February 5, 2026

S&P 500 futures +0.2% Thursday morning after a mixed U.S. session on Wednesday. The S&P 500, Nasdaq, and Russell 2000 closed lower, but the equal-weight S&P rose nearly 0.9% to a fresh record, underscoring continued broadening. Semiconductors were the main drag, while software fell for a seventh straight session. Select cyclicals and defensives outperformed.

Overnight, Asian markets were mostly lower, led by South Korea (-4%), while European equities are down ~0.5%. Treasuries are little changed to slightly firmer. The dollar index is up 0.3%, with sterling weakness the FX story. Commodities are softer: gold -1.1%, silver -7.5%, WTI crude -1.3% after Wednesday’s surge. Bitcoin futures -1.3%.

Markets are holding up despite pressure in high-profile tech. Alphabet (GOOGL) lagged on outsized capex guidance, but the report reinforced the broader AI bullish case with upbeat monetization, engagement, and productivity takeaways. Recent software weakness reflects AI competition concerns, while semiconductor softness appears more positioning-driven. Broadening leadership and “run-it-hot” macro momentum continue to cushion risk sentiment. Elsewhere, precious metals—especially silver—are giving back part of their rebound; geopolitics remain fluid with U.S.–Iran talks back on for Friday. Japan’s 30-year JGB auction drew solid demand, easing near-term rate concerns.

Corporate Highlights

- Alphabet (GOOGL): Shares lagged on heavy capex guidance; Search and Cloud growth commentary strong, reinforcing AI investment thesis.

- Qualcomm (QCOM) / Arm (ARM): Post-earnings laggards; memory shortages (notably at Chinese OEMs) a key overhang for QCOM.

- Snap (SNAP): Higher after earnings beat.

- Costco (COST): January comps viewed positively by the Street.

- O’Reilly Automotive (ORLY): Comps beat; earnings missed on higher SG&A.

- McKesson (MCK): Beat with North America Pharma a bright spot.

- Align Technology (ALGN): Upside in aligners and scanners.

- Symbotic (SYM): Big gainer on beat and raise.

- Crown Castle (CCI): Pressured on softer 2026 leasing outlook.

- Workday (WDAY): To cut ~2% of headcount.

- Ciena (CIEN): Set to join the S&P 500.

Macro & Events

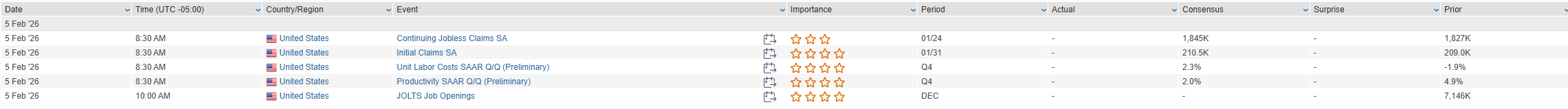

- Today: Initial jobless claims (consensus 212K).

- Fed: Atlanta Fed President Bostic speaks at 10:30 ET.

- Friday: Preliminary University of Michigan consumer confidence; January employment report delayed to next Wednesday due to the partial government shutdown.

U.S. equities finished mixed Wednesday (Dow +0.53% | S&P 500 -0.51% | Nasdaq -1.51% | Russell 2000 -0.90%), with index-level performance weighed down by concentrated tech and AI weakness, even as market breadth improved materially. The equal-weight S&P 500 outperformed the cap-weighted index by more than 130 bp, with RSP setting a fresh record high, underscoring the continued broadening of leadership. Software—already the worst-performing S&P industry YTD—remained under pressure but recovered meaningfully from session lows, while semiconductors resumed their role as a drag.

The macro backdrop remained constructive despite softer-than-expected labor data. January ISM services held at 53.8, in line with expectations, though new orders and employment eased modestly. ADP private payrolls rose just 22K, well below consensus, reflecting weakness in professional and business services but continued strength in education and health care. Treasury’s quarterly refunding announcement came in line with expectations, with no changes to auction sizes.

Rates were mixed, with the curve steepening modestly as long-end yields rose ~2 bp. The dollar index gained 0.2%, driven primarily by yen weakness. Commodities were volatile but supportive of cyclicals: WTI crude rose 3.1%, gold added 0.3%, and silver gained 1.3%. Bitcoin futures fell nearly 4%, slipping below $74K.

Narratives in focus included continued software/AI disruption fears, growing bifurcation within AI and software similar to the Mag 7 dynamic last year, renewed “run-it-hot” macro framing, heavy earnings flow, and anticipation ahead of Alphabet (GOOGL) earnings post-close. Geopolitical headlines around Iran also contributed to energy volatility.

Sector Highlights

Leadership continued to rotate away from concentrated growth and toward cyclicals and defensives. Energy, Materials, Real Estate, Health Care, Consumer Staples, and Financials outperformed, supported by commodity strength, resilient earnings, and improving breadth. Technology was the clear laggard, weighed down by semiconductors and persistent software weakness, while Communication Services and Consumer Discretionary also underperformed. The session reinforced the market’s ongoing transition toward a broader, more macro-sensitive leadership profile rather than narrow AI-driven index performance.

Information Technology

- Advanced Micro Devices (AMD): Beat on Q4 results with Data Center strength, but shares sold off as upside was partly driven by one-time China MI308 sales; high expectations into the print weighed on sentiment.

- Super Micro Computer (SMCI): Strong beat and raise; guidance reflected sustained AI server demand, though analysts continued to flag margin sensitivity.

- Teradyne (TER): Continued to outperform following prior AI-driven beat and guide-up.

- Texas Instruments (TXN): Confirmed agreement to acquire Silicon Laboratories (SLAB) for $7.5B, sending SLAB shares sharply higher.

- Cognizant Technology Solutions (CTSH): Beat with stronger bookings and improved FY26 outlook; Financial Services vertical a standout.

- Gartner (IT): Extended recent weakness as FY26 revenue guidance disappointed despite an earnings beat.

- Varonis Systems (VRNS): Pressured by softer 2026 ARR and FCF guidance; management cited SaaS churn but highlighted improving renewal metrics.

- Intapp (INTA): Beat and raised FY outlook, but stock sold off amid broader AI-driven software disruption concerns.

Communication Services

- New York Times (NYT): Shares fell on higher-than-expected compensation costs despite solid ad revenue trends.

- Take-Two Interactive (TTWO): Bookings beat and FY outlook improved, but shares lagged amid ongoing uncertainty around AI competition and GTA VI timing.

Consumer Discretionary

- Uber Technologies (UBER): Q4 bookings beat but Q1 EBITDA guidance disappointed; autonomous vehicle competition remained a key investor concern.

- Match Group (MTCH): Beat on earnings with engagement improvements; Hinge continued to offset Tinder pressure.

- MGM Resorts (MGM): Strong performance driven by BetMGM growth in iGaming and online sports betting.

Consumer Staples

- Clorox (CLX): Organic sales growth better than feared, but margins and EPS missed expectations.

- Mondelez (MDLZ): Shares lagged after issuing light 2026 organic sales and EPS guidance.

- Reynolds Consumer Products (REYN): Stock surged despite mixed results as pricing actions were seen offsetting commodity cost inflation.

Health Care

- Eli Lilly (LLY): Strong beat and raised guidance; Mounjaro and Zepbound volumes exceeded expectations.

- Amgen (AMGN): Beat on core franchises; focus remains on upcoming MariTide obesity data.

- Boston Scientific (BSX): Sold off sharply as weaker Electrophysiology trends weighed on forward guidance.

- AbbVie (ABBV): Beat on results, but shares fell amid concerns around growing competition in immunology.

Financials

- Prudential Financial (PRU): Flagged earnings headwind from Japan policy changes, pressuring shares.

- T. Rowe Price (TROW): Shares lagged amid ongoing fee and flow pressure.

Energy

- Phillips 66 (PSX): Outperformed as refining margins improved alongside crude rebound.

- Energy equities broadly benefited from higher oil prices tied to geopolitical headlines.

Industrials

- Johnson Controls International (JCI): Beat and raised guidance; data center exposure and backlog growth highlighted.

- Emerson Electric (EMR): Positive takeaways on orders, growth verticals, and leverage to U.S. industrial policy priorities.

- Old Dominion Freight Line (ODFL): Beat driven by cost control and improving demand trends.

- Woodward (WWD): Continued to rally on strong commercial aftermarket and defense demand.

Materials

- Avery Dennison (AVY): Mixed quarter; RFID growth acceleration a key positive, though tariff uncertainty remains an overhang.

Eco Data Releases | Thursday February 5th, 2026

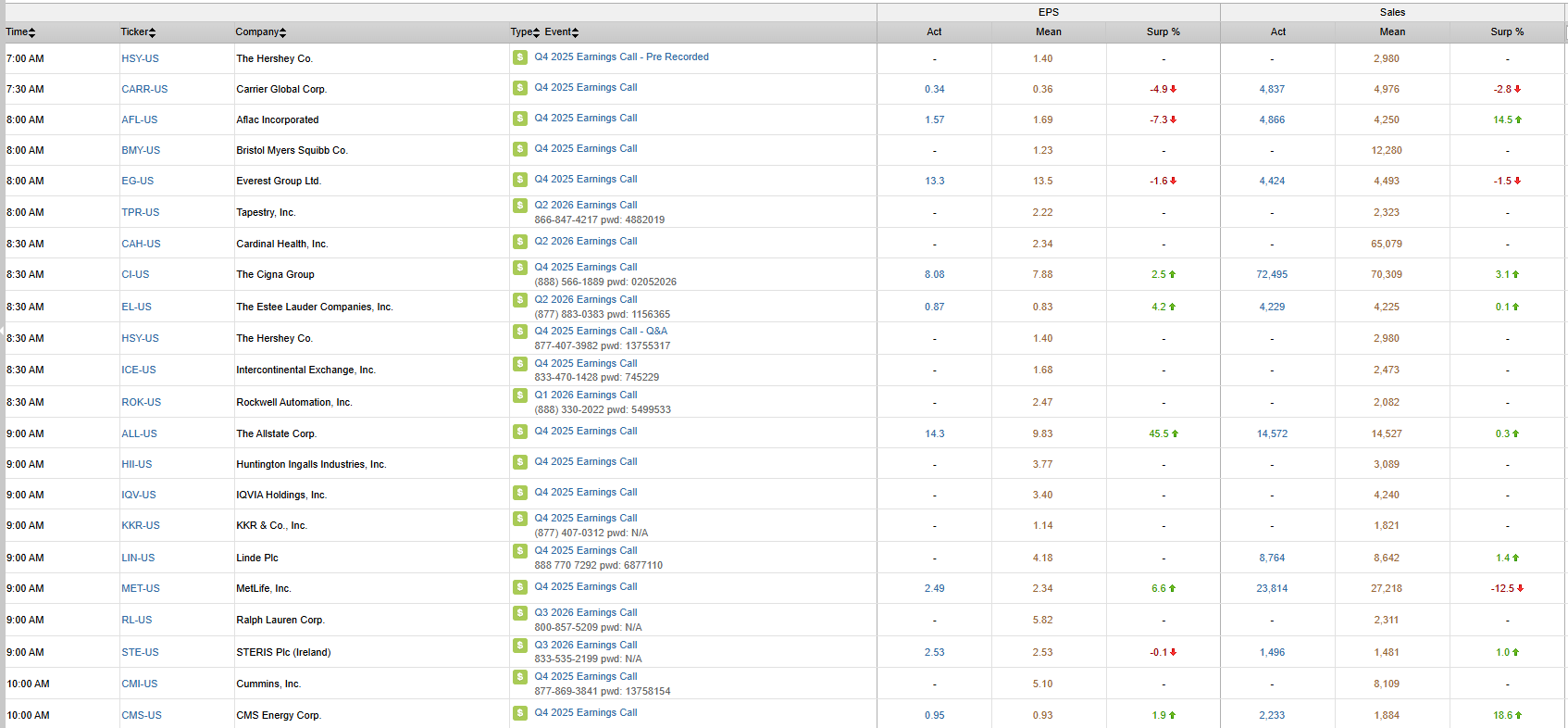

S&P 500 Constituent Earnings Announcements | Thursday February 5th, 2026

Data sourced from FactSet Research Systems Inc.