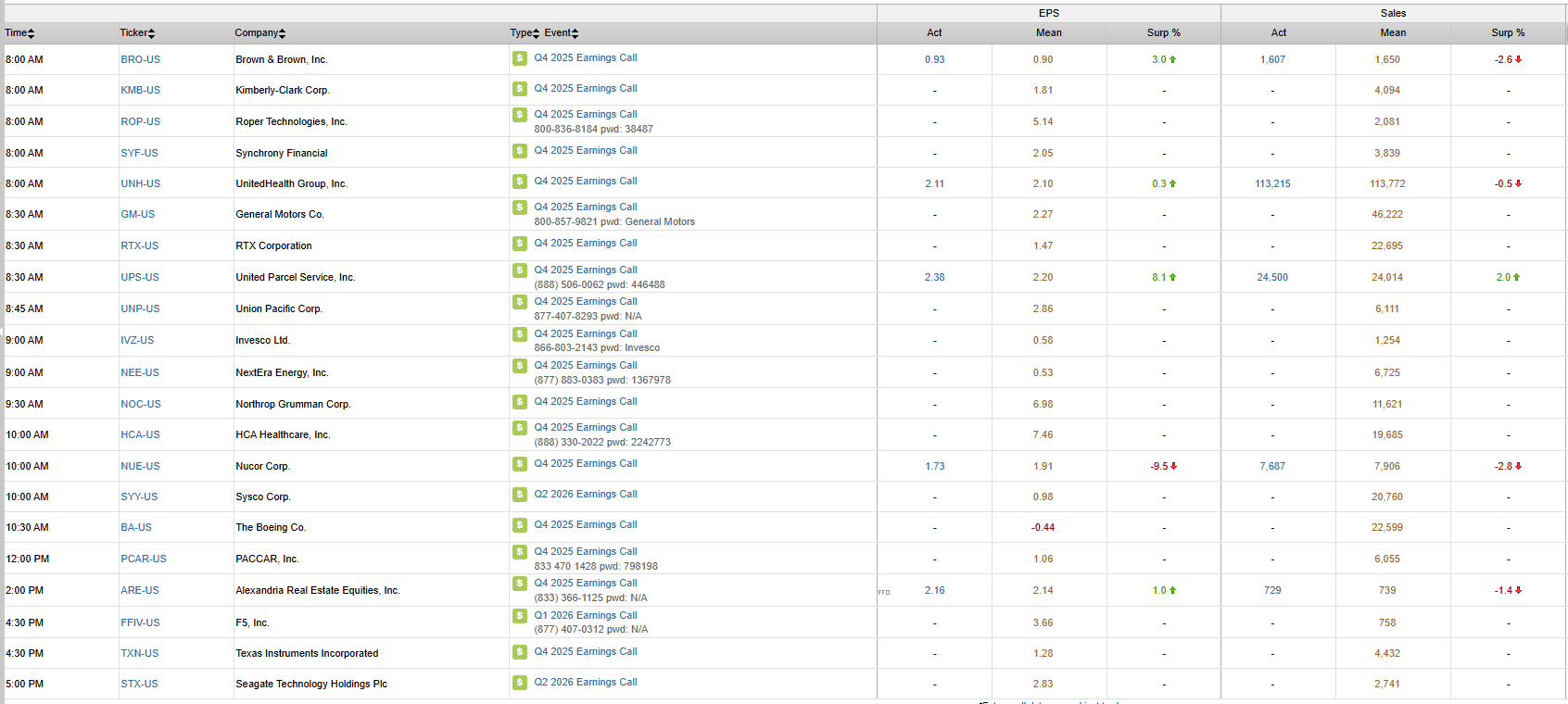

Company News (selected):

- UNH, HUM pressured after CMS proposed +0.09% Medicare Advantage rate for 2027 (below 4–6% expectations).

- META reportedly to test premium subscriptions across apps.

- MU plans $24B investment in Singapore to expand chip production.

- NUE down after Q4 EBITDA miss, though 2026 outlook commentary more upbeat.

- CRM secured a $5.6B U.S. Army contract.

- SANM beat; highlighted AI-hardware demand, but Q2 revenue guide light.

- AGYS pressured on slower subscription growth outlook.

- CR beat, guided in line; announced CEO succession.

- GGG Q4 in line; 2026 organic sales outlook light.

U.S. equities finished mostly higher on Monday (Dow +0.64% | S&P 500 +0.50% | Nasdaq +0.43% | Russell 2000 −0.36%), rebounding from last week’s volatility despite elevated headline risk around trade and fiscal policy. President Trump renewed tariff threats, warning of a 100% levy on Canada should it deepen trade ties with China, while uncertainty persists over a U.S.–EU trade framework following the Greenland dispute. Government shutdown risk also returned to focus after several Democrats threatened to block DHS funding ahead of Friday’s deadline.

Macro data leaned supportive. November durable-goods orders rose 5.3% m/m, well above expectations, with core capital-goods orders up 0.7%, reinforcing the resilient capex narrative. The Dallas Fed manufacturing index improved materially. In rates, Treasuries firmed with modest curve flattening; a $69B 2Y auction stopped through by 1.4 bp on strong international demand. FX volatility remained elevated as the dollar slid 0.6% to a four-month low, while yen strength dominated amid intervention chatter tied to potential coordinated U.S.–Japan action. Commodities surged, led by gold (+2.1%) breaking above $5,000/oz and silver (+14.0%), its strongest one-day gain since 1985.

Sector Highlights

Sector performance reflected a tilt toward growth and communications, with Communication Services (+1.32%) and Information Technology (+0.84%) leading the market alongside Utilities (+0.78%) and Financials (+0.65%). More cyclical and rate-sensitive groups lagged, with Consumer Discretionary (−0.71%), Consumer Staples (−0.05%), and Real Estate (−0.02%) finishing behind, while Energy (+0.04%), Industrials (+0.10%), Materials (+0.29%), and Health Care (+0.41%) delivered only modest gains, underscoring a selective, rotation-heavy advance rather than broad-based risk-on behavior.

Communication Services

- ZM (+11.3%) rallied after analysts highlighted the implied value of its Anthropic stake.

- TTD (−7.5%) fell on a CFO transition despite reaffirmed guidance.

Information Technology

- AAPL led megacap tech higher and unveiled upgraded AirTag hardware.

- MU (−2.6%) weakened after reports Samsung secured an HBM4 supply deal with NVDA.

- SKYT (+3.3%) jumped after agreeing to be acquired by IONQ for ~$1.8B.

- CRWV (+5.7%) surged after reports of an additional $2B NVDA investment to expand AI compute capacity.

- MSFT revealed a second-generation in-house AI chip to bolster its cloud platform.

- CSCO (+3.2%) was upgraded at Evercore on AI-driven demand and refresh-cycle tailwinds.

Financials

- BOH (+6.1%) rose after a clean Q4 beat with upside in NII, fees, and credit metrics.

- CPAY (+1.1%) gained following a constructive Morgan Stanley initiation tied to freight recovery.

- Investment banks and money-center banks broadly outperformed as yields stabilized.

Energy

- BKR (+4.4%) advanced on a Q4 beat driven by gas technology equipment and LNG-linked orders.

- CVI (−9.5%) dropped on weak preliminary Q4 results tied to refinery and fertilizer issues.

Health Care

- SRPT (+7.7%) surged after positive long-term efficacy data for Elevidys.

- RVMD (−16.9%) plunged after reports takeover talks with MRK collapsed.

Consumer Discretionary

- LE (+33.5%) soared on a $300M IP monetization deal with WHP Global.

- GME (+4.4%) rose after Michael Burry disclosed ongoing share purchases.

- Autos and homebuilders lagged amid renewed affordability concerns.

Industrials

- ETN announced plans to spin off its Vehicle and eMobility segments.

- BAH (−8.1%) sold off after Treasury cancelled all federal contracts with the firm.

- LSTR preannounced weaker results due to higher insurance costs.

Materials

- Precious-metals miners broadly outperformed as gold and silver hit new highs.

- STLD beat earnings though revenue was light; management reiterated a solid demand backdrop.

- USAR (+7.9%) jumped after reports the U.S. government plans to take a 10% equity stake.

Eco Data Releases | Tuesday January 27th, 2026

S&P 500 Constituent Earnings Announcements | Tuesday January 27th, 2026

Data sourced from FactSet Research Systems Inc.