January 29, 2026

S&P futures up 0.2% after U.S. equities finished flattish/mixed Wednesday. Tech continued to lead, while consumer, healthcare, and A&D lagged. Asia was mixed overnight (strength in South Korea, Hong Kong; weakness in Taiwan, India, Indonesia). Europe higher (+0.4%). Treasuries little changed with long-end yields +1–2 bp. Dollar −0.2%. Gold +3.8% (after ~+4.5% Wednesday), silver +3.4% (after +7%+), copper +6%. Bitcoin −1.4%. WTI +2.4% on Iran strike concerns.

Key themes: First wave of Big Tech earnings reinforced elevated capex, improving AI monetization, and lingering capacity constraints. MSFT Azure growth (~38%) was solid but guidance disappointed; META stood out with a strong beat and upbeat revenue outlook despite higher capex. Softer dollar and a renewed precious metals/copper surge in focus. Geopolitics remain elevated with oil supported by Iran rhetoric. Shutdown odds eased to ~40% after reported Trump–Schumer talks.

Company highlights:

- MSFT Azure growth in line but guidance weighed on shares.

- META big revenue beat and strong guide; AI monetization the story.

- TSLA beat; narrative centered on AI/robotics pivot.

- NOW results broadly positive, stock still pressured by AI-overhang concerns in software.

- LRCX beat and guided above on memory spend strength.

- IBM supported by Software strength and FY26 upside.

- LVS EBITDA ahead on Marina Bay Sands; Macau softer.

- URI pressured by weaker equipment sales/fleet productivity.

- LUV lifted by better Q1 and FY26 EPS guidance.

- CHRW positive takeaways on execution/cost control despite tough spot rates.

- WHR missed materially on softer sales and margins.

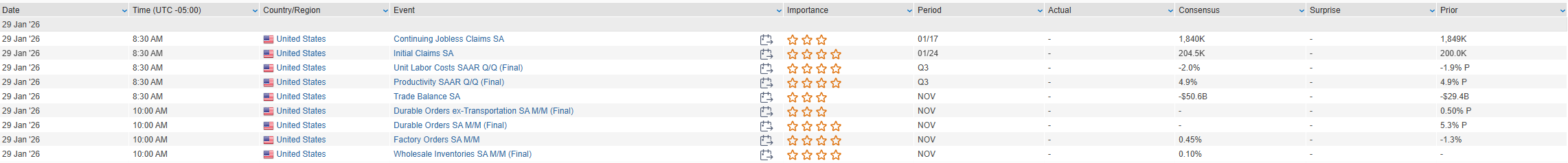

Today’s calendar: Final Q3 unit labor costs, initial claims (consensus ~205K), Nov trade balance & factory orders; $44B 7-year Treasury auction. Dec PPI Friday. Looking ahead: heavy earnings and next week’s ISM, JOLTS, ADP, and January jobs report.

U.S. equities finished narrowly mixed on Wednesday (Dow +0.02% | S&P 500 −0.01% | Nasdaq +0.17% | Russell 2000 −0.49%). After an early push saw the S&P 500 briefly break above 7,000 for the first time investors faded the close. Price action reflected a familiar “high-bar” dynamic following strong tech earnings and AI headlines, with investors shifting into wait-and-see mode ahead of megacap results after the bell (MSFT, META).

The FOMC decision was largely a non-event: rates were held at 3.50–3.75%, with two dovish dissents (Waller, Miran) favoring a 25 bp cut. The statement modestly upgraded economic activity to “solid,” acknowledged labor-market stabilization, and reiterated that inflation remains elevated. Chair Powell emphasized policy remains restrictive and the Fed is well positioned to stay on hold. Market pricing for 2026 easing was little changed at ~44 bp of cuts through year-end.

Rates moved modestly higher with curve steepening (yields +1–2 bp). The U.S. dollar stabilized after sliding to a near four-year low in the prior session, aided by Treasury Secretary Bessent reiterating a strong-dollar policy, though gains faded during Powell’s press conference. Precious metals extended their breakout despite the firmer dollar (gold +4.4%, silver +7.1%). WTI crude +1.3%, while Bitcoin −0.2%.

Geopolitically, Iran rhetoric stayed elevated, and shutdown risk remains in the background, but neither materially shifted risk appetite. Focus now turns to upcoming data (unit labor costs, claims, trade/factory orders, then PPI) and the remainder of Big Tech earnings.

Sector Highlights

Sector leadership skewed pro-cyclical and commodity-linked. Energy (+0.74%) and Technology (+0.62%) led, helped by oil strength and continued AI/semiconductor momentum. Materials (+0.18%) benefited from the surge in precious metals, while Communication Services (+0.08%) finished modestly higher.

On the downside, Real Estate (−0.92%), Consumer Staples (−0.78%), and Healthcare (−0.77%) underperformed, reflecting sensitivity to higher rates and the drag from Medicare Advantage headlines. Consumer Discretionary (−0.67%), Industrials (−0.53%), Utilities (−0.24%), and Financials (−0.03%) also lagged, underscoring a rotation away from defensives and rate-sensitive groups toward tech, energy, and metals.

Information Technology

- STX +19.1%: Beat and raised; hyperscaler demand strong, HAMR qualified across U.S. customers, tight capacity and pricing power drove upside.

- INTC +11.0%: Rumors of potential NVDA collaboration on Intel’s Feynman platform (2028) and CFO stock purchase boosted shares.

- TXN +9.9%: Q1 guide above consensus; improving linearity, rising backlog, and broad industrial recovery highlighted.

- FFIV +8.1%: Beat and raised; strong billings, record EMEA performance, enterprise AI adoption a tailwind.

- APH −12.2%: Beat and guided above, but shares sold off on elevated expectations into the print.

- QRVO −6.8%: Beat on Apple content, but guidance disappointed due to Android exits and margin mix.

- OTIS −2.2%: Missed and guided FY26 below Street; framed as a transition year.

Communication Services

- T +4.7%: Beat and raised; Business Wireline strength, FCF upside, and a $10B buyback increase supported shares.

- SNAP +2.8%: AR glasses unit spun into wholly owned subsidiary (“Specs Inc.”).

Health Care

- LRN +14.3%: Beat with enrollment growth and stabilization of platform issues; FY operating income guide raised.

- ELV: Shares weak intraday as medical loss ratio and FY EPS guidance missed, adding pressure to managed care post-MA rate update.

- DHR −4.8%: Results largely in line; stock lower after preannouncement set expectations.

Consumer Discretionary

- SBUX: Better comps on higher transactions supported relative outperformance.

- EAT: Beat on strong Chili’s performance.

- VFC −5.8%: Beat but EBIT and outlook softer than expected.

- CVNA −14.2%: Hit by a negative Gotham City Research short report alleging earnings overstatement.

Industrials

- TXT −7.9%: FY26 FCF guide ~25% below Street due to MV-75 investment and higher capex.

- GD −2.7%: Beat but FY26 EPS guide materially below consensus; Gulfstream margins pressured.

- NXT +13.3%: Beat and raised; announced $500M buyback and solar tracker contract; upgraded at KeyBanc.

- DB −2.0%: German authorities reportedly raided offices in a money-laundering probe.

Energy

- Sector broadly firmer with WTI +1.3%, supported by ongoing Iran risk premium despite choppy equity tape.

Materials

- Copper, aluminum, and precious-metals miners outperformed alongside the sharp rally in gold and silver.

Financials

- Financials lagged as higher rates and curve steepening weighed on banks and insurers; no major positive earnings catalysts on the day.

Eco Data Releases | Thursday January 29th, 2026

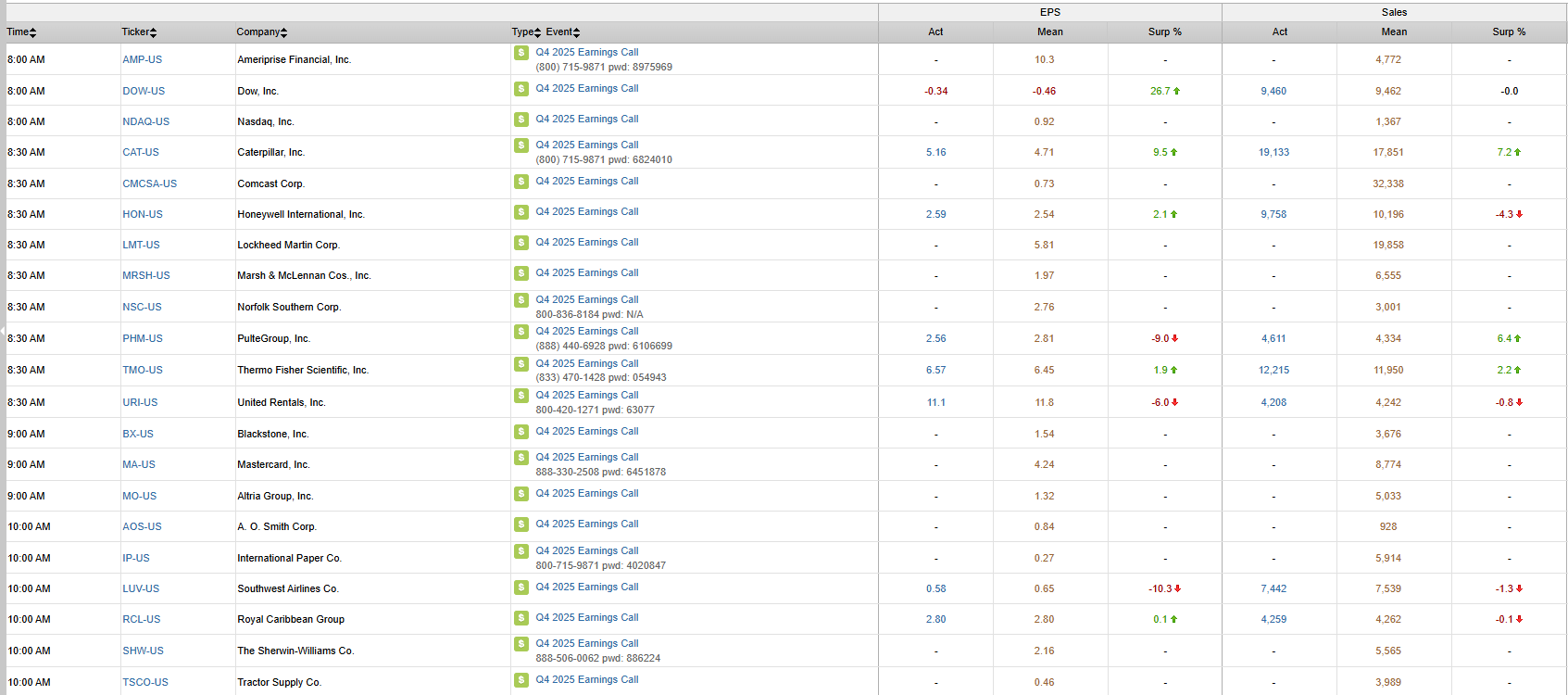

S&P 500 Constituent Earnings Announcements | Thursday January 29th, 2026

Data sourced from FactSet Research Systems Inc.