February 2, 2026

U.S. equity futures are lower to start the week, with S&P 500 futures down 0.6% and Nasdaq futures down 0.9%, following Friday’s selloff and a mostly negative week for equities. Risk aversion carried through Asia, where South Korea fell more than 5%, while Hong Kong and China dropped over 2%. European markets are modestly lower, down about 0.2%.

Treasuries are firmer with yields down roughly 4 bp at the long end. The dollar index is up 0.1%. Commodities remain volatile: gold is down 1.1%, silver up 2% after Friday’s historic decline, and WTI crude sharply lower, down 4.5%. Bitcoin futures are down 7.2% as of this writing.

Precious metals volatility remains the dominant cross-asset theme. Early pressure in gold and silver has partially reversed, reinforcing the view that last week’s move reflected a positioning shakeout rather than a fundamental shift. Elsewhere in commodities, copper and oil remain under pressure, with crude hit by comments from President Trump suggesting Iran is engaged in serious nuclear discussions.

The AI trade is back in focus amid renewed debate over capex intensity and funding structures. Street commentary on the Q4 earnings season remains broadly constructive, while discussion continues around the potential market impact of Kevin Warsh as the next Fed chair.

Company-Specific News

- NVIDIA: Reportedly downplayed the likelihood of finalizing a $100B investment in OpenAI, though CEO Jensen Huang said the company still plans a substantial investment.

- Oracle: Announced plans to raise up to $50B in capital to fund AI infrastructure, with roughly half coming via equity.

- Apple: Facing increased scrutiny over profit margins amid rising memory and component costs.

- Disney: Reportedly preparing to name Parks head Josh D’Amaro as CEO successor to Bob Iger; company reports earnings this morning.

- Ford: Reportedly held talks with Xiaomi about forming a joint venture to manufacture EVs in the U.S.

- Peloton: Announced an 11% workforce reduction as part of ongoing cost-cutting efforts.

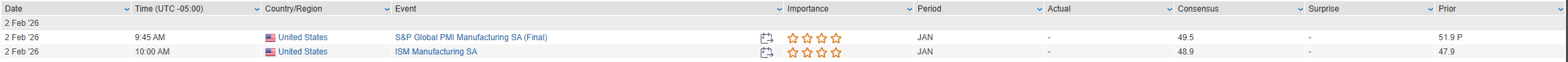

Economic Calendar

ISM manufacturing is expected to rise modestly to 48.5 in January from 47.9. Fed’s Bostic speaks at 12:30 pm ET, and Treasury releases its quarterly borrowing estimates this afternoon. Looking ahead, the week includes JOLTS (Tuesday), ADP and ISM services alongside the refunding announcement (Wednesday), and Friday’s January employment report, with consensus at +68K nonfarm payrolls.

U.S. equities finished lower Friday (Dow -0.36% | S&P 500 -0.43% | Nasdaq -0.94% | Russell 2000 -1.55%) but recovered from intraday lows as markets absorbed a heavy mix of policy headlines, inflation data, and earnings. The key macro catalyst was President Trump’s nomination of Kevin Warsh to succeed Jerome Powell as Fed Chair. Warsh is viewed as hawkish primarily on balance-sheet policy rather than the policy rate, which initially pressured the long end of the curve and lifted the dollar before both moves moderated.

December PPI surprised sharply to the upside, with headline prices up 0.5% m/m and core PPI up 0.7% m/m, driven by services inflation—particularly machinery and equipment wholesaling. January Chicago PMI rose to 54.0, its first expansionary reading in over two years, signaling improving manufacturing momentum.

Treasuries were mixed with modest curve steepening as short-end yields fell 3–4 bp. The dollar index rose 0.8% on the day but remained lower on the week. Precious metals suffered historic declines following Thursday’s reversal, reflecting crowded positioning and forced liquidation rather than a single macro catalyst.

Sector Highlights

Leadership skewed defensive. Consumer Staples, Energy, and Health Care outperformed, reflecting investor preference for cash-flow durability amid inflation uncertainty and policy noise. Materials and Technology were the weakest sectors, pressured by the collapse in precious metals and ongoing multiple compression in software and semicap stocks. The session reinforced a market increasingly selective and sensitive to positioning, expectations, and macro durability rather than headline earnings beats alone.

Information Technology

- Apple (AAPL): Beat earnings and guided higher; iPhone strength a standout. Stock reaction muted amid commentary on rising memory costs and supply constraints.

- KLA (KLAC): Earnings and margins beat; cautious WFE growth outlook weighed on shares versus peers.

- Western Digital (WDC): Strong beat and raise driven by HDD demand and pricing; stock sold off given elevated expectations after a sharp YTD rally.

- Sandisk (SNDK): Significant earnings beat and sharply higher guidance; strength driven by datacenter demand and ASP growth.

- AppFolio (APPF): Beat across EPS, revenue, and operating income; FY26 revenue guidance below consensus, reinforcing broader software caution.

Communication Services

- Verizon (VZ): Strong EPS and revenue beat; best quarterly wireless subscriber adds in six years; raised FCF and EPS outlook and authorized $25B buyback.

- Charter Communications (CHTR): EBITDA beat; residential net adds better than feared with video subscribers returning to growth.

- Meta Platforms (META): Reportedly under investigation over claims personnel can access WhatsApp messages.

Consumer Discretionary

- Deckers Outdoor (DECK): Large earnings beat and raised guidance; strong HOKA acceleration, UGG outperformance, and improved DTC trends.

- Tesla (TSLA): Shares rose on reports SpaceX is considering a potential merger with Tesla or xAI.

- GameStop (GME): CEO said company is targeting a major acquisition in consumer or retail to drive turnaround.

Consumer Staples

- Colgate-Palmolive (CL): Earnings and revenue beat with notable strength in pet nutrition; FY revenue growth outlook below consensus; skin health outlook trimmed.

- Church & Dwight (CHD): EPS beat aided by better margins; organic sales growth outlook light but better than feared.

Financials

- Visa (V): EPS and revenue beat; healthy consumer spending trends offset by FX headwinds and higher opex.

- American Express (AXP): Revenue beat but EPS slightly light; investor focus on higher Platinum refresh costs despite constructive guidance.

- Robert Half (RHI): Strong earnings and guidance; management cited improving hiring momentum and easing recession fears.

Health Care

- Stryker (SYK): Beat across EPS, revenue, and organic growth; FY guidance above consensus with strength in MedSurg and Neurotechnology.

- Regeneron (REGN): FY expense guidance above expectations weighed on shares.

- Corcept Therapeutics (CORT): Sold off sharply after receiving a corrected FDA response letter questioning adequacy of clinical program.

Energy

- No major earnings drivers; sector outperformed as investors favored cash-flow stability despite a modest pullback in crude prices.

Industrials

- Air Products (APD): Earnings and revenue beat; strength in Americas and Europe offset softness in Middle East and India; guidance reaffirmed.

- Schneider National (SNDR): EPS miss and weak 2026 guidance; management cited soft demand and utilization.

Materials

- Olin (OLN): EBITDA missed; flagged weaker chlorine demand and higher near-term costs.

- LyondellBasell (LYB): Revenue beat but earnings missed; sees seasonal demand improvement but near-term pressure in Asia.

Eco Data Releases | Friday February 2nd, 2026

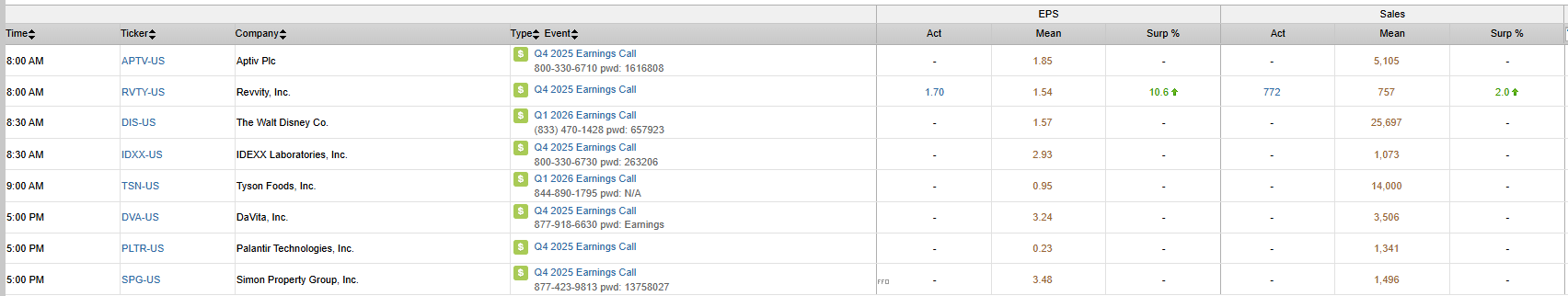

S&P 500 Constituent Earnings Announcements | Friday February 2nd, 2026

Data sourced from FactSet Research Systems Inc.