January 30, 2026

S&P futures −0.8% after U.S. equities finished mixed Thursday, ending off worst levels. The software selloff following earnings from MSFT, NOW, and SAP remained the dominant theme, while META stood out positively in big tech. Outside tech, energy, banks, airlines, cruise lines, diversified industrials, and HPCs outperformed. Asia was weaker overnight (pressure in Greater China; Taiwan lagged), while Europe traded higher (~+0.5%). Treasuries weakened with a bear steepening bias; the dollar rose ~0.4%. Precious metals sold off sharply (gold ~−5%, silver ~−13.5%). Bitcoin −2.3%; WTI −1.2%.

Key drivers: Markets are digesting reports that President Trump will nominate Kevin Warsh as Fed Chair—seen as hawkish, particularly on balance-sheet policy—supporting the dollar and weighing on the back end. The stronger dollar and crowded positioning triggered a sharp reversal in precious metals after outsized recent gains. In tech, results were broadly solid but met a high bar, with continued, unrelenting weakness in software. Oil eased despite reports Trump reviewed expanded military options regarding Iran. In Washington, Trump and Senate Democrats reportedly reached a tentative short-term deal to avert a partial government shutdown (two-week DHS extension).

Earnings & corporate highlights:

- AAPL beat with strong iPhone demand; guidance surprised with gross margin upside despite memory cost pressures.

- KLAC posted upbeat results but shares pressured on a more conservative WFE outlook and GM scrutiny.

- WDC beat and raised but lagged on a high bar post-STX.

- SNDK surged on blowout results (ASP growth; data-center demand).

- V solid but unchanged FY guide and expenses drew focus.

- SYK beat and guided above.

- DECK beat and raised (Uggs, HOKA).

- EMN guided Q1 below; no 2026 guide.

- SNDR sold off on a soft outlook amid truckload demand challenges.

- Reports: OpenAI considering a Q4 IPO; SpaceX exploring a merger with TSLA or xAI; META reportedly under investigation over WhatsApp access claims; GME CEO signaled plans for a major consumer/retail acquisition.

Calendar: Trump’s Fed Chair announcement expected today; December PPI is the U.S. data highlight. Fed’s Musalem speaks later. Looking ahead: ISM manufacturing (Mon), JOLTS (Tue), ADP & ISM services (Wed), January jobs report and preliminary UMich sentiment (Fri). Treasury quarterly borrowing estimates due Monday; refunding announcement Wednesday.

U.S. equities finished mixed (Dow +0.11% | S&P 500 −0.13% | Nasdaq −0.72% | Russell 2000 +0.05%). Index performance was again heavily influenced by large-cap tech weakness, while breadth was modestly positive and the equal-weight S&P outperformed the cap-weighted index. The Nasdaq lagged on post-earnings pressure in mega-cap tech, while the Dow and Russell 2000 held near flat.

Several macro and policy headlines drove intraday moves:

- Geopolitics: Oil prices jumped as concerns ramped around a potential U.S. strike on Iran. Reports suggested heightened military contingency planning amid stalled nuclear and missile talks, lifting crude more than 3% and supporting energy equities.

- Volatility: The VIX saw its second-largest jump YTD, though it remained below 20. Volatility was concentrated in tech and crypto rather than broad risk assets.

- Precious metals: Gold, silver, and copper surged sharply early, then reversed part of the move amid talk of crowded positioning and profit-taking. Copper still closed up more than 4% after reports of strong China buying.

- Rates: Treasuries were firmer overall, though the $44B 7-year auction tailed modestly. Initial jobless claims printed at 209K (slightly above consensus), while continuing claims improved.

- Policy: President Trump said he plans to announce his Fed Chair pick next week. Government shutdown odds fluctuated intraday, briefly easing on reports of progress in Senate negotiations.

- FX/Crypto: The dollar weakened again, while Bitcoin futures fell ~6% in their worst session since early December.

Sector Highlights

Sector performance reflected continued rotation rather than broad risk-off behavior. Communication Services, Real Estate, Financials, Energy, and Industrials led the market, supported by META’s earnings, higher oil prices, and strength in cyclicals. Technology was the clear laggard due to MSFT-led weakness, while Consumer Discretionary and Health Care also underperformed. Utilities and Materials finished modestly higher, helped by commodity strength and defensive flows.

Communication Services

- META surged after a strong Q4 revenue beat and much higher-than-expected Q1 guidance, with AI-driven engagement and monetization cited as key drivers despite sharply higher capex.

- CMCSA posted mixed results, with solid FCF offset by weaker broadband net adds.

Information Technology

- MSFT sold off sharply after Azure growth came in at +38%, in line but below buyside expectations; continued references to capacity constraints and elevated capex weighed on sentiment.

- IBM rallied on strength in Software and Infrastructure and upside to 2026 guidance; management highlighted a growing generative AI book of business.

- LRCX beat and guided above consensus on sustained memory-spending strength.

- NOW delivered solid results and authorized a new buyback, but shares remained pressured amid ongoing AI disruption concerns in software.

- SAP fell sharply on slightly softer cloud backlog growth despite profit upside.

- AMZN reportedly plans to invest up to $50B in OpenAI, according to media reports.

- INTC rose on continued speculation around potential collaboration with NVDA.

Energy

- Energy stocks outperformed as WTI crude rose ~3.5%, supported by escalating Iran-related tensions.

- Sector strength was macro-driven rather than tied to company-specific earnings.

Financials

- Banks and diversified financials traded higher, benefiting from rotation away from tech and a relatively stable rates backdrop.

- MA reported results showing healthy consumer and business spending.

Industrials

- CAT beat and guided positively, citing datacenter-related demand in its Power segment and a growing backlog.

- PH beat and raised guidance on aerospace strength.

- LMT posted solid results and announced an agreement to quadruple THAAD interceptor production capacity.

- URI fell after missing expectations and guiding FY26 below consensus.

- IP missed but confirmed plans to split into two publicly traded companies.

Consumer Discretionary

- RCL and LUV rallied sharply on upbeat guidance and strong booking trends.

- WHR missed badly on weaker sales and margins, pressuring household durables.

- Retail-investor favorites and most-shorted names underperformed.

Consumer Staples

- MO slipped after a light earnings print and ongoing volume pressure in smokeables, despite an in-line to slightly better EPS outlook.

Health Care

- TMO declined as Life Sciences margins weighed on results.

- Managed care and life sciences stocks were broadly softer amid policy and funding uncertainty.

Materials

- Copper posted one of its biggest single-day gains in over a decade on reports of strong China buying.

- DOW beat earnings but guided cautiously, highlighting project-related cost pressures and additional cost-savings plans.

Real Estate

- REITs outperformed as investors rotated into real assets amid commodity strength and dollar weakness.

Utilities

- Utilities posted modest gains, acting as a partial defensive offset in an otherwise rotational session.

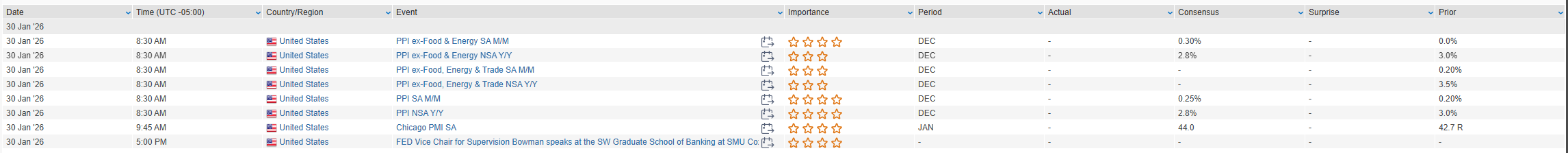

Eco Data Releases | Friday January 30th, 2026

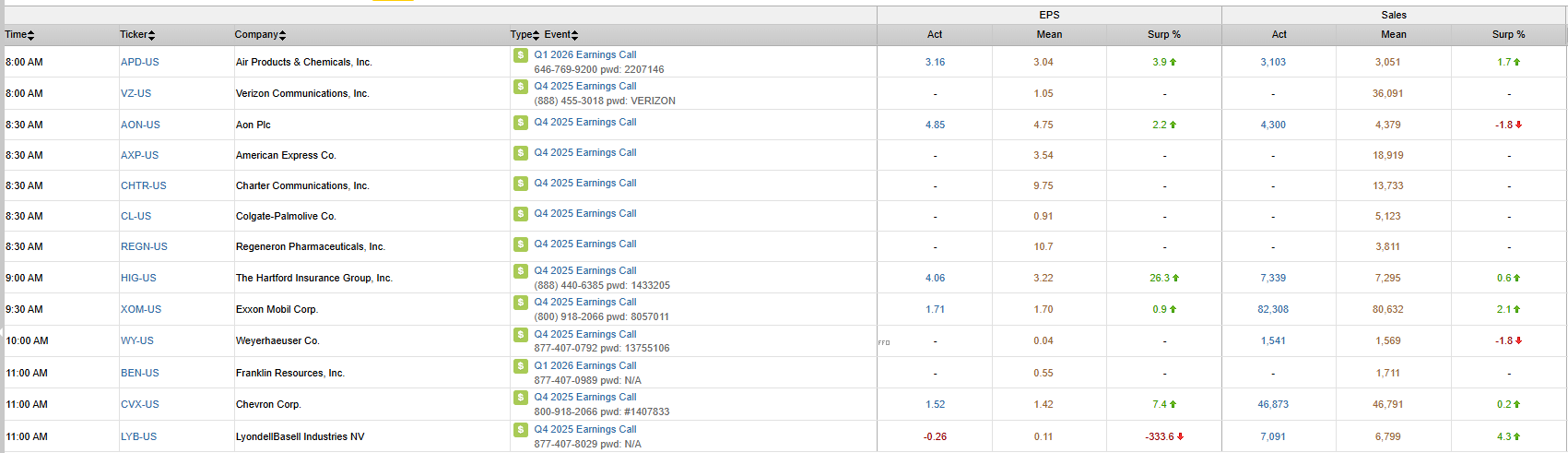

S&P 500 Constituent Earnings Announcements | Friday January 30th, 2026

Data sourced from FactSet Research Systems Inc.